Watch the full update here

Strong solar generation kept the spot market in check throughout October, but the contract market remains volatile.

Spot market

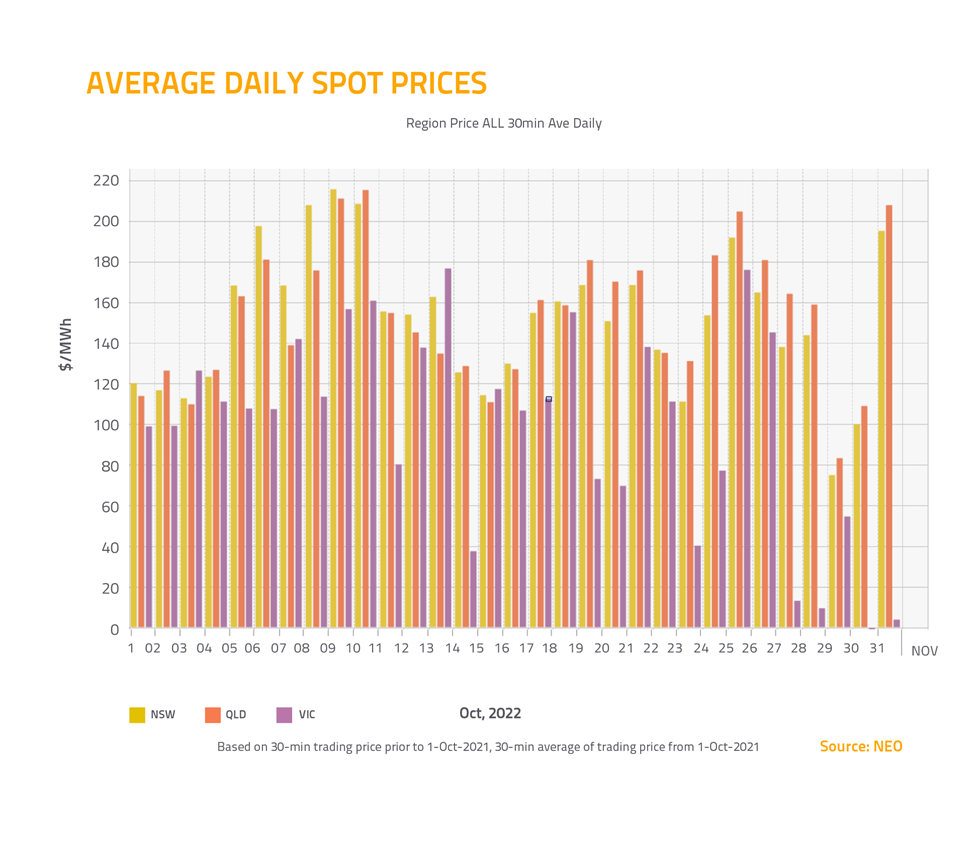

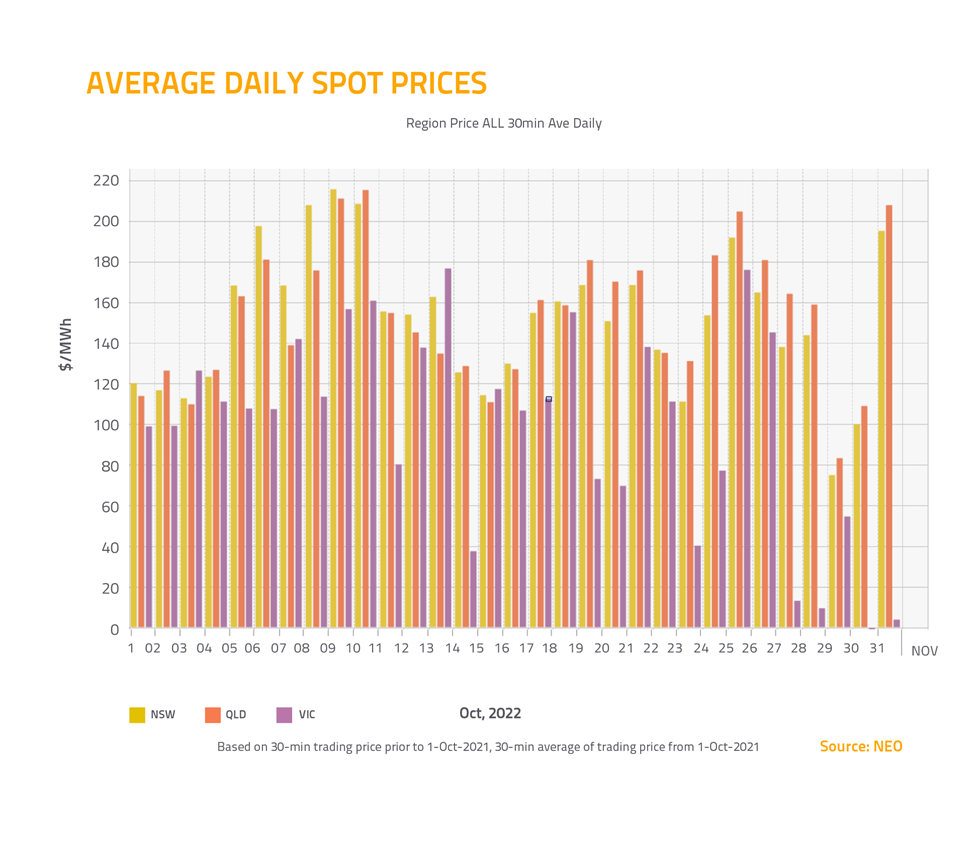

In the spot market, strong wind and solar generation continued to keep prices in check throughout October, with prices finishing the month lower in Queensland (down $2.89 to $154); New South Wales (down $1.86 to $152) and Victoria (down $12.76 to $99).

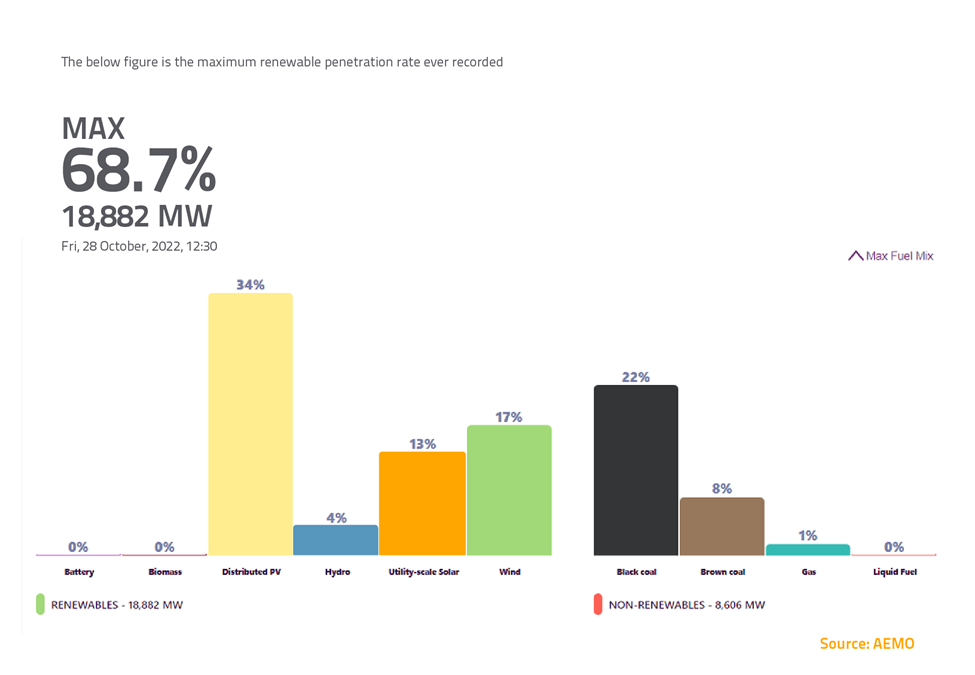

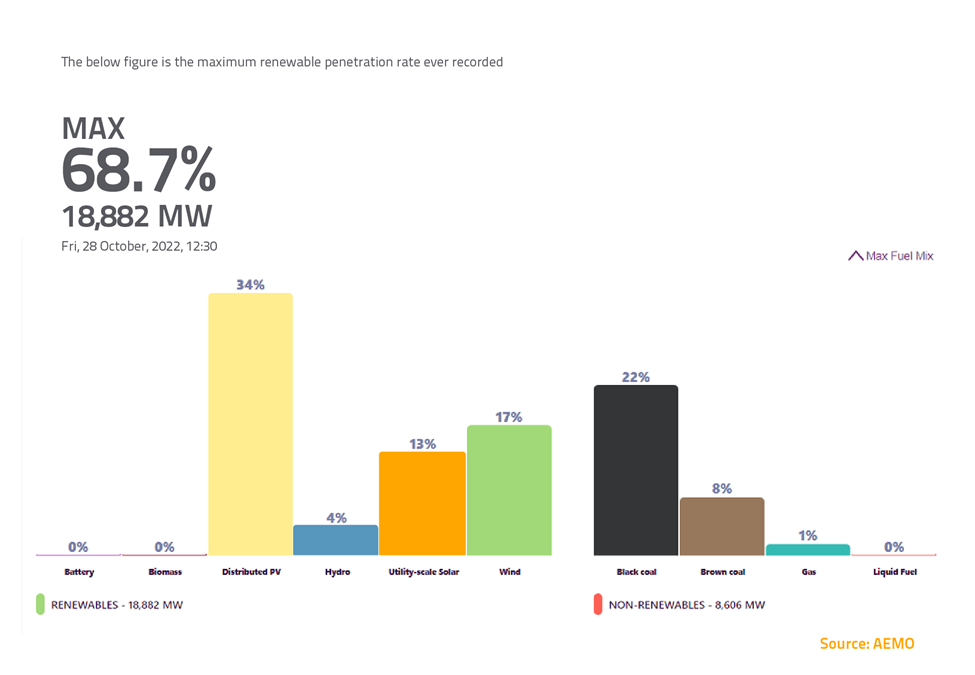

At 12:30pm on Friday October 28, the National Electricity Market reached the highest renewable penetration rate ever recorded, with renewables providing 68.7 per cent of all the energy in the grid. Rooftop solar accounted for 34 per cent of the fuel mix at that time, with wind accounting for 17 per cent and utility-scale solar accounting for 13 per cent.

There was also more generation available than there was last month, when a series of unexpected unit outages led to a slight price rise in Queensland. With availability returning to normal levels this month, the spot price fell accordingly.

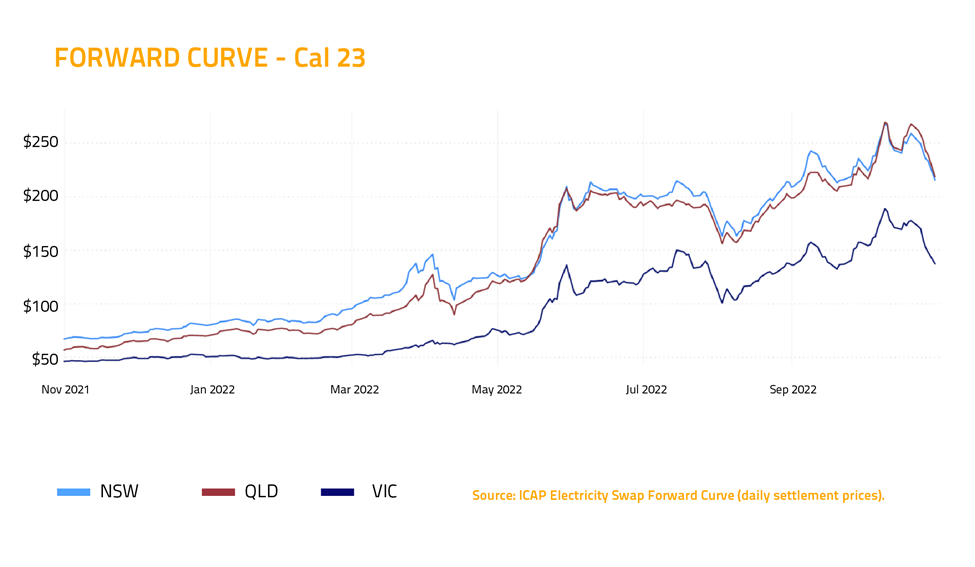

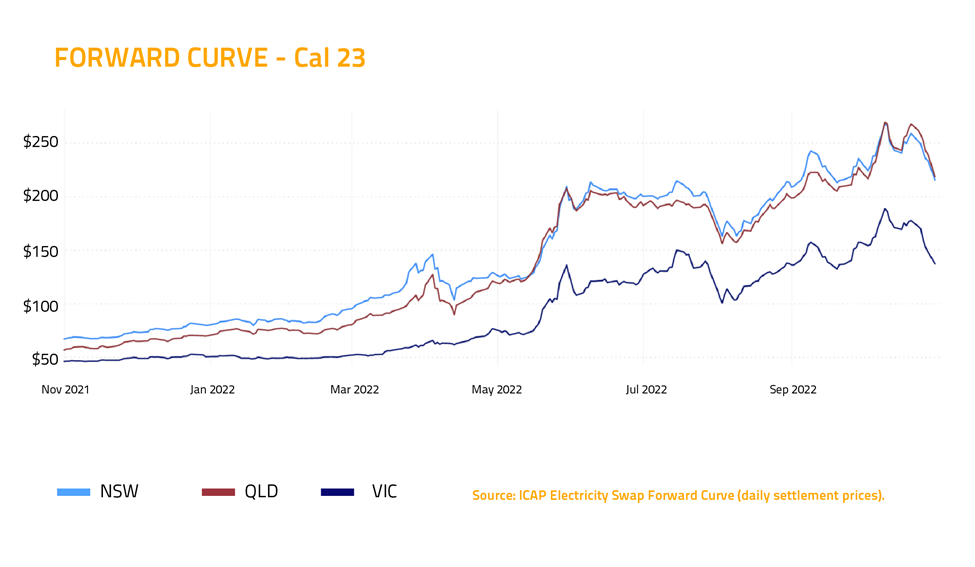

In the contract market, volatility is hitting all-time highs, with significant swings of up to $40 in prices over the final week of the month. Ultimately, the Cal 23 price finished lower in Queensland (down $5.55 to $218.15), New South Wales (down $16.85 to $215.25) and Victoria (down $18.80 to $138.35).

The ongoing volatility we’ve seen throughout the year has largely been the result of increases in international commodity prices, and a lack of market liquidity.

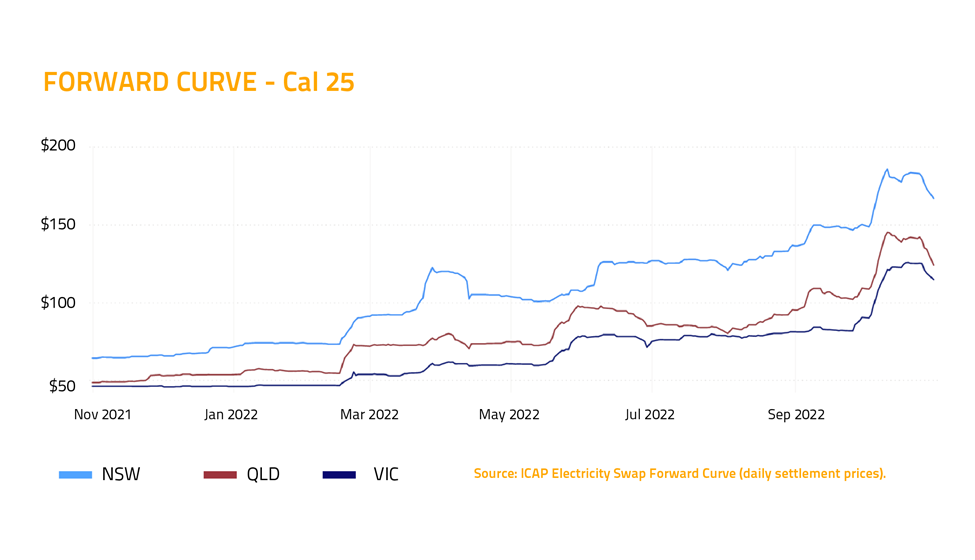

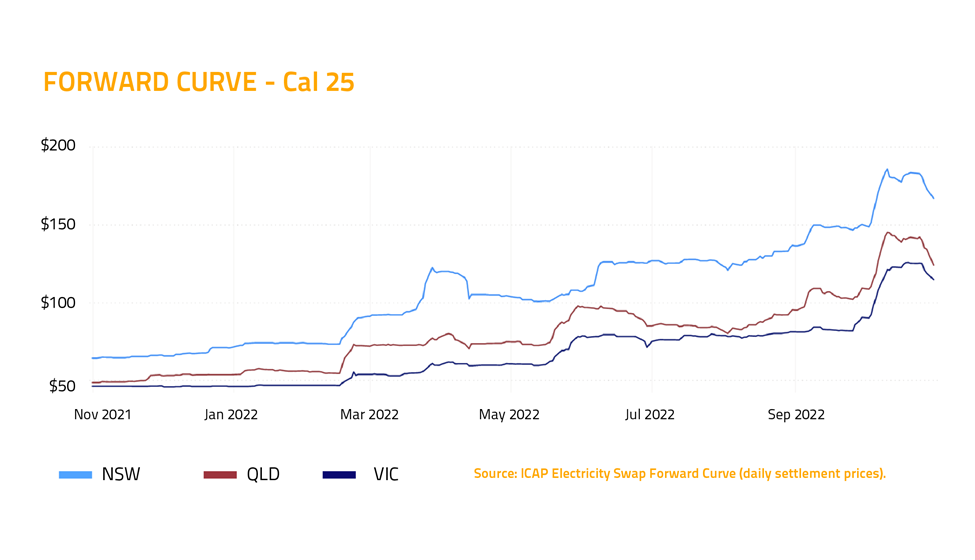

Looking ahead to Cal 25, there’s been a perception that the curve has been too backwardated, meaning that the back end of the curve was too low in comparison to the front end of the curve.

Overall, there’s an expectation that commodity prices will still be high in Cal 25, while dispatchable generation will be retiring earlier than expected. Ultimately, we saw rises in the Queensland (up $14.75 to $124) and Victorian (up $24.35 to $114.75) prices, bringing them more in line with the New South Wales price (down $15.50 to $168).

Environmental market

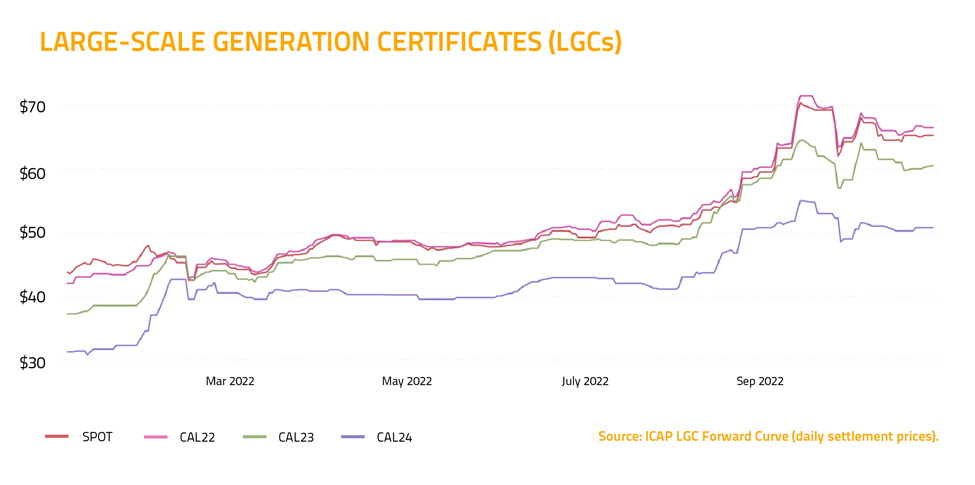

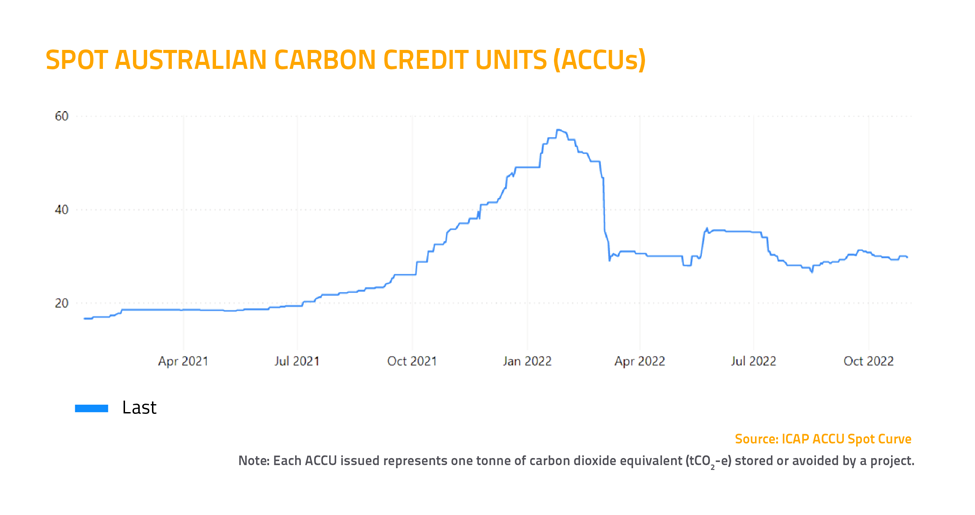

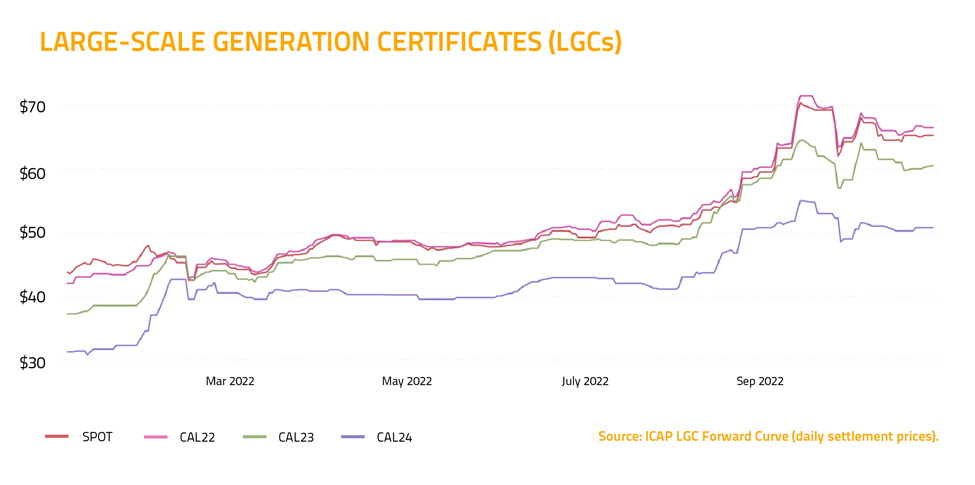

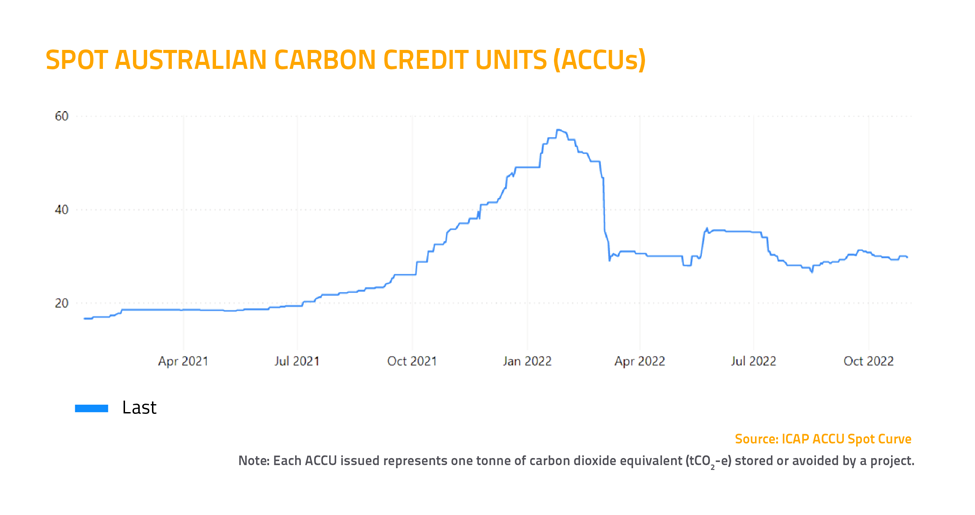

The environmental market remained steady, with minimal movement in the prices of Large-Scale Generation Certificates (up $1 to $65.25) and Australian Carbon Credit Units (down 75 cents to $30).

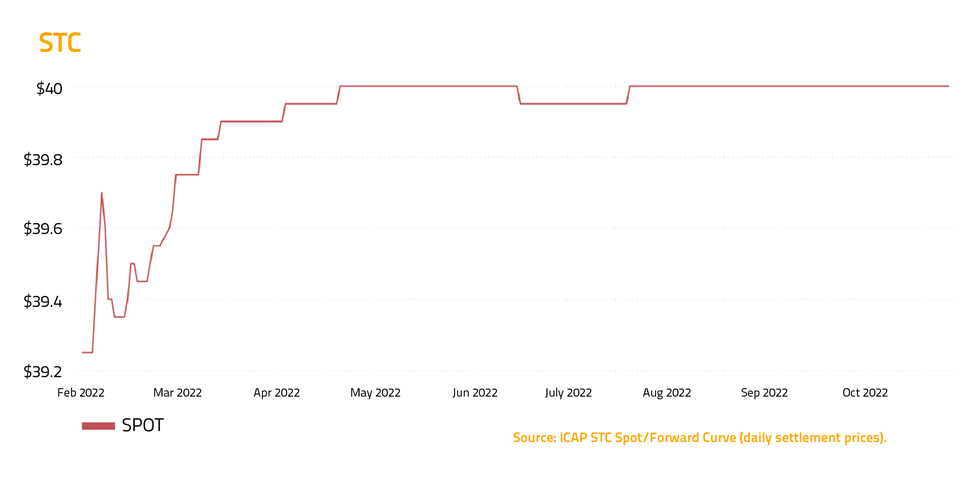

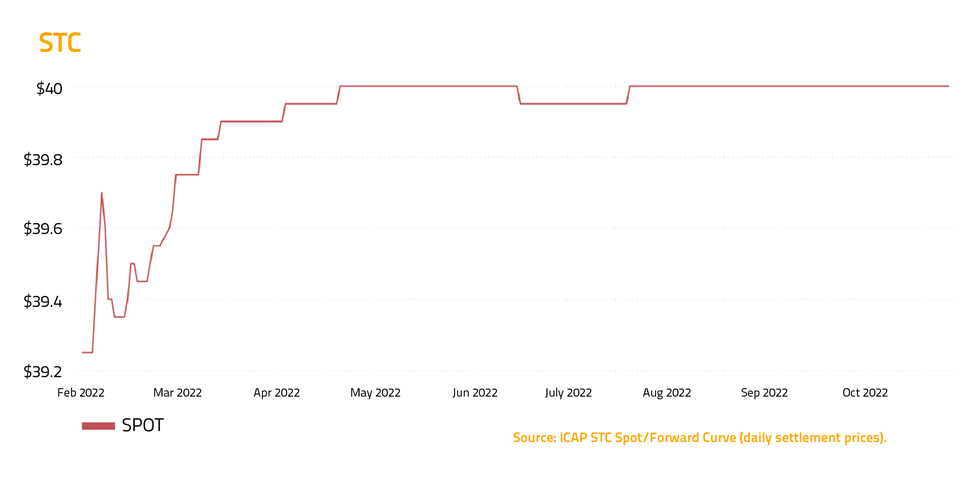

The Small-Scale Technology Certificate (STC) clearing house remained in deficit for the entire month, keeping STC prices at the clearing house cap of $40.

And that’s it for October… wishing you all the best for November from the team at Stanwell Energy!