Watch the full update here

Market Update – January 2023

The weather is heating up and so are prices in the spot and forward markets, while the environmental market reacts to the release of the Chubb Review.

Spot market

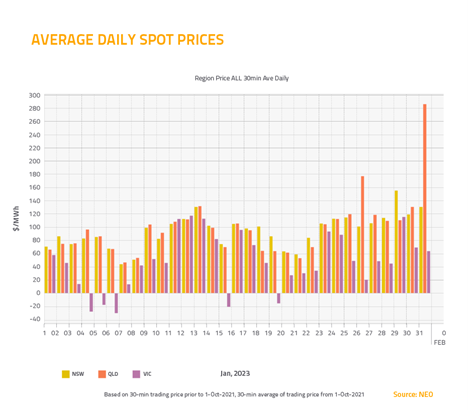

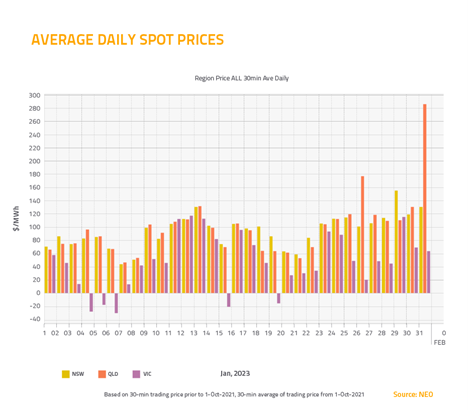

In the spot market, cooler-than-expected weather kept demand – and prices – low for much of January.

But that classic Australian summer heat finally started to creep in towards the end of the month, turning quickly to heatwave conditions.

As we gave our air conditioners a work-out, demand crept back up – and so did prices. And, as can be expected for a Queensland summer, these heatwave temperatures will now carry into February and possibly into March.

Contract Market

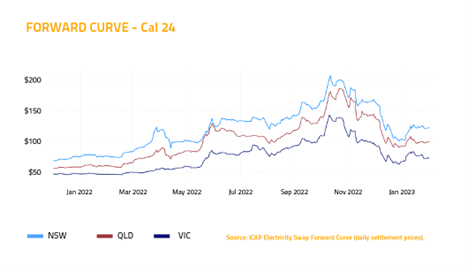

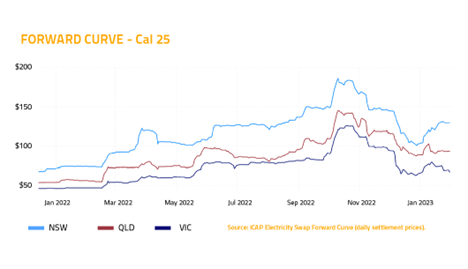

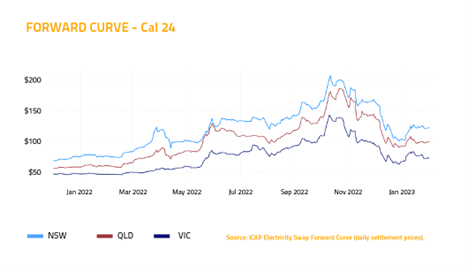

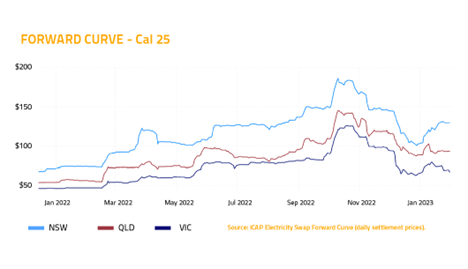

In the forward market, the National Cabinet’s decision to impose caps on the wholesale price of coal and gas led to price decreases across the board in December. However, the curve reversed trend in January.

The Australian Energy Market Operator is forecasting record demand for the start of February, which has lifted the forward curve across all contracts.

Retail customers also returned from holidays in January and began requesting new contracts, which provided support to the curve.

Prices in New South Wales have risen more sharply than in Queensland and Victoria, potentially due to Liddell Power Station fully closing down by April 23.

Environmental Market

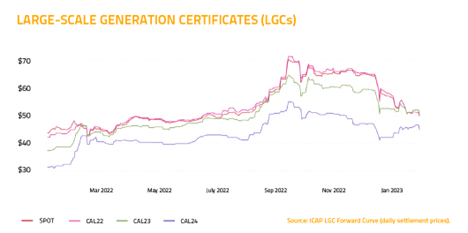

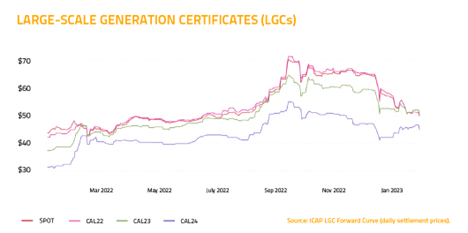

In the environmental market, there was a slow-down in buying interest for Large-Scale Generation Certificates over the holiday period that extended into the new year. This has led to the LGC curve getting traded down.

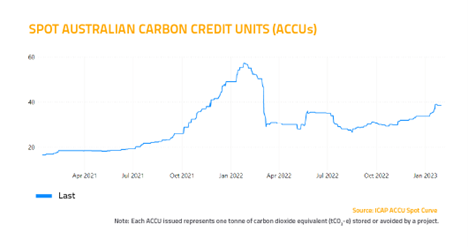

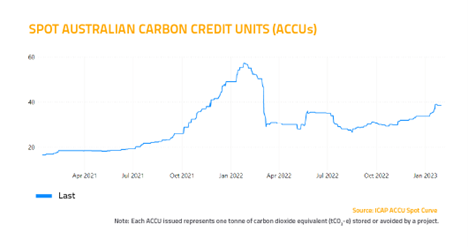

But Australian Carbon Credit Units, or A-C-C-Us, were up. This was on the back of the Chubb review, which was released in December. The independent panel convened to review the integrity of the ACCU scheme found that the scheme was fundamentally well-designed, and rejected suggestions it had led to carbon dioxide abatement being overstated.

This assurance about the scheme’s integrity led to renewed interest in ACCU trading.

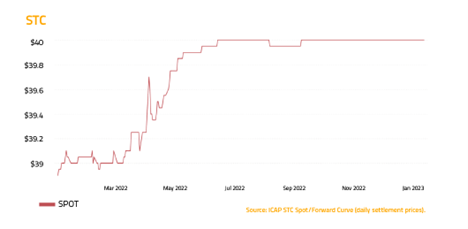

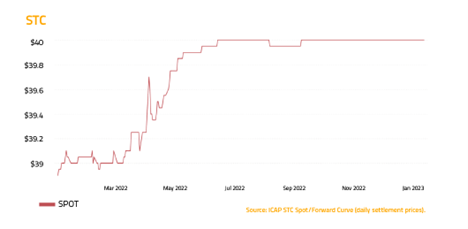

Finally, the clearing house for Small-Scale Technology Certificates, or STCs, once again remained in deficit throughout the month, which kept STCs at or close to the fixed price of $40.

And that’s it for January… wishing you all the best for February from the team at Stanwell Energy!