Watch the full update here

Strong solar generation kept downward pressure on prices in the spot market this month, while global commodity prices continue to keep contract prices high. Here’s your September energy market wrap.

Spot Market

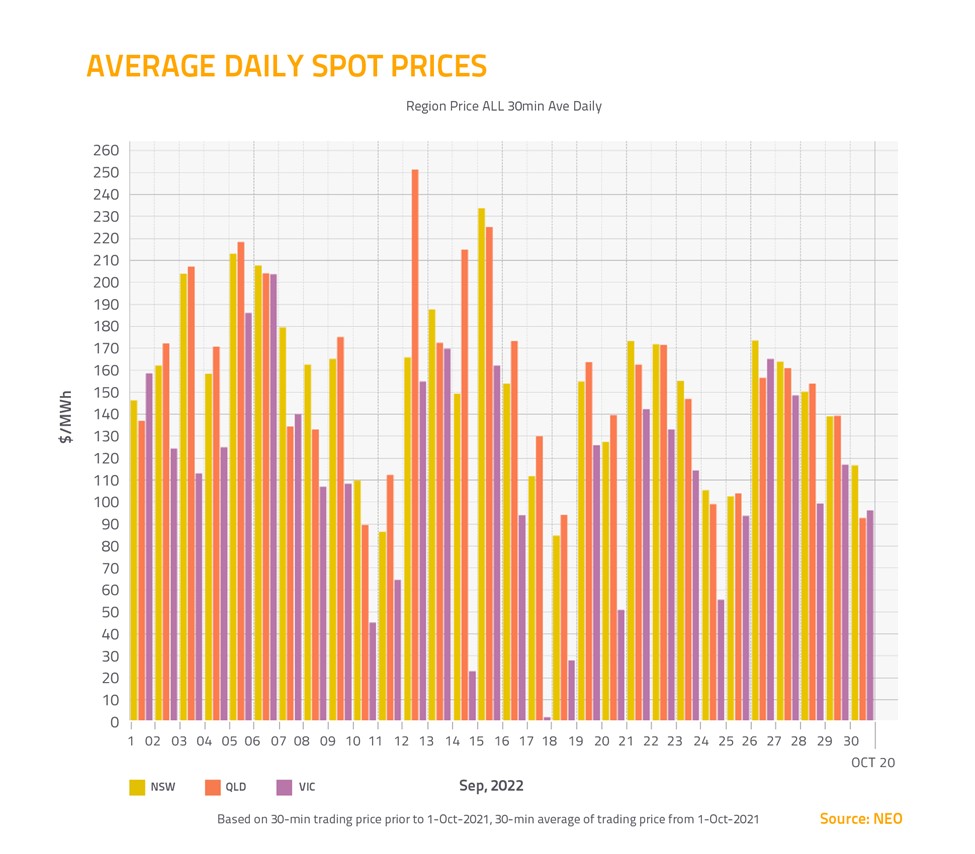

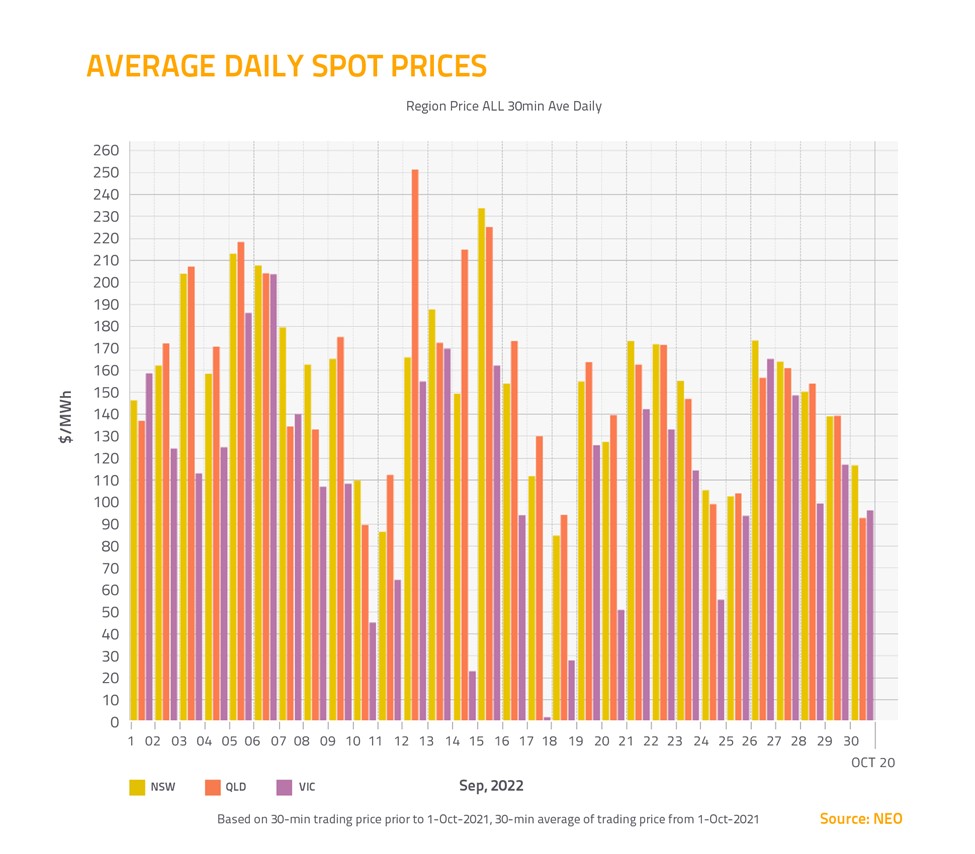

After prices dropped sharply by hundreds of dollars in August, the spot market was steady throughout September.

Strong solar generation and warmer weather continued to limit demand during the daytime. In fact, the National Electricity Market set a new minimum demand record this month.

From noon to 12:30 on Sunday 25 September, demand averaged 12,255 megawatts – the lowest 30 minute average for demand since January 2000. Demand was particularly low in New South Wales, with the state reaching a minimum demand record of 4,253 megawatts.

However, there was also a series of unexpected unit outages in Queensland. This meant there was less availability than last month, which pushed prices slightly higher in Queensland (up $23.39 to $156.89), and to a lesser extent, New South Wales (up $5.86 to $153.86). In Victoria, the spot price fell $9.24 to $111.76.

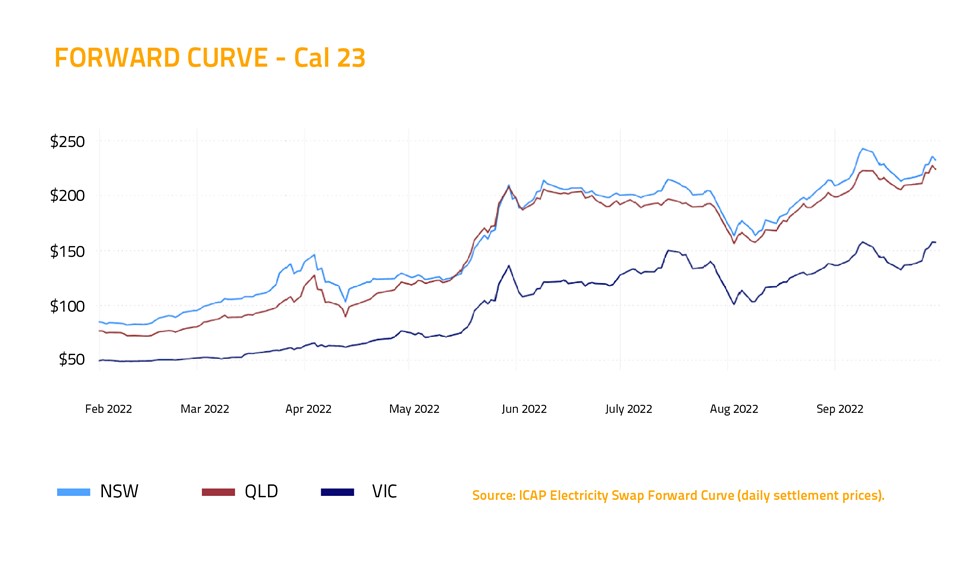

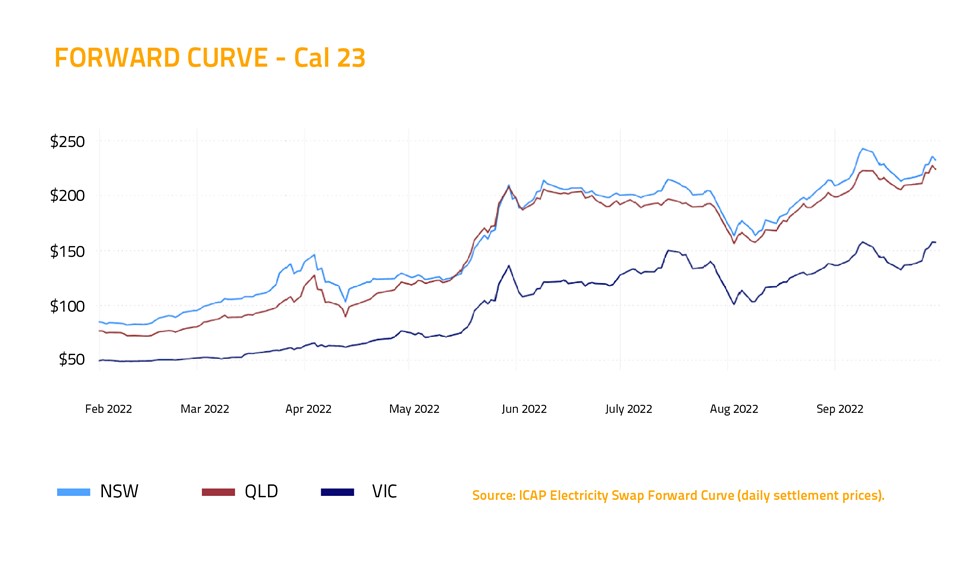

Contract Market

In the contract market, increases in international commodity prices, as well as fears that extreme European electricity prices would take hold elsewhere, led to increases in price across the board (up $23.70 to $223.70 in Queensland; up $19.10 to $232.10 in New South Wales; and up $19.80 to $157.15 in Victoria).

Low Australian coal plant stockpiles, which are still struggling to rise after multiple rain events, have also contributed to elevated prices in the contract market.

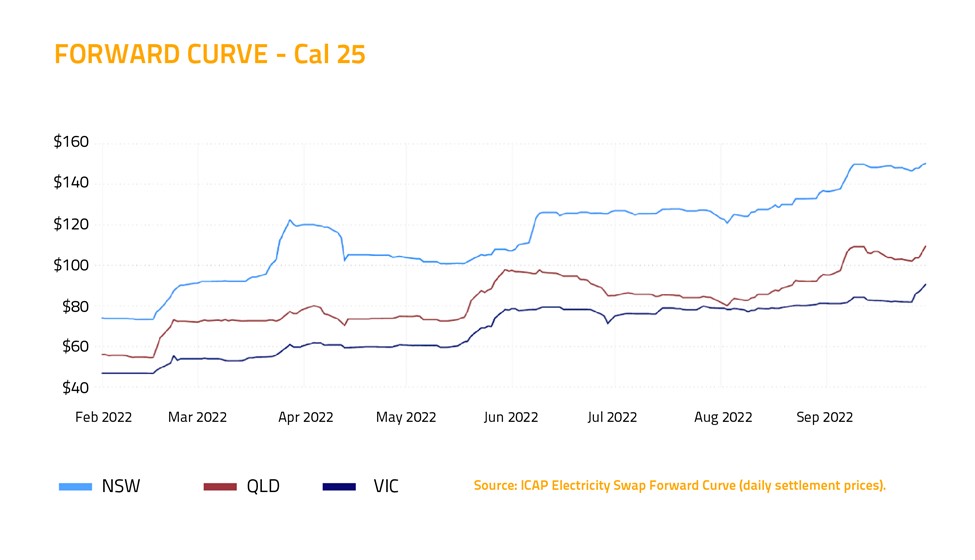

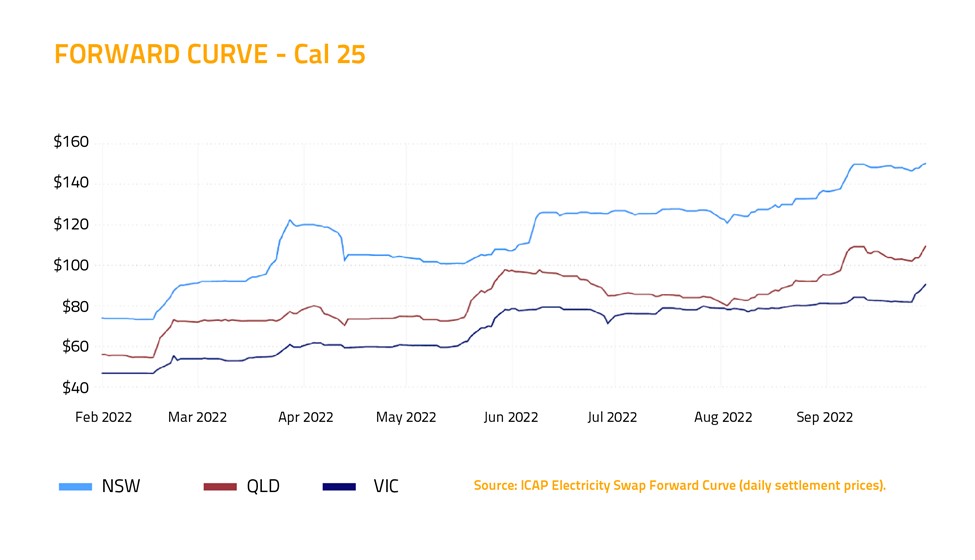

Looking ahead to Cal 25, we see the curve is still trending upwards, in line with rising global commodity prices.

The forward curve for Newcastle coal is still trading well above $300 US dollars up to March 2024. This signals that current supply and demand conditions will persist – particularly the increasing demand for coal in Asia and Europe. However, this trend may be starting to revert on the back of recession fears in Europe and the US.

A third consecutive La Niña this summer is also expected to add to the stockpile struggles for Australian coal plants.

Build delays and cost increases for large-scale renewable generators and storage systems, which are slowing the supply of new renewable energy to the market, are also contributing to elevated contract prices.

Prices are highest in New South Wales (up $12.40 to $149.10), which is partly due to concerns about the early closure of coal-fired power stations in that state. Cal 25 prices also rose in Queensland (up $13.95 to $109.25) and Victoria (up $9.40 to $90.40).

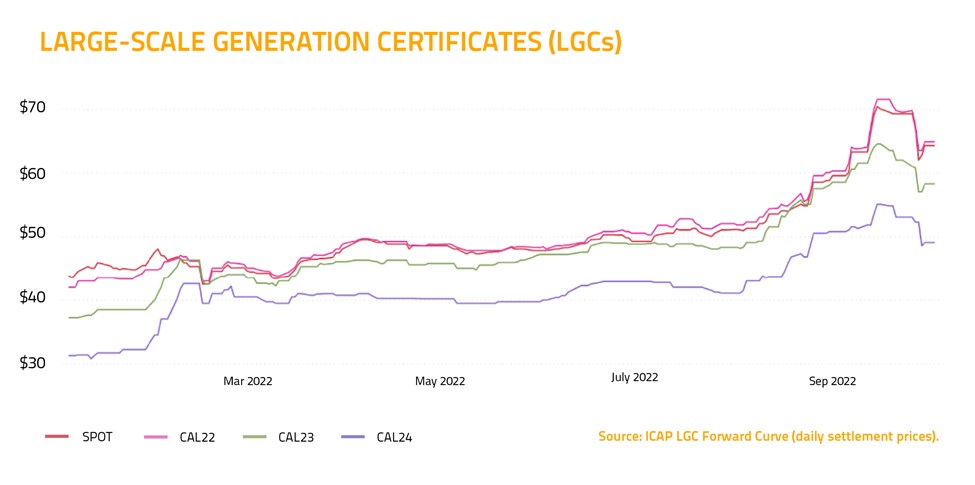

Environmental Market

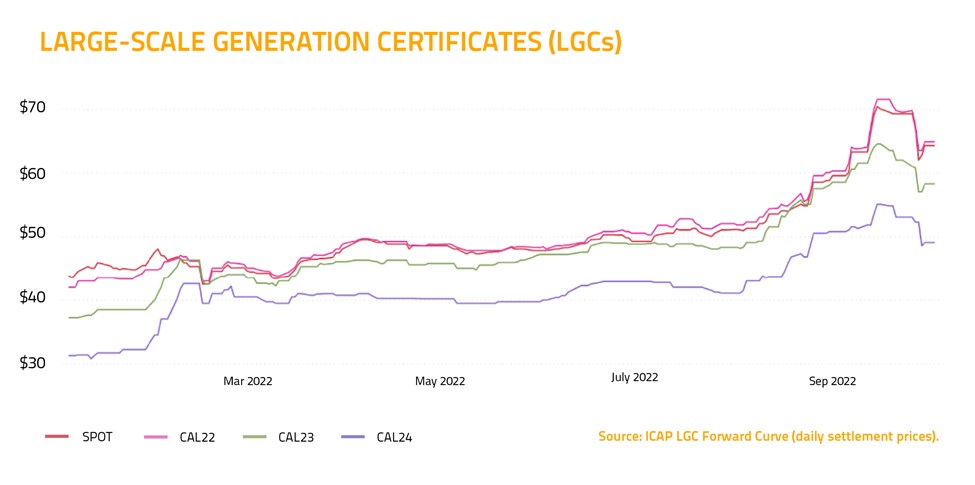

In the environmental market, prices for Large-Scale Generation Certificates (LGCs) continued to rise (up $5.50 to $64.25). Strong demand from buyers, as well as the anticipated increase in the voluntary surrender of certificates by liable entities that we discussed in last month’s market update, has placed upward pressure on LGC prices.

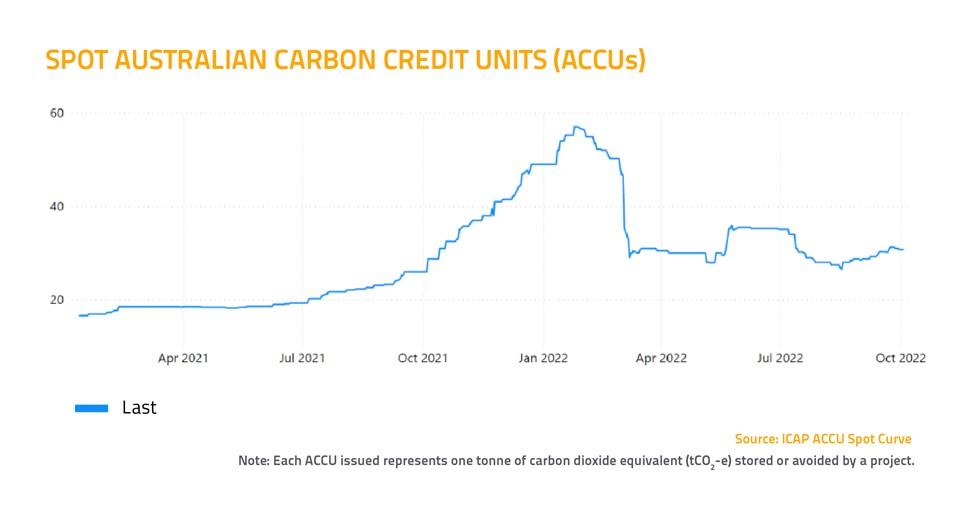

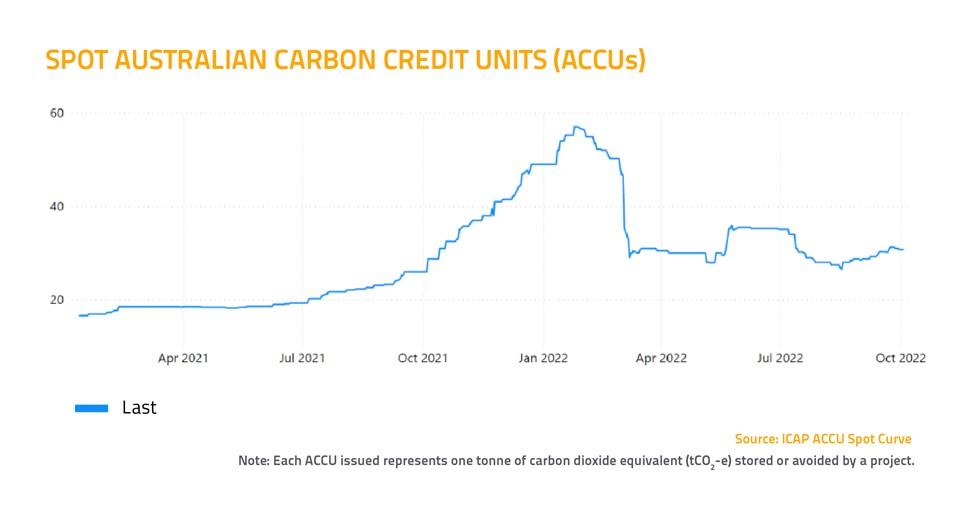

The price of Australian Carbon Credit Units (ACCUs) also rose (up $2.25 to $30.75), driven by interest from international trading entities

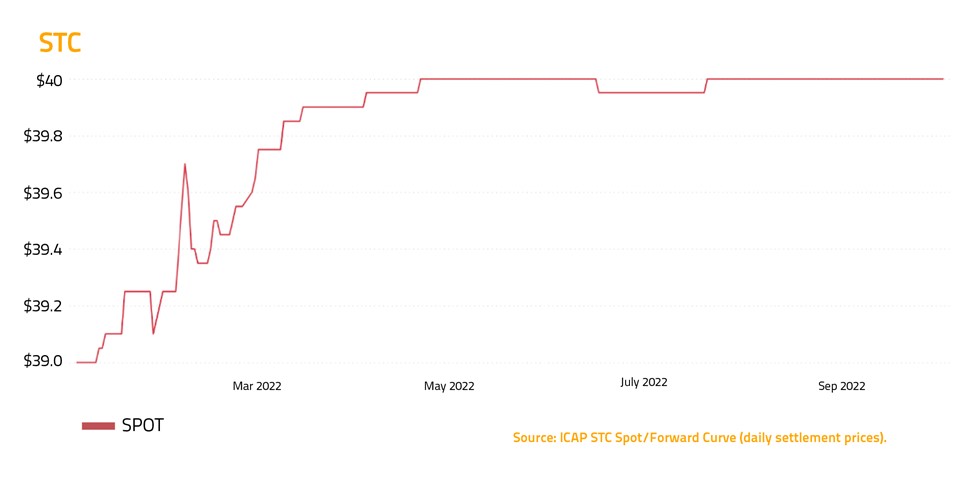

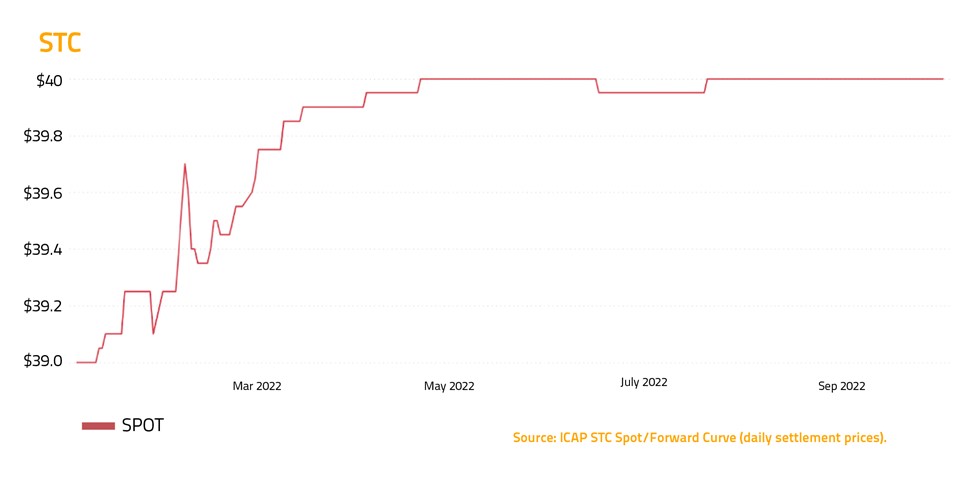

The clearing house for Small-Scale Technology Certificates (STCs), remains in deficit by 3.06 million certificates, which is keeping the STC price close to the clearing house cap of $40.

And that’s it for September… wishing you all the best for October from the team at Stanwell Energy!