By Mike Cave – Stanwell Trading Manager, Financial Markets

Watch the full update here

Rising temperatures, higher international fuel prices and outages across several units all contributed to an eventful start to the new year for the energy market.

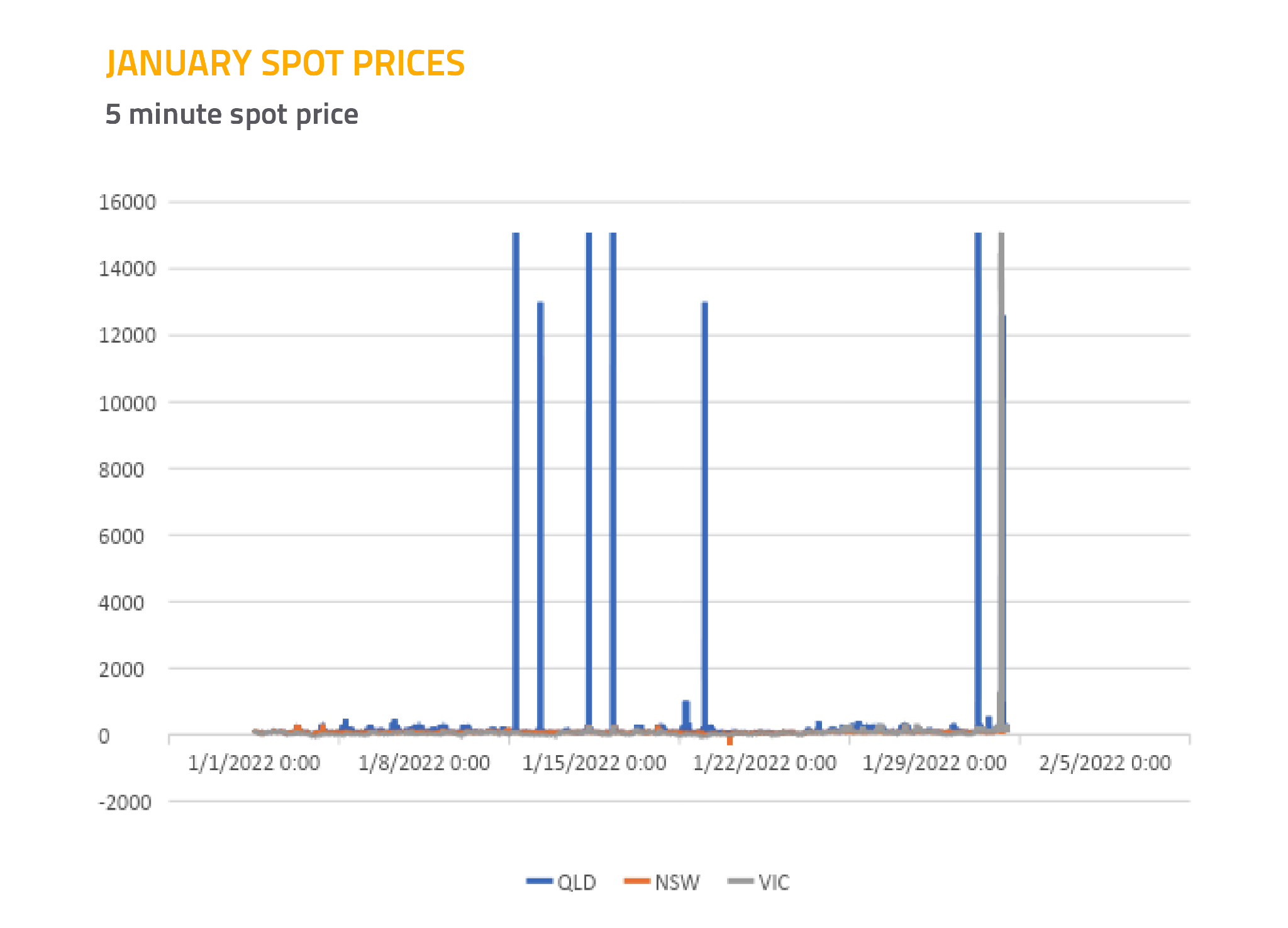

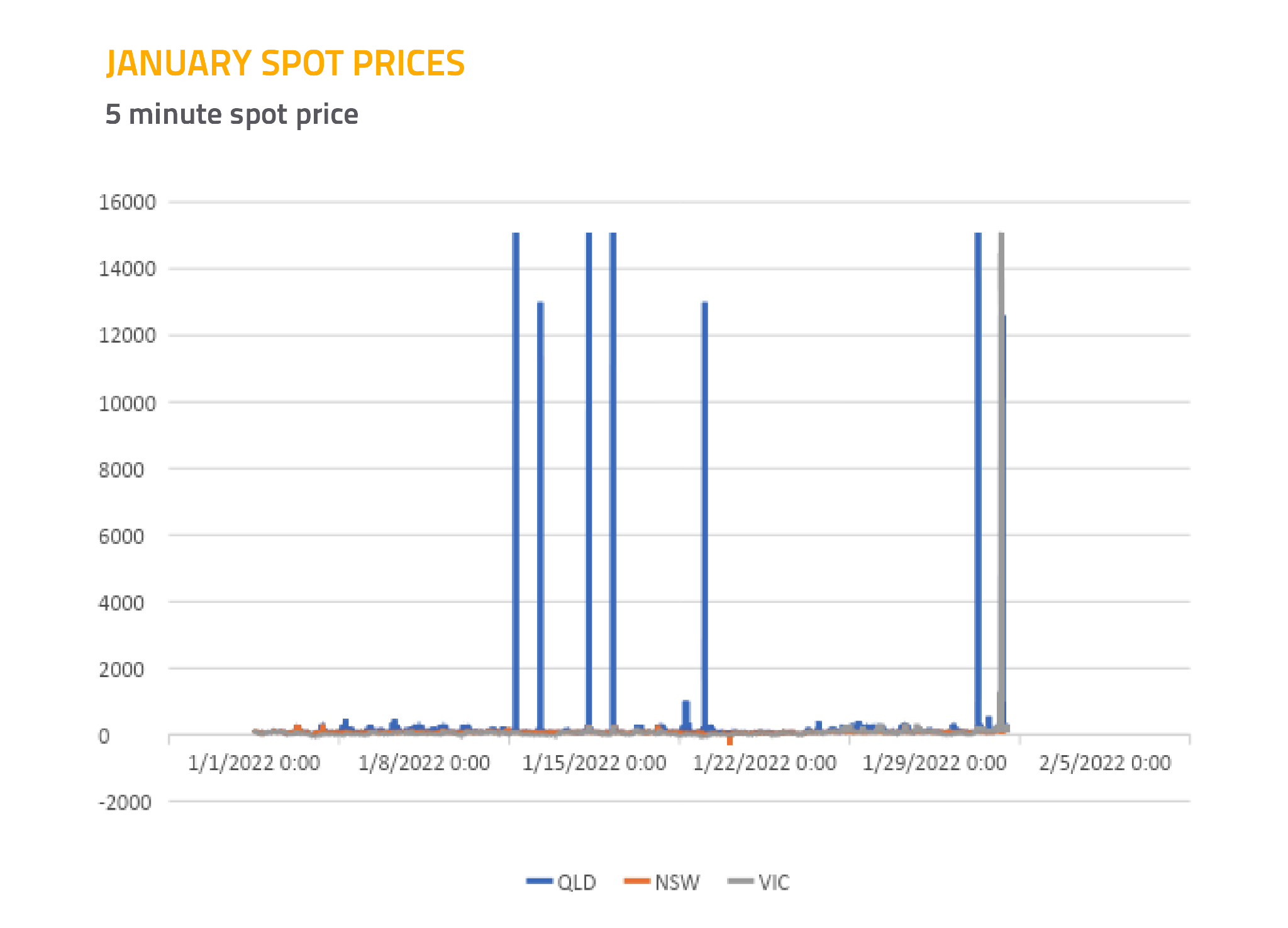

Spot market

The spot market continued to rise in January.

In Queensland, where the flat price closed $11.29 higher, this was primarily due to substantial outages at the Kogan Creek, Gladstone 1 and 5, Callide B1, B2 and C4 and Swanbank E power stations. This also had an impact on New South Wales prices (up $9.21), because of the interconnectivity between the states.

On top of those Queensland outages, the summer heat had us all reaching for the air con remote, which is a sure sign that demand will be high.

Victoria had a particularly warm January. There were 118 five-minute intervals where demand in Victoria exceeded 8,000MW in January, peaking at 8,406MW at 5:50pm on January 27 – considerably higher than the December peak of 7,547MW.

This was coupled with high demand in neighbouring South Australia, which is interconnected with Victoria in the National Electricity Market. With overcast weather affecting solar production in the middle of the day, dispatchable baseload generators helped to make up the shortfall, contributing to Victoria’s sharp rise (up $28.59).

We’ve also seen fuel stockpiles in Queensland and New South Wales ramp down since the Callide incident last year, which required generators to run harder than forecast. These plants are now seeking to conserve coal, which leads to higher bid prices.

Higher international gas, coal and crude oil prices have also made securing additional fuel more expensive. While black coal generators don’t pay international prices directly for all of their coal supply, they do tend to be an important pricing factor, particularly in New South Wales, where they can shape prices for short-term supply contracts and the renegotiation of long-term contracts.

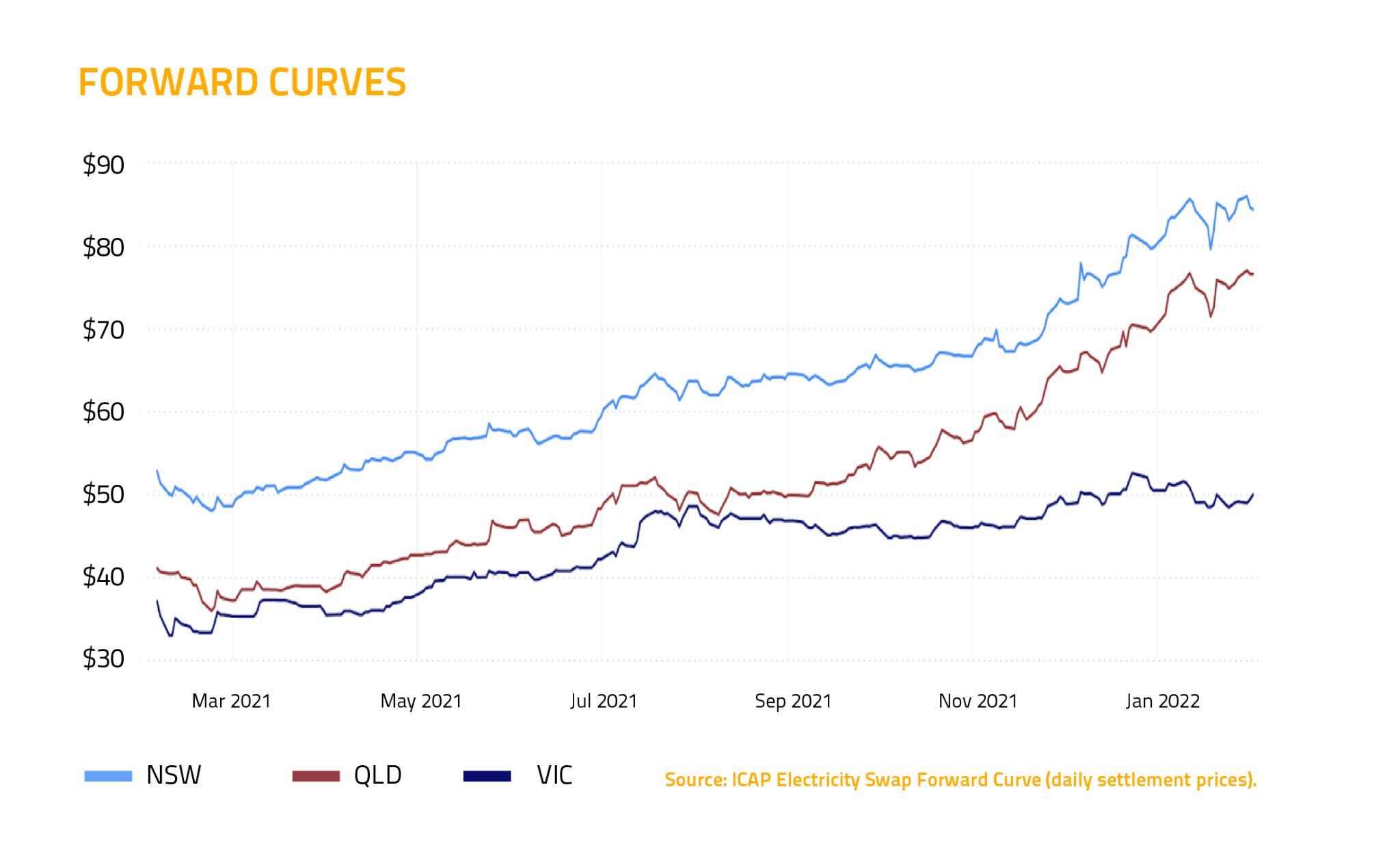

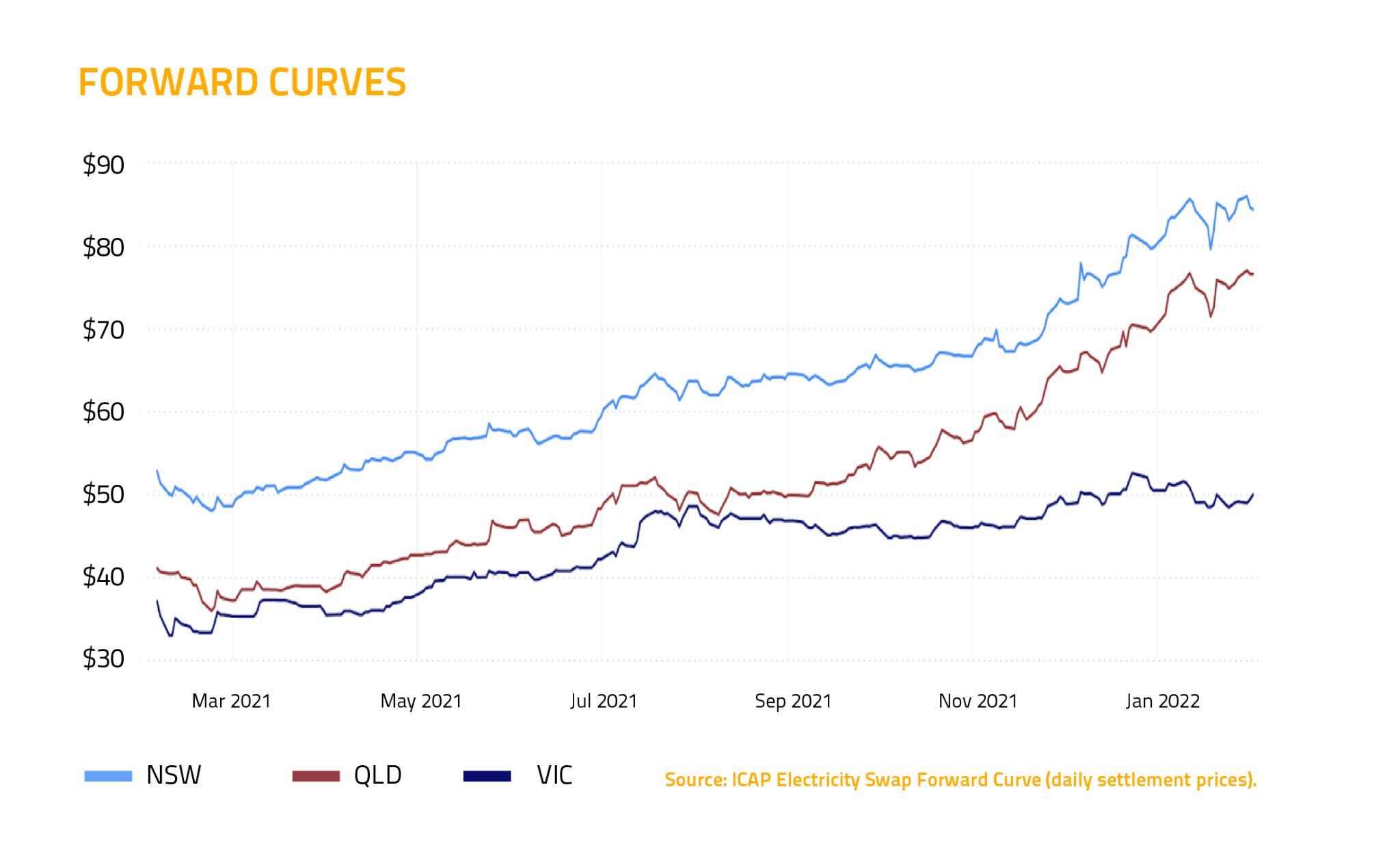

Contract market

In the contract market, these outages in Queensland, combined with the high demand caused by the mini heatwave, saw the state’s Q1 22 price rise significantly (up $38.23).

The extension of Swanbank E’s outage, in particular, has become a point of interest for Queensland’s contract price, flowing through to the forward curve (up $7.16). Here, too, New South Wales is following suit (up $6.14) because of the interconnectivity between the states.

On the other hand, Victoria’s Cal 23 prices are trending downwards (down $1.53), because of the high wind output and availability of traditional generators expected down south.

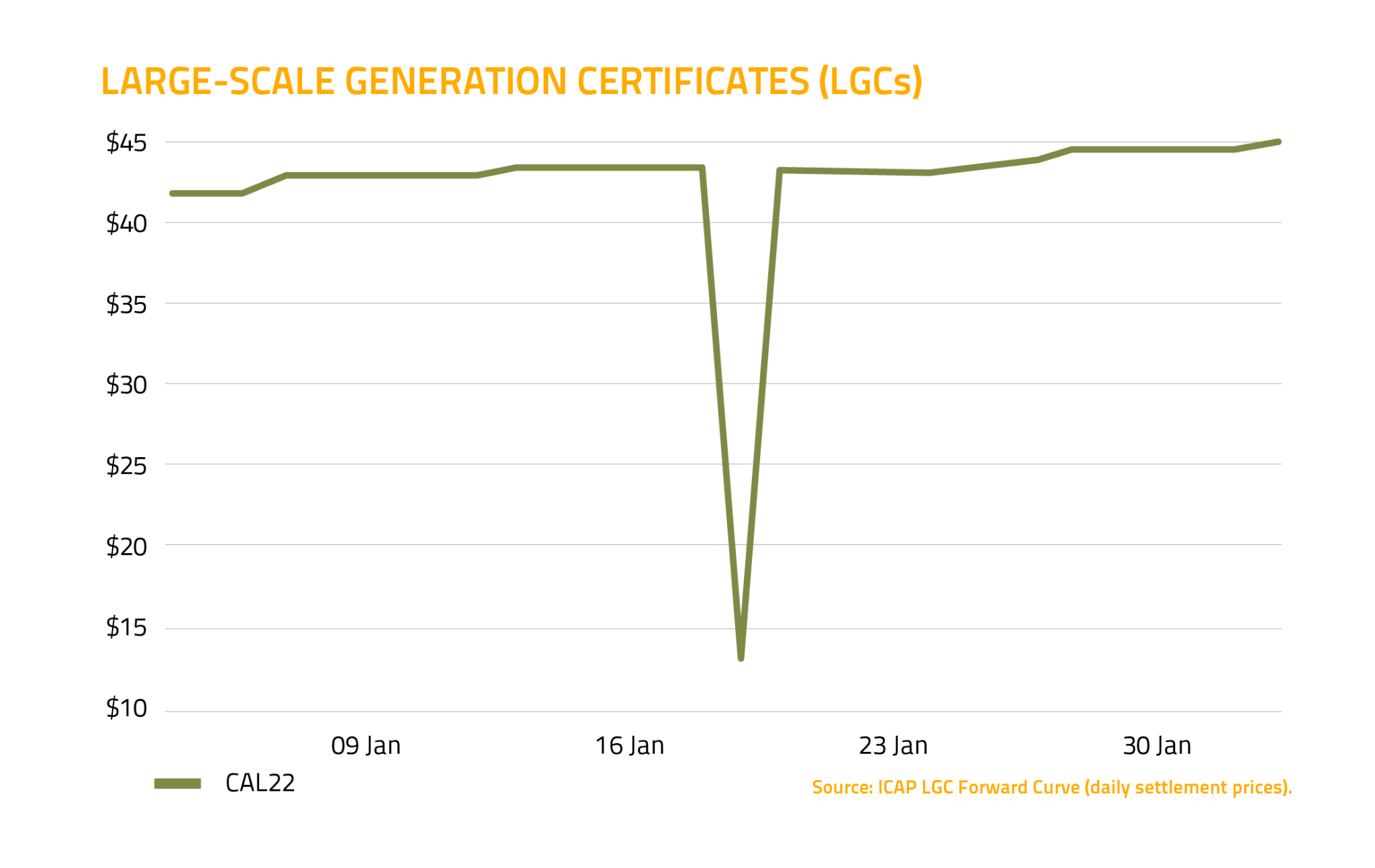

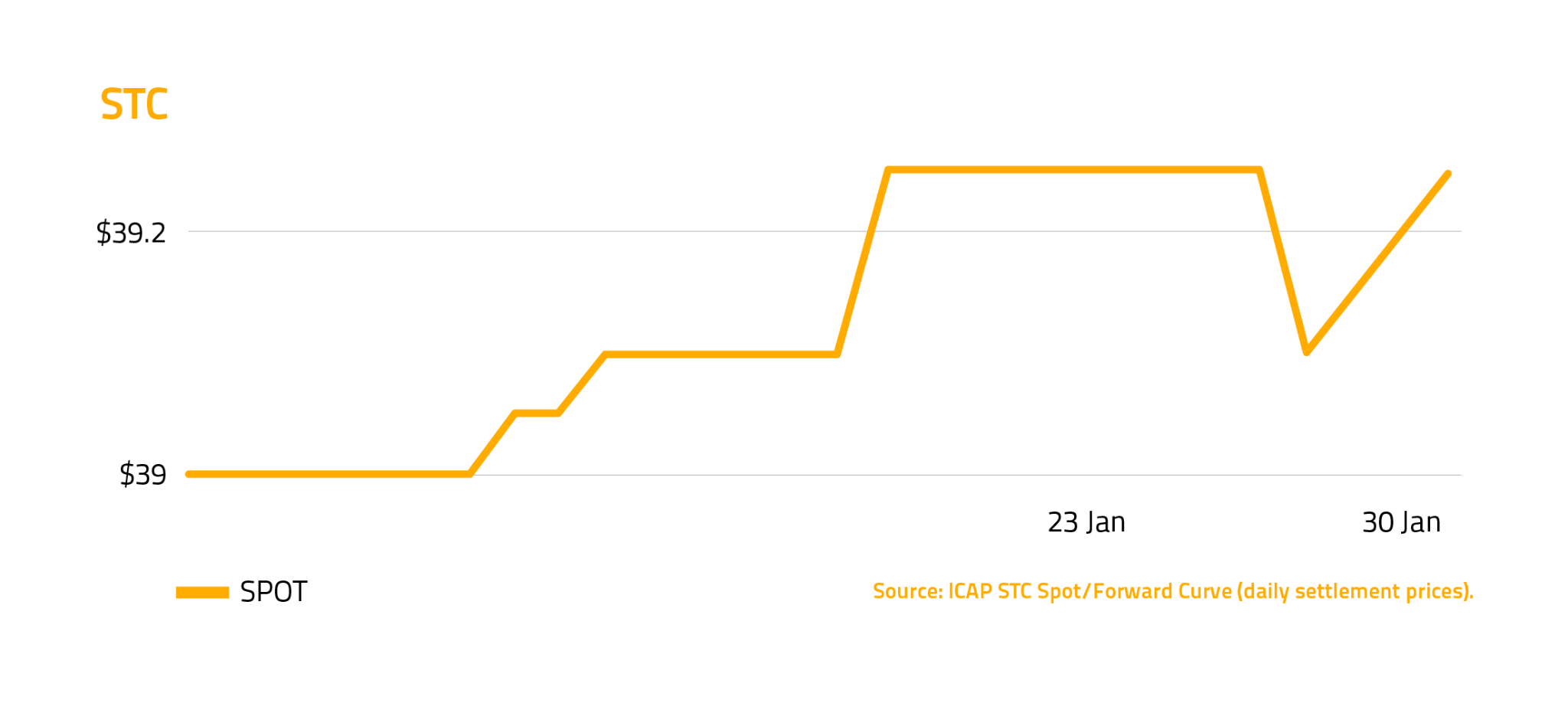

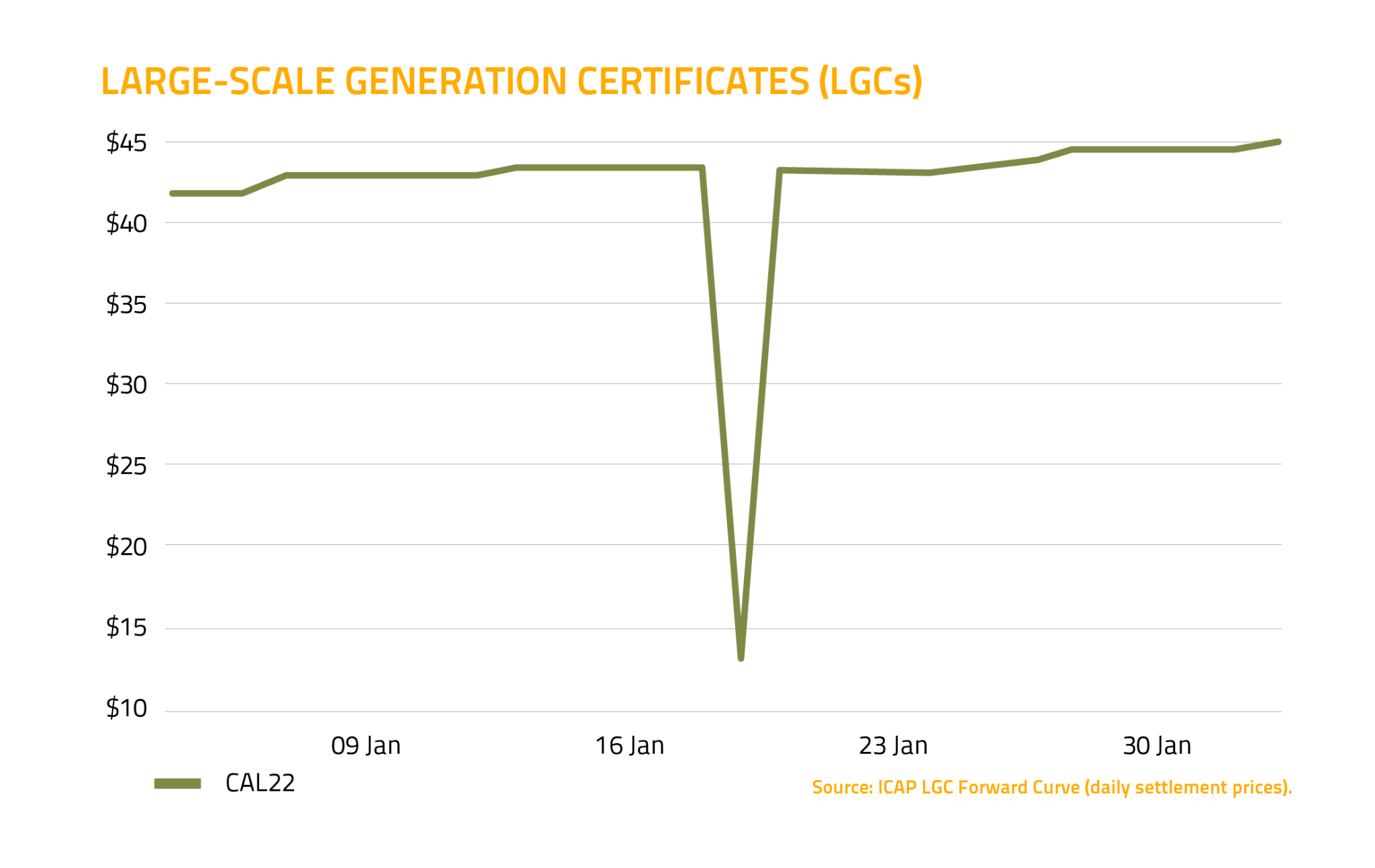

Environmental market

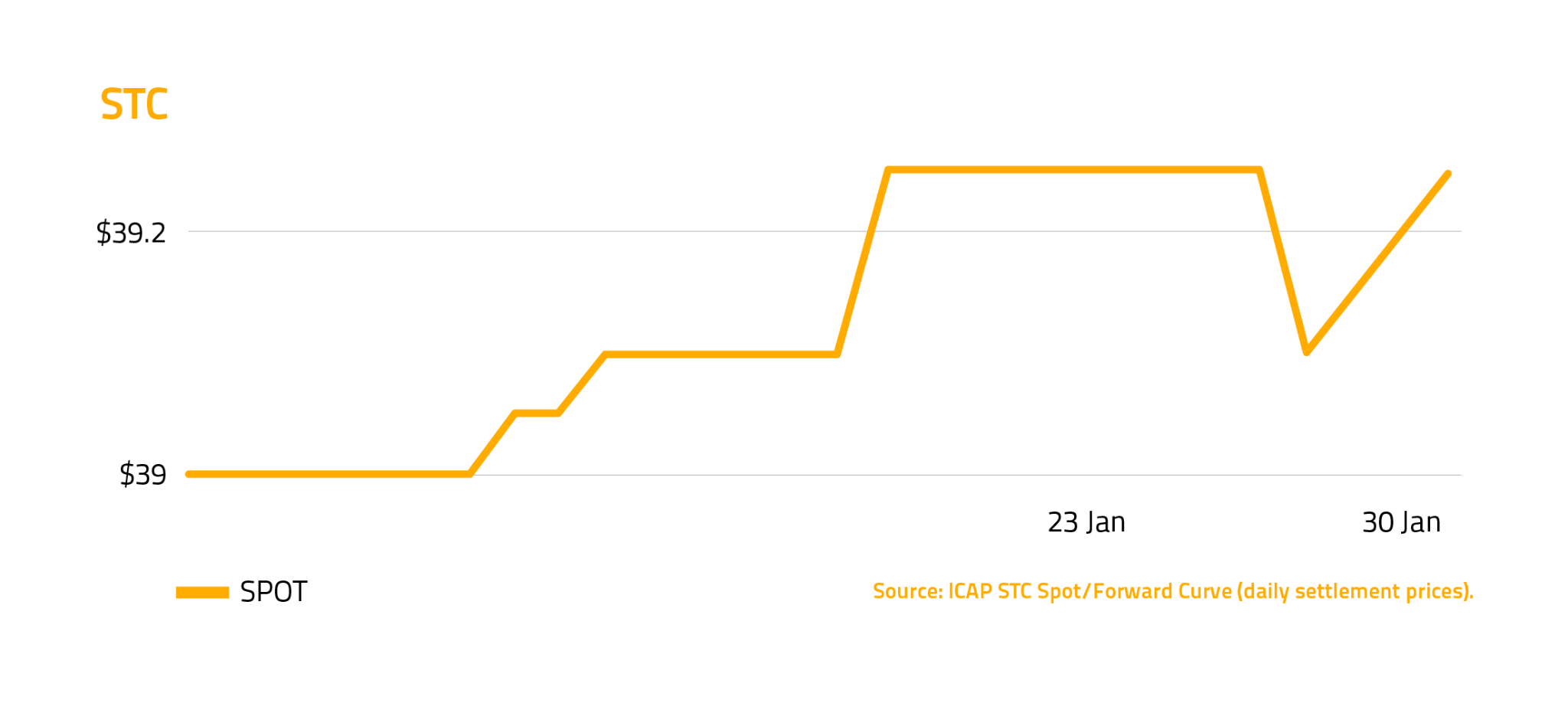

In the environmental market, Large-Scale Generation Certificates (LGCs) and Small Generation Units (STCs) both closed higher (up $4.25 and $0.30, respectively), as buying intensified in the lead-up to the LGC 2021 Calendar Year surrender deadline and the STC Q4 21 surrender deadline on February 14.

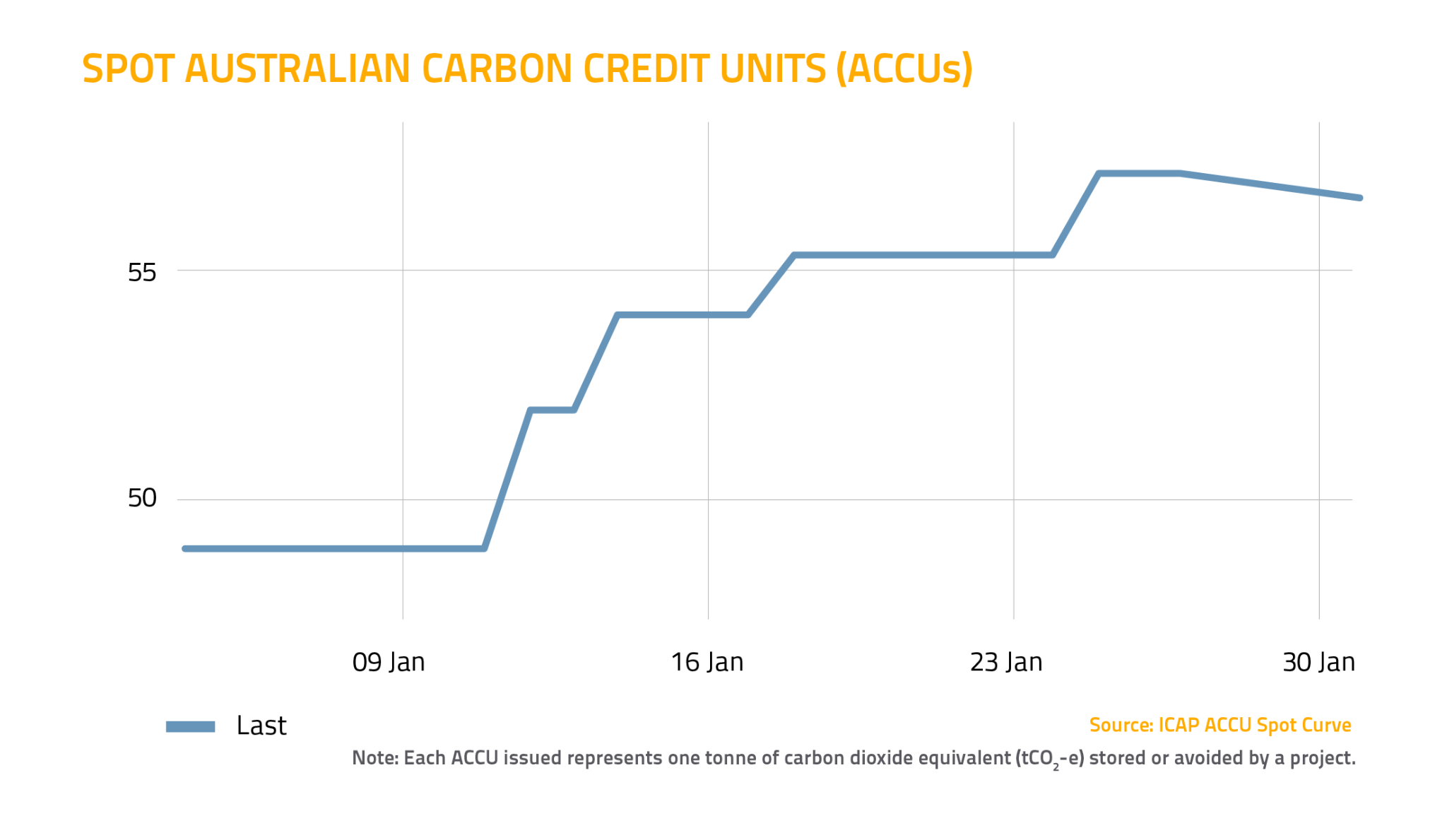

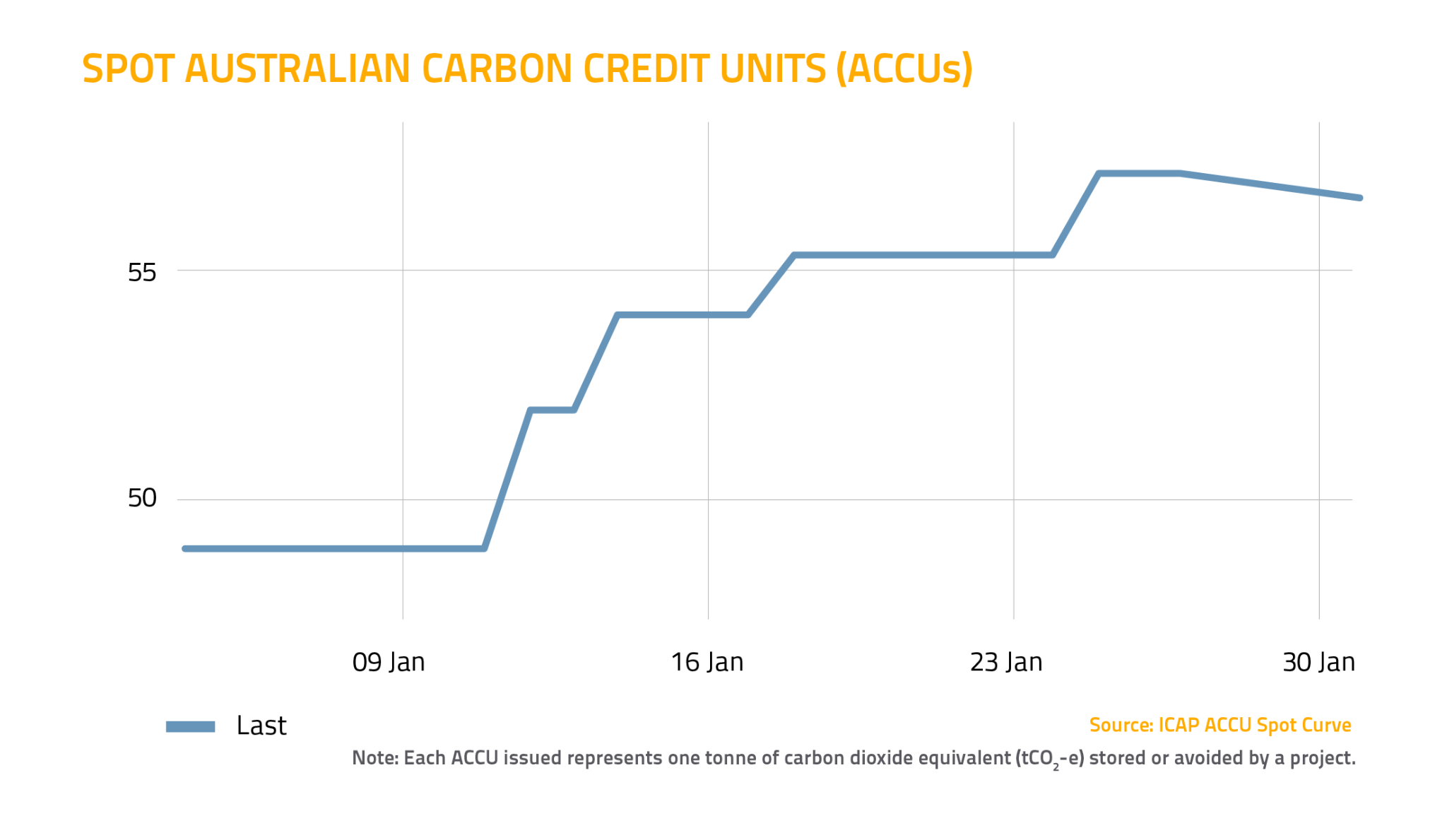

Spot Australian Carbon Credit Units (ACCUs) continued to trade higher across the month (up $7), with demand outstripping the supply of units sold in the market.

That’s it for January – wishing you all the best for February from the team at Stanwell Energy.