Watch the full update here

It was an unprecedented month in the energy market, as the Australian Energy Market Operator made the decision to suspend the spot market in all regions of the NEM for the first time.

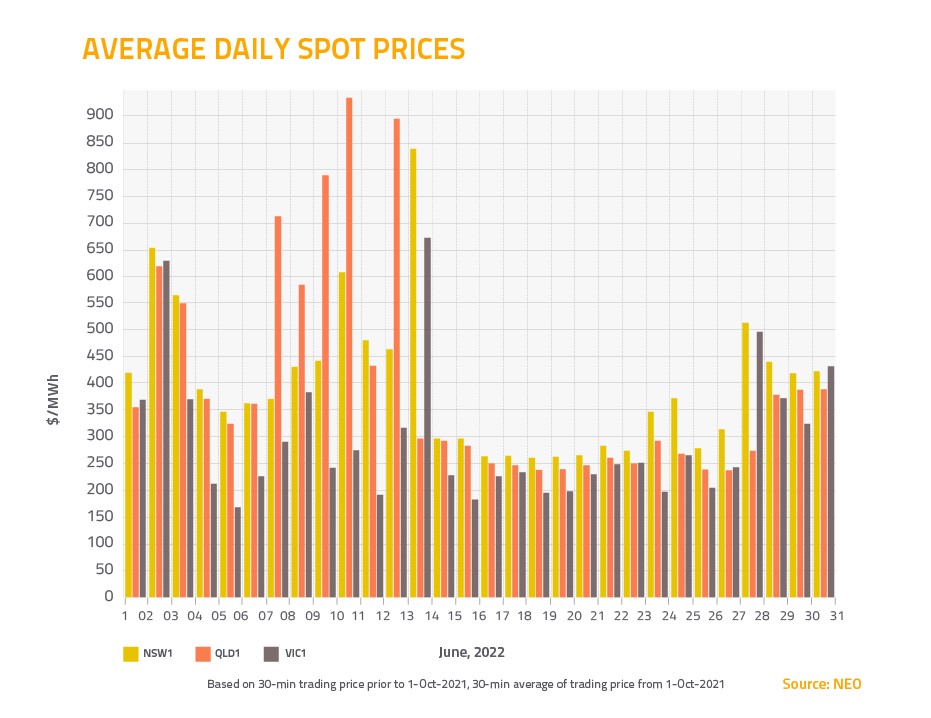

Spot market

Instead of the price of wholesale electricity being set competitively, AEMO set fixed prices for the length of the suspension, and took a greater role in directing which power stations to generate energy and when.

AEMO said it took this step because it had become impossible to continue operating the spot market while ensuring a secure and reliable supply of electricity for consumers, in accordance with the National Electricity Rules.

The suspension came as the result of a perfect storm in the energy market that included a meteoric rise in international coal and gas prices; a number of unplanned generator outages, as well as some units being out of action for planned maintenance; heavy rains slowing coal mine output; sustained periods of low wind and solar output that limited renewable generation; and a fierce June cold snap that increased demand.

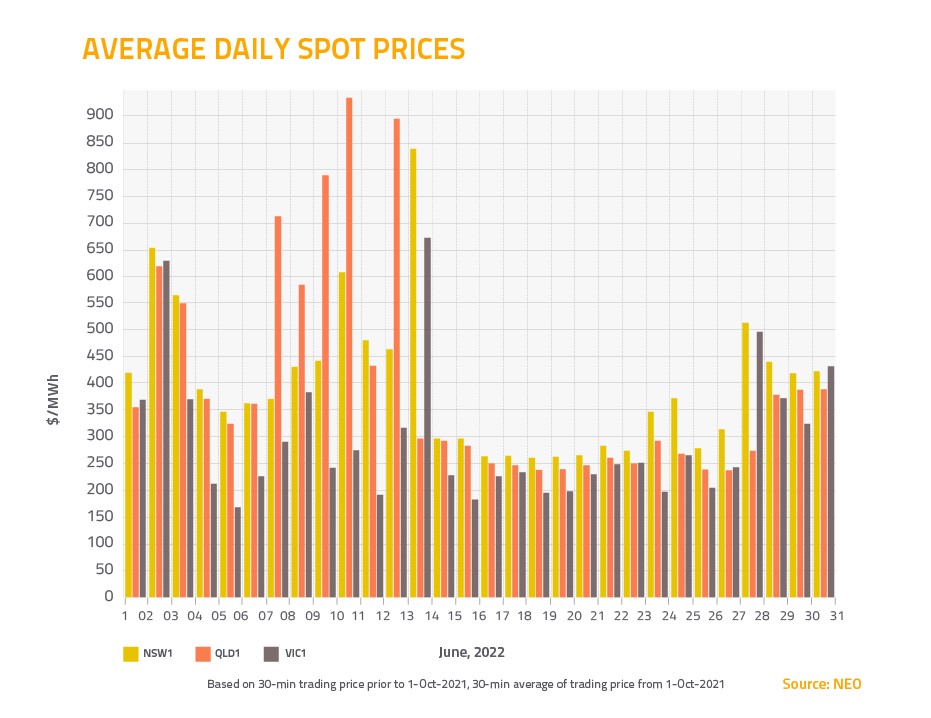

These conditions resulted in very high wholesale electricity prices, which triggered an automatic price cap that limited wholesale spot prices to $300 per megawatt hour (MWh).

That’s much less than the usual market price cap of $15,100/MWh – so much less that it didn’t cover the cost of producing power for some generators, particularly gas generators, causing them to withdraw their availability from the market, and leading to further shortfalls.

On June 14, to ensure there would be enough supply to meet demand, AEMO directed five gigawatts of generation through direct interventions – that’s about 20 per cent of demand. The next day, the market operator decided it had become impossible to continue operating the spot market this way, and ordered the suspension of the market to begin.

The suspension meant that generators would inform the market operator of their availability, and the market operator would tell them when to run.

A pre-determined suspension pricing schedule was applied to each region in the NEM, ranging from $150/MWh to $300/MWh across the day.

If the cost of generating electricity was higher than that pre-determined price, generators could apply for additional compensation to make up the shortfall.

The market suspension was lifted at 2pm on June 24, as the market operator was satisfied that conditions had stabilised, and it could resume operating the market under the normal rules.

Prices finished the month higher across Queensland, New South Wales and Victoria. It’s expected that the electricity market will remain volatile in the months ahead, with coal and gas prices remaining four to five times higher than the long-term average in Australia.

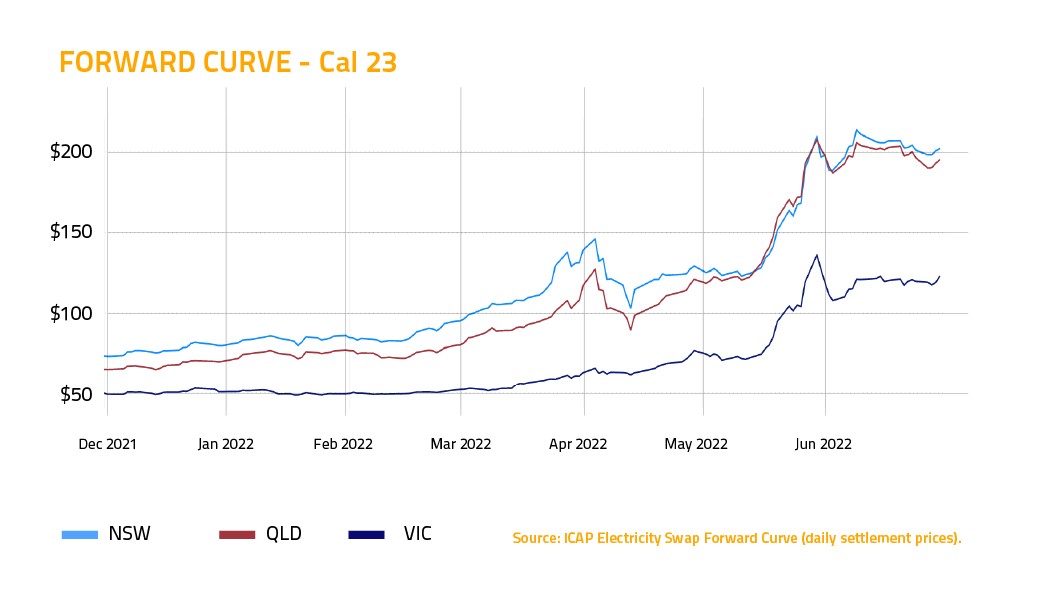

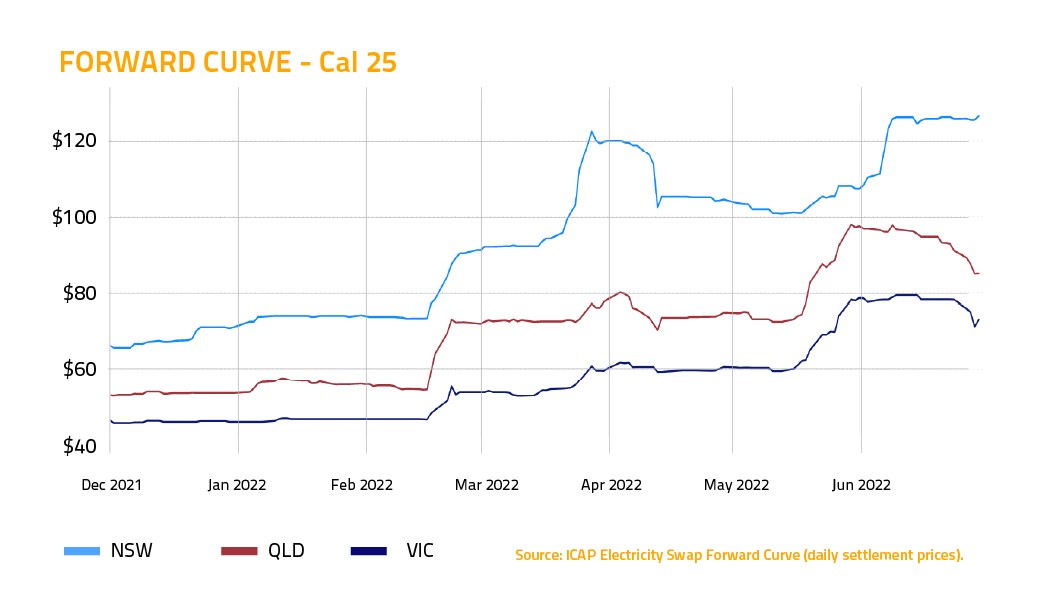

Contract market

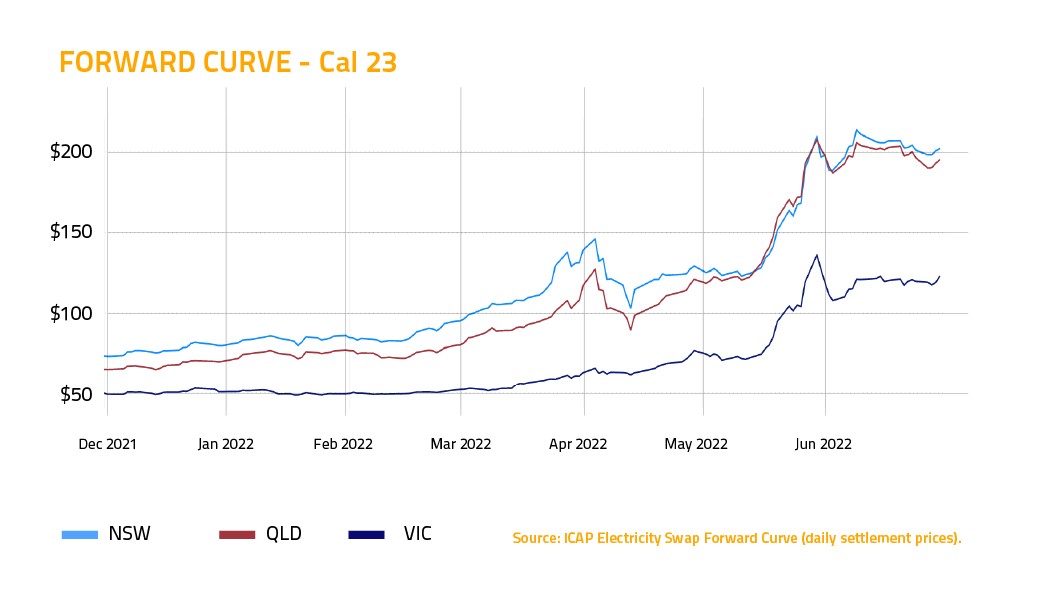

The contract market was quiet during the suspension, as most participants were trying to make sense of the events in the spot market.

Before the suspension, fears that generators in New South Wales would have to source coal from the highly inflated spot market were driving an increase in Cal 23 prices for the state. New South Wales plants have since been successful in procuring additional coal, which has seen prices drift back down.

On the other hand, the Cal 23 price in Victoria initially decreased as generators returned from outages. But prices increased throughout the month due to unplanned maintenance for two units at Yallourn Power Station, leading to fears that Victorian generators would continue to be unreliable.

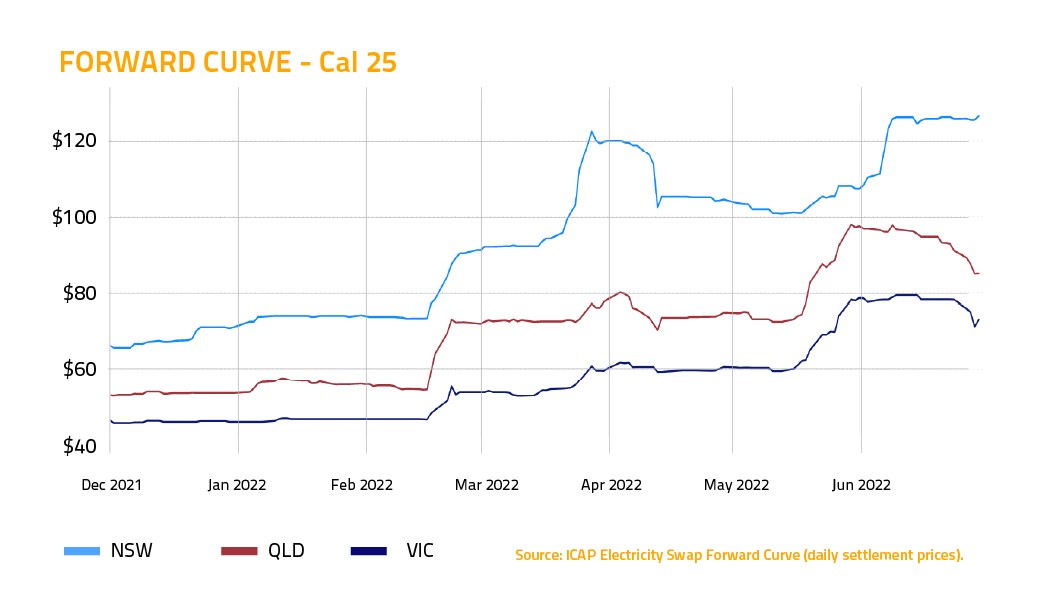

Looking ahead to Cal 25, we’ve seen a spike in the forward price in New South Wales, as the recent outages and instances of reduced generation throughout the state appear to have reignited market apprehension about the large gap that could be left by the closure of Eraring in 2025.

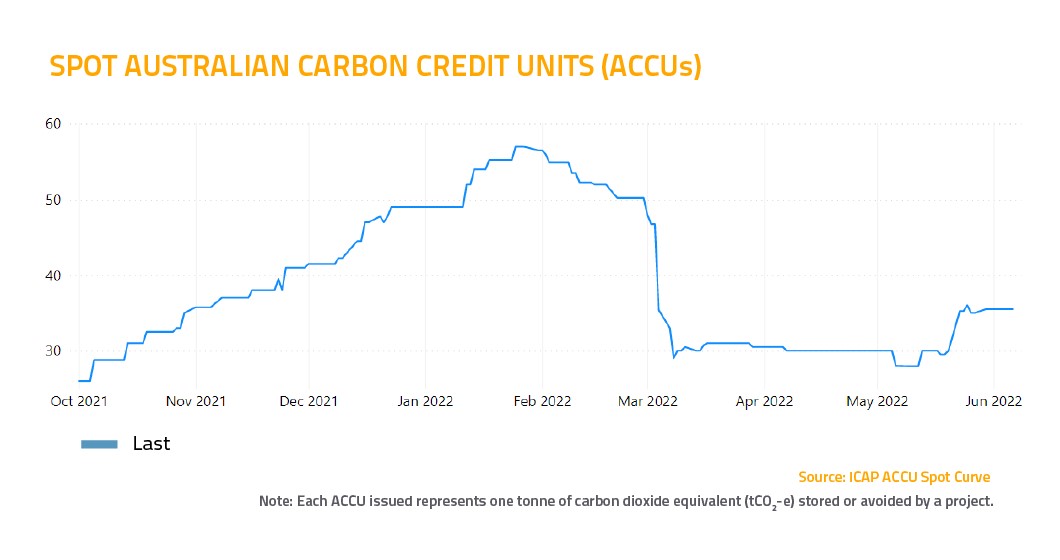

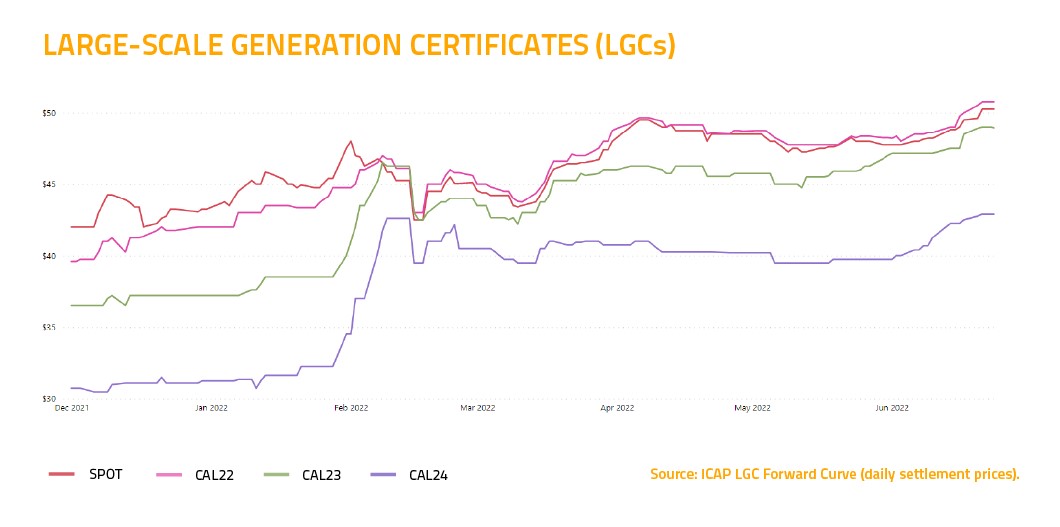

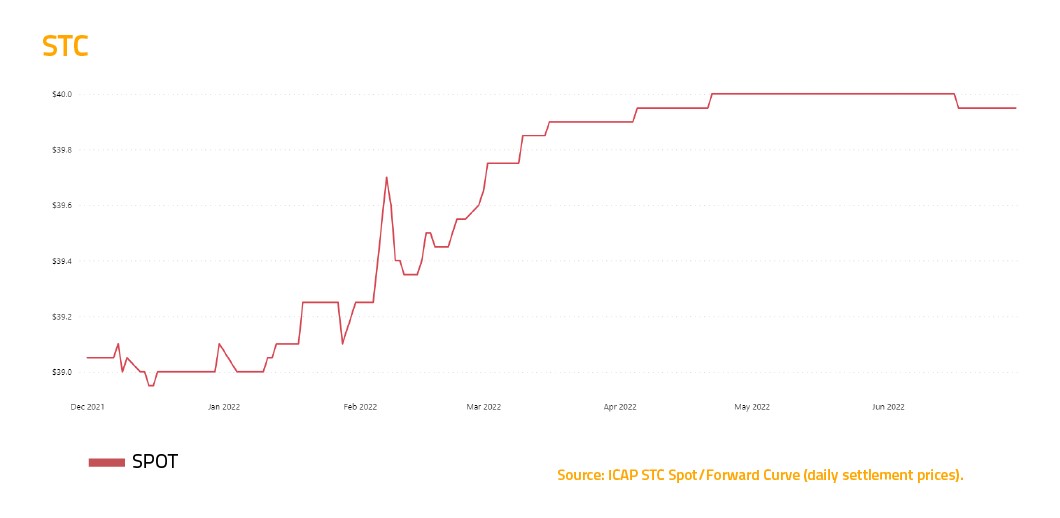

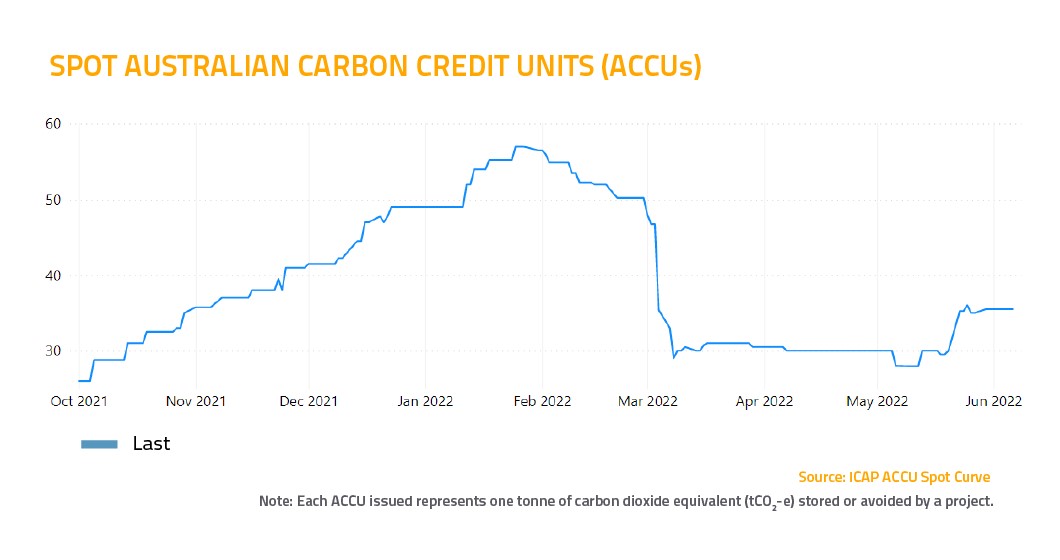

Environmental market

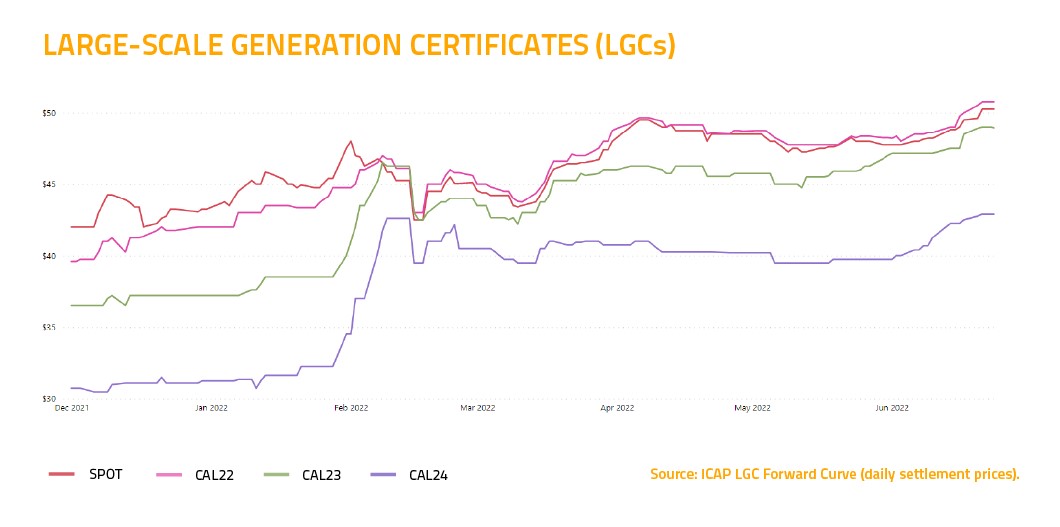

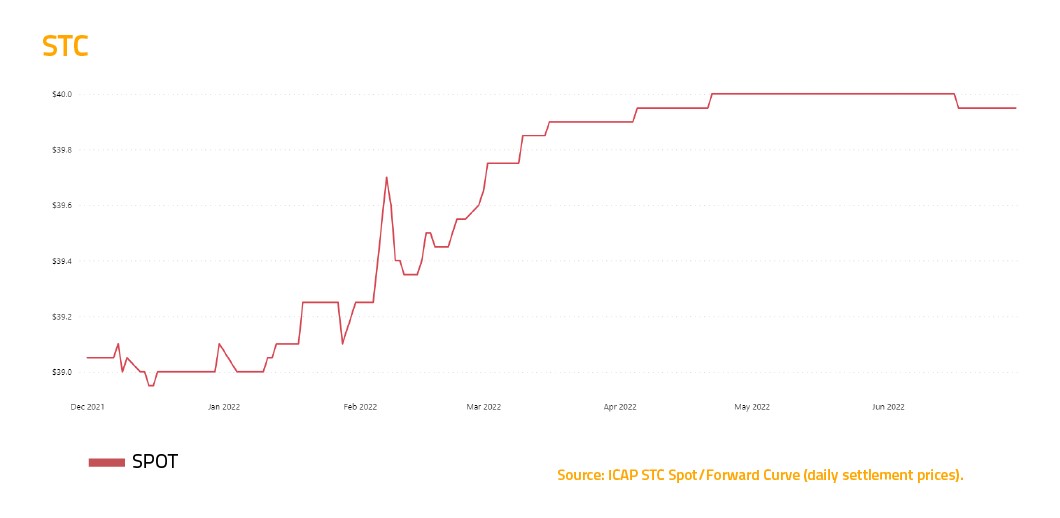

It’s been a quiet month by comparison in the Environmental Market, but we have seen prices for Large-Scale Generation Certificates (LGCs) increase. This is due to the market’s expectation that supply chain constraints will make new renewable projects more difficult and more expensive to build moving forward.

And that’s it for our June market wrap-up. Wishing you all the best for July from the team at Stanwell Energy!