Watch the full update here

Market Update – November 2022

Plenty of available generation and cooler-than-expected weather drove prices down in the spot market in November, while the volatility in the contract market continued.

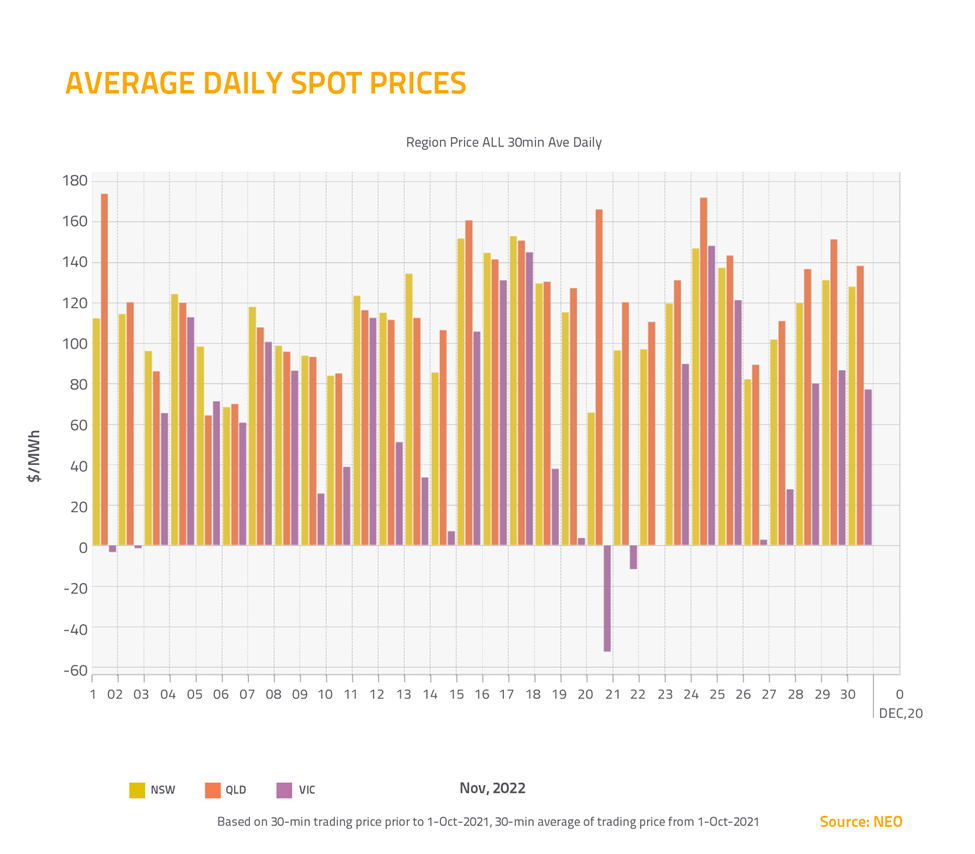

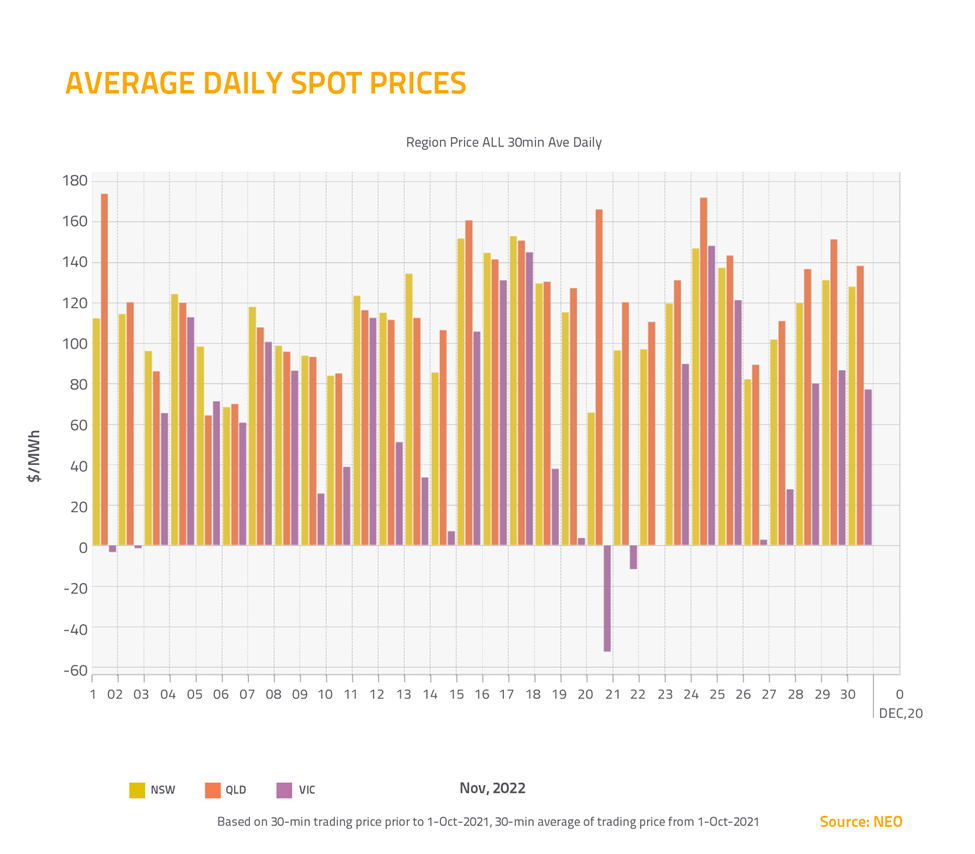

Spot market

In the spot market, an abundance of available generation put downward pressure on prices in all regions. The weather was also cooler than expected, which helped to give our air-conditioning units a break and drive down demand. At the end of the month, prices finished lower in Queensland (down $32.55 to $121.50), New South Wales (down $38.75 to $112.90) and Victoria (down $40.27 to $58.63).

International commodity prices have been a major contributor to elevated spot market prices throughout the year. In November, the price of coal dropped below US$300 a ton, but it was back up to almost 400 dollars by the start of December.

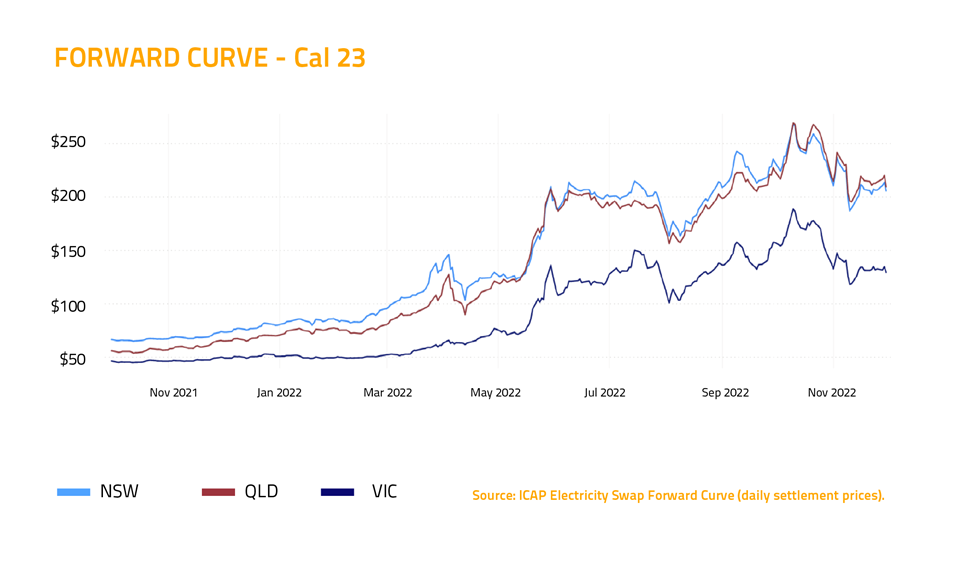

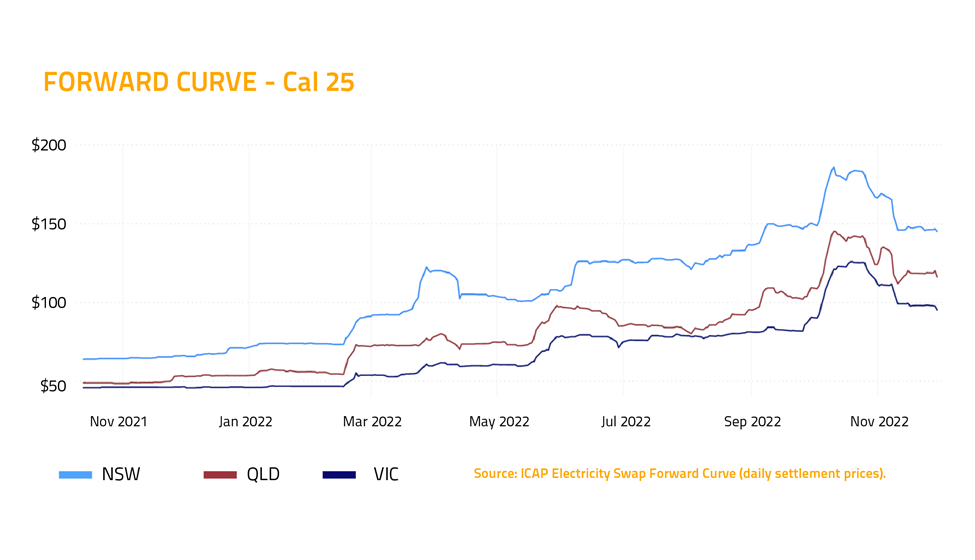

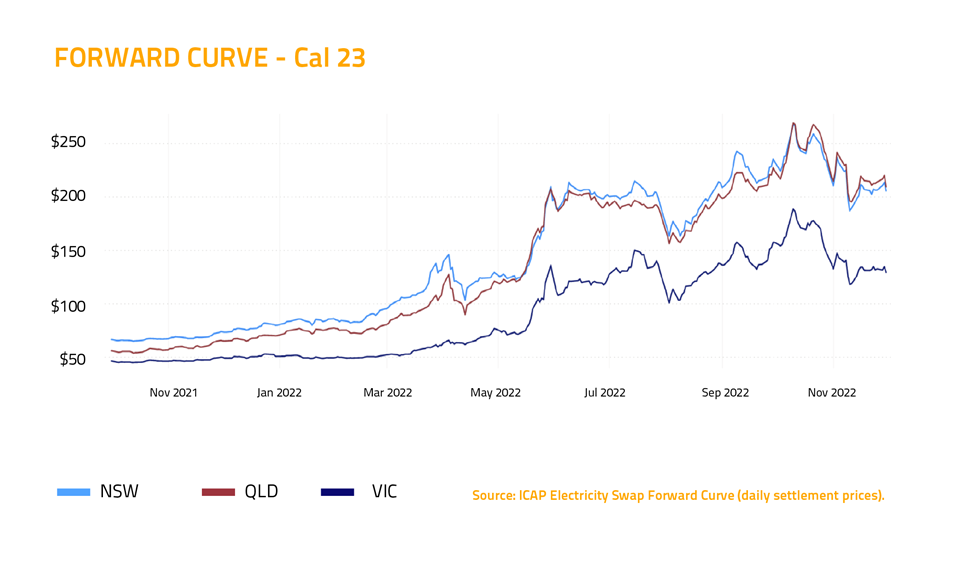

Contract market

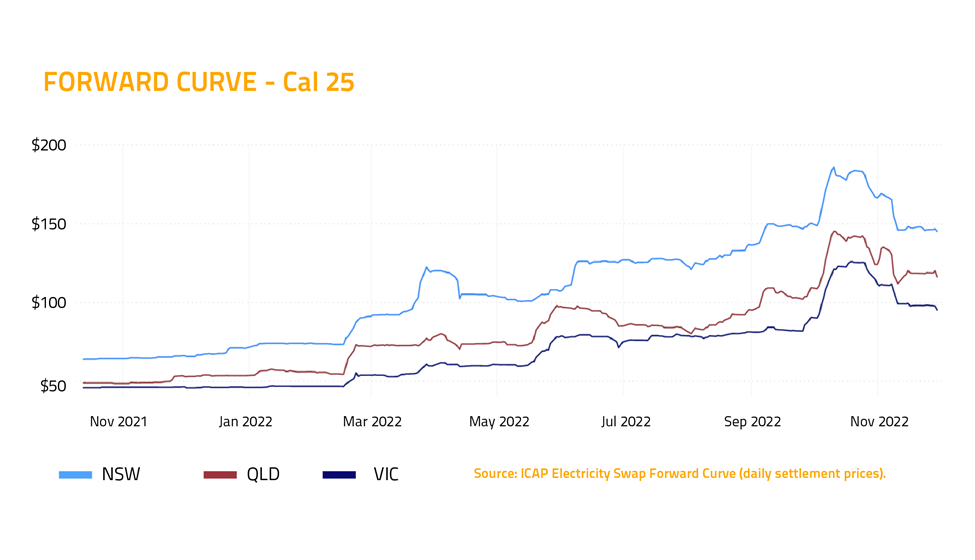

The contract market was highly volatile in October, and that volatility continued in November, fuelled by reports that the Federal Government is preparing to introduce a cap on coal and gas prices.

Prices were down across the board, due to widespread concerns about how government intervention on market-determined coal and gas prices would impact the forward market.

Cal 23 prices finished the month lower in Queensland (down $7.85 to $210.30), New South Wales (down $10 to $205.25) and Victoria (down $9.75 to $128.60).

Looking ahead to Cal 25, prices also finished lower in Queensland (down $8 to $116), New South Wales (down $23 to $145) and Victoria (down $19.75 to $95).

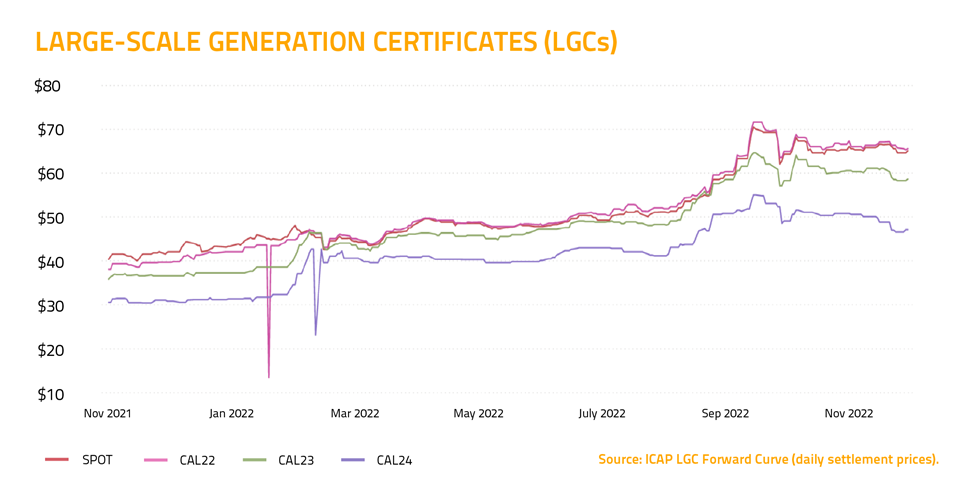

Environmental market

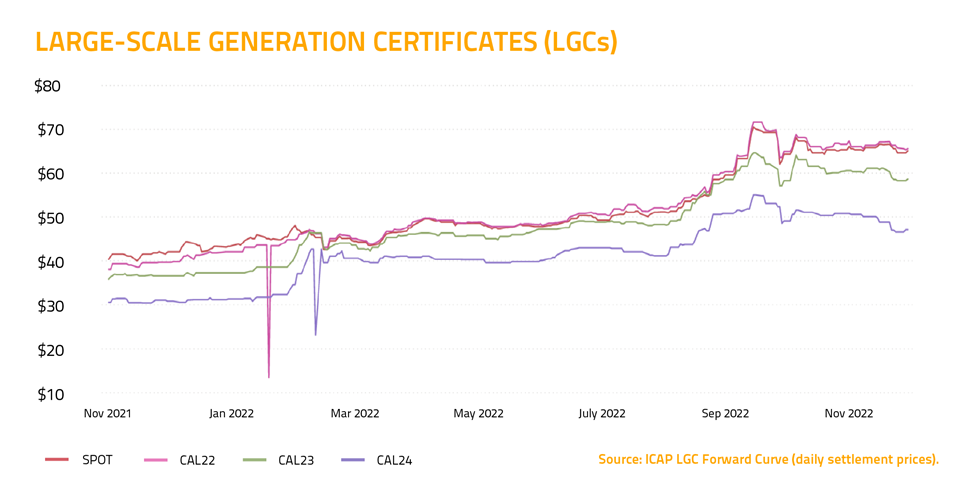

There was little volatility in the environmental market, with prices for renewable products remaining stable.

While there was some downward pressure on the curve for Large-Scale Generation Certificates (LGCs), which finished the month down 25 cents at $65, the market outlook remains buoyant.

Driven by sustainability goals and renewable energy commitments, corporations are highly motivated to reduce or offset their emissions by voluntarily surrendering LGCs. In November, the Clean Energy Regulator released data showing the third quarter of 2022 was the single largest quarter ever for voluntary LGC surrenders.

4.7 million LGCs were voluntarily surrendered throughout the quarter, which is a 36 per cent increase on the previous record, set in the third quarter of 2020.

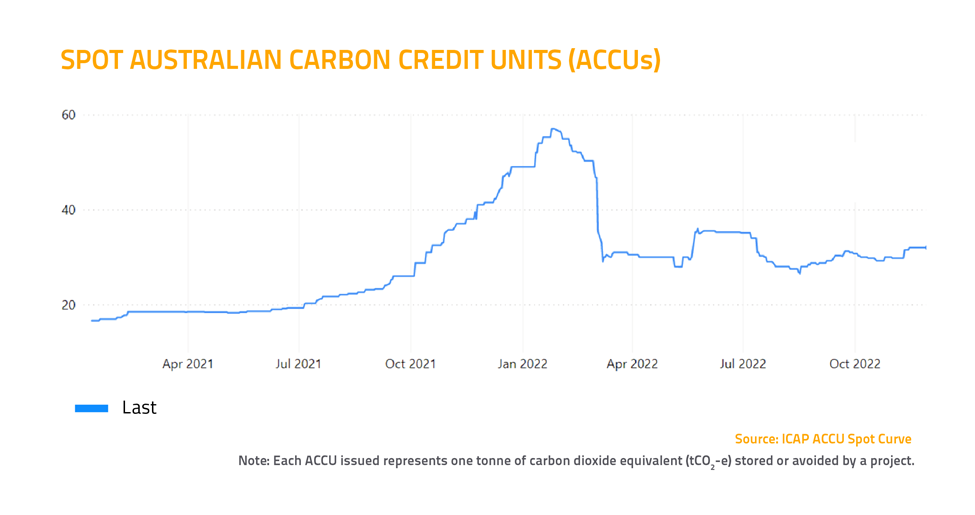

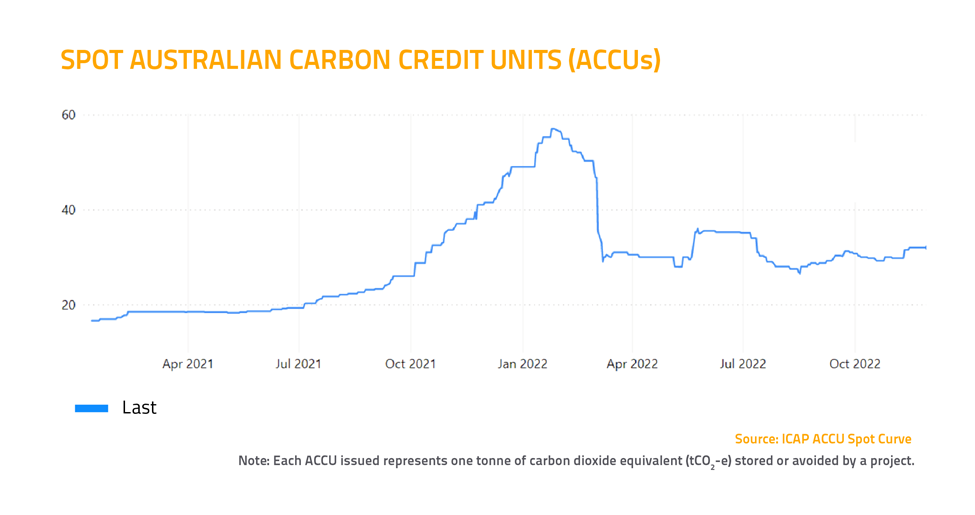

We also saw strong buying demand for Australian Carbon Credit Units (ACCUs), throughout the month. Demand was particularly high for Human Induced Regeneration, or H-I-R, projects, which regenerate native vegetation by adjusting land management practices.

HIR ACCUs, specifically, closed at $34.50, $2.50 higher than the overall spot market price for ACCUs, which finished $2 above last month at $32.

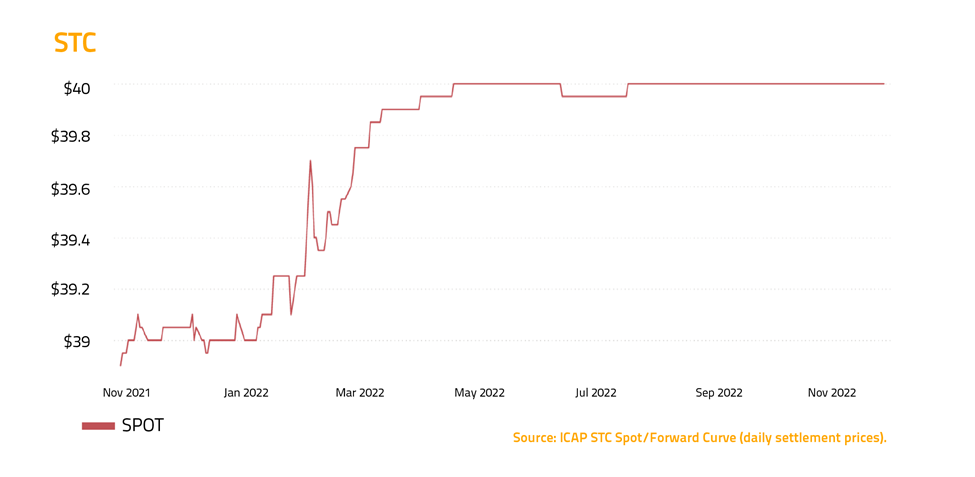

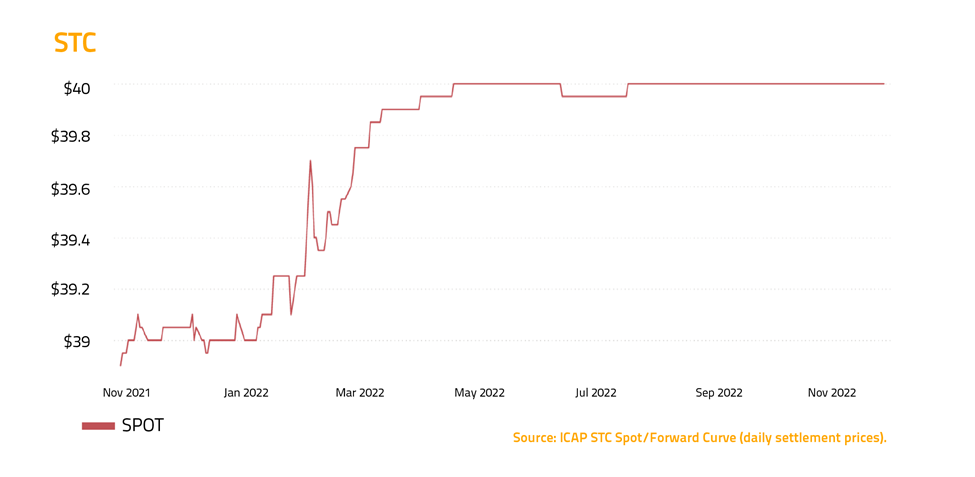

Finally, the clearing house for Small-Scale Technology Certificates, or STCs, remained in deficit throughout November, which kept STCs at or close to the STC clearing house fixed price of $40 all month.

And that’s it for November… wishing you all the best for December from the team at Stanwell Energy!