Watch the full update here

It was another eventful month in the energy market, with elevated coal and gas prices and concerns about gas availability over the next 12 months continuing to drive high prices.

Spot Market

June was an unprecedented month in the spot market, with the implementation of the Administered Price Cap and the temporary suspension of the market in all regions of the NEM.

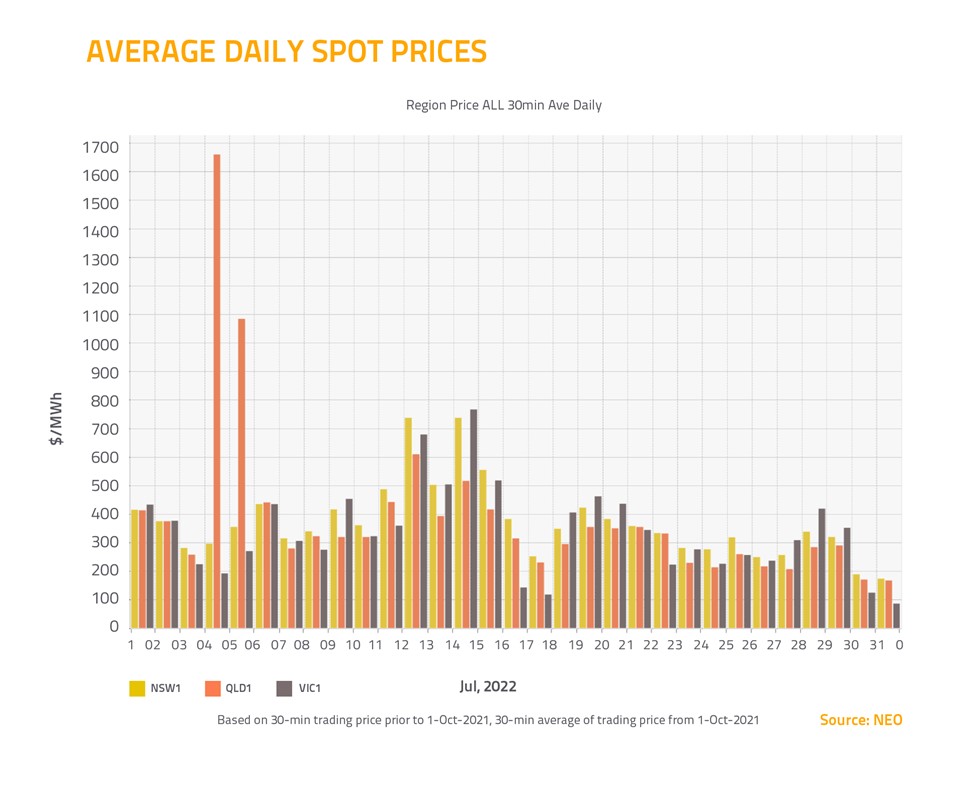

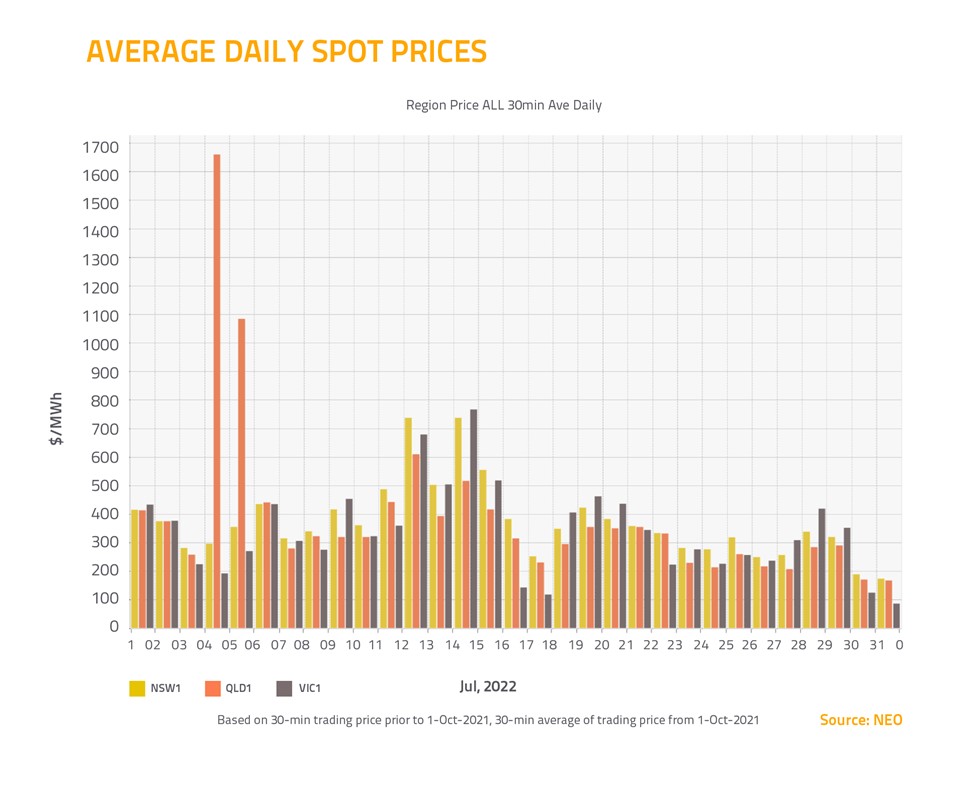

In July, the market operated under the normal rules, but prices remained elevated, although Queensland (down $9.65 to $185.15) and New South Wales (down $9.70 to $192.25) finished lower than last month. Unit outages continued throughout the month, and coal and gas prices remain much higher than the long-term average.

In Queensland, overcast and rainy conditions also limited solar generation and contributed to higher prices in the middle of the day, with occasional price spikes up to the market cap of $15,500 per megawatt hour.

In Victoria, rising prices (up $43.86 to $340.34) were driven by lower wind output, as well as gas constraints. Record low gas storage levels at IONA led AEMO to issue an official system security threat, which will remain in place until the end of September.

AEMO also triggered the gas supply guarantee mechanism to secure additional gas supplies from Queensland LNG producers.

The regulator also ordered two gas-fired power plants in Victoria to shut down until October 1, in order to keep the gas supply operating safely and securely at the correct pressure for customers.

Contract Market

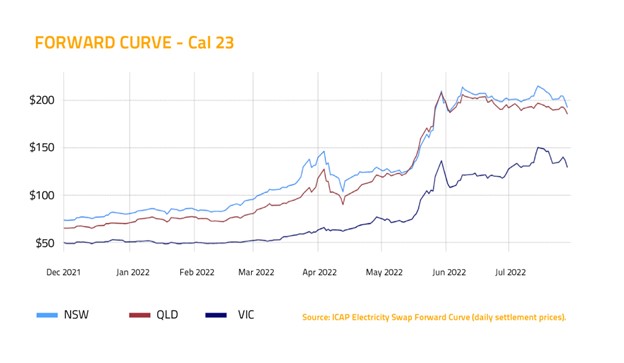

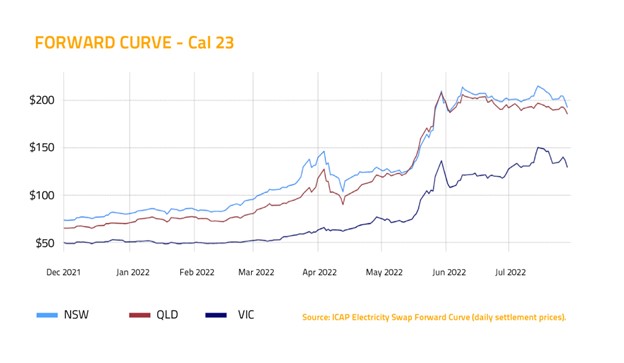

In the contract market, we’ve seen Cal 23 prices for Queensland (down $9.65 to $185.15) and New South Wales (down $9.70 to $192.25) stabilise, after their rally in May and early June. That’s because much of the price risk for Cal 23 is now assumed to be priced in by the market.

Victorian prices are on an upward trend, however (up $5.49 to $128.09), as concerns increase about gas availability over the next 12 months. The state’s gas storage levels are low and pipeline capacity is tight, which means gas prices are expected to remain elevated.

There are also concerns about the reliability of Victoria’s traditional generation assets, which are the only stations in Australia to be fuelled by brown coal.

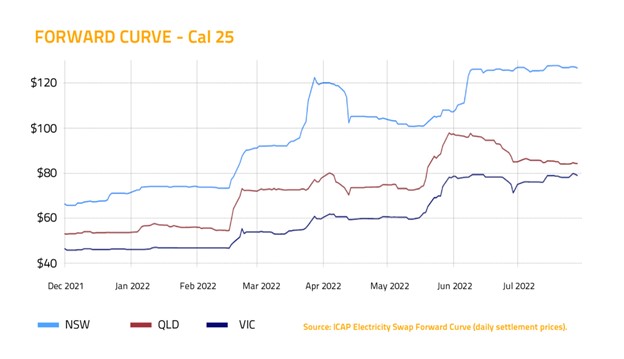

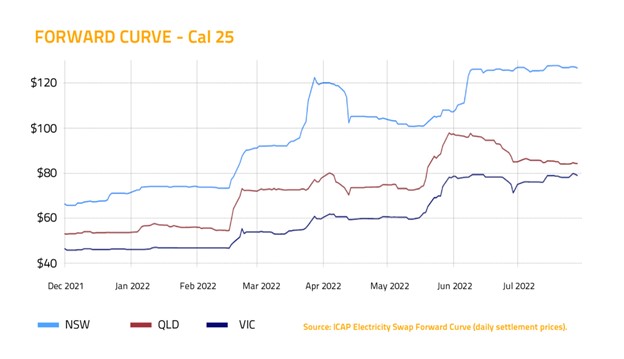

Looking ahead to Cal 25, there was little movement in Queensland (down 50 cents to $84) and New South Wales (up 20 cents to $126.50).

But in Victoria, those same concerns about gas prices and the reliability of brown coal plants led the Cal 25 price to rise (up $6.25 to $79).

It returned to levels observed earlier in June, before a lack of trading volume led the price to drop off at the end of that month.

Environmental Market

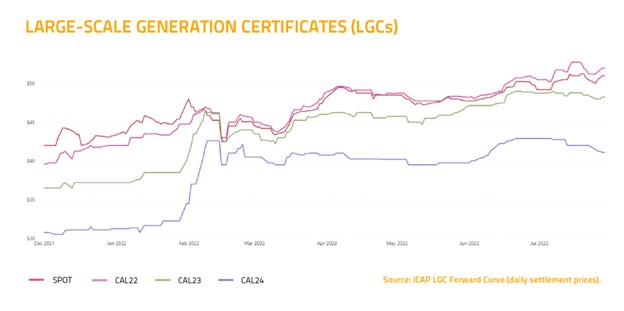

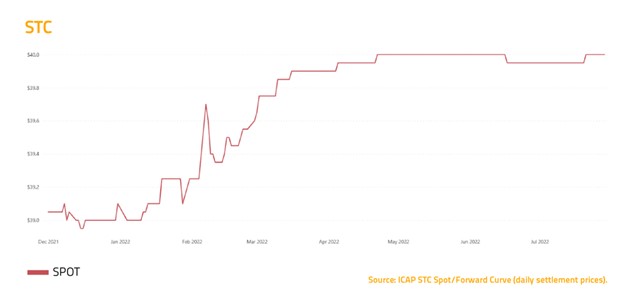

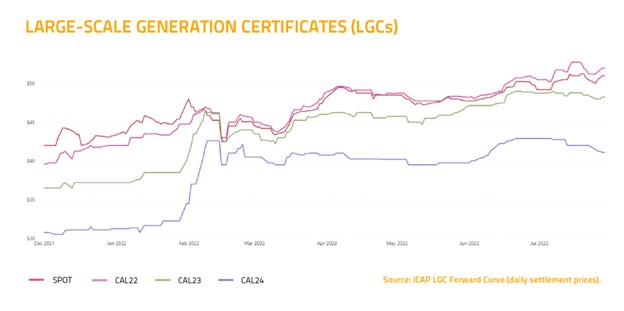

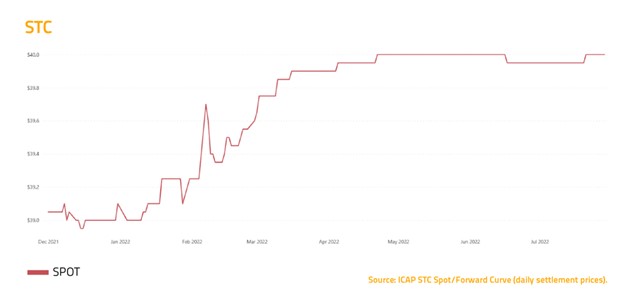

In the environmental market, there was little movement in the prices of Large-Scale Generation Certificates (LGCs) (up $1.80 to $51) and Small-Scale Technology Certificates (STCs) (up 5 cents to $40).

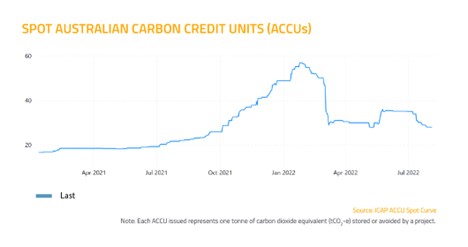

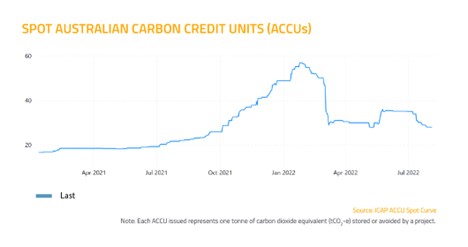

The price of Australian Carbon Credit Units (ACCUs) initially rose, due to market expectations that the change in Federal Government would lead to more support for the carbon market.

But there was less buying demand for these ACCUs as the month went on, leading prices to fall (down $7.10 to $28).

There are signs of recovery for the ACCU market, however. The Federal Government has locked in an emissions reduction target of 43 per cent by 2030, and it’s expected that the ACCU scheme will be used to help attain that target.

And that’s it for July… wishing you all the best for August from the team at Stanwell Energy!