Watch the full update here

Prices were down across most of the energy market in February, despite scorching temperatures throughout the month.

Spot market

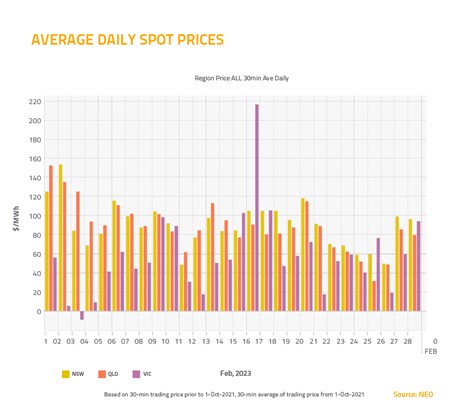

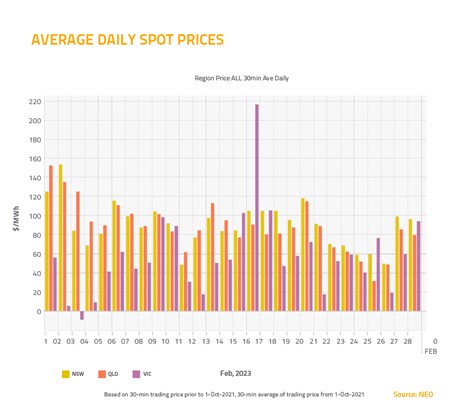

Many regions experienced their hottest maximum temperatures in years throughout February.

But despite this heat, which often leads to rising energy prices, we actually saw the spot price go down in Queensland and New South Wales.

This was largely due to a decrease in fuel costs, and increased availability from generators in these states, with assets generating more megawatts at cheaper price bands than the previous month.

In Victoria, where Melbourne recorded its first 40-degree day in three years, we didn’t see a similar increase in generation, and prices rose by almost $10.

Contract market

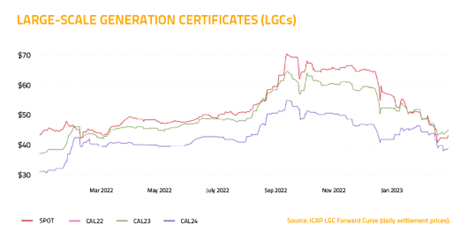

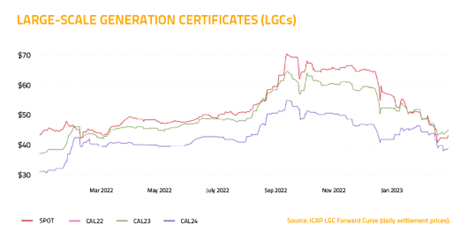

The decrease in the spot price in Queensland and New South Wales has contributed to lower prices in the forward market.

We’re also expecting to see an increase in solar generation this winter, because of the El Niño weather forecast for the season. This is also putting downward pressure on prices in the forward market.

In Victoria, however, less wind generation is forecast for winter, so we didn’t see the same drop in price there that we saw in Queensland and New South Wales.

Environmental market

In the environmental market, there’s been a slump in prices for Large-Scale Generation Certificates (LGCs).

This is typical of this time of year, because liable entities must surrender their LGCs midway through February. In the weeks after the surrender date, urgency to buy LGCs is at its lowest.

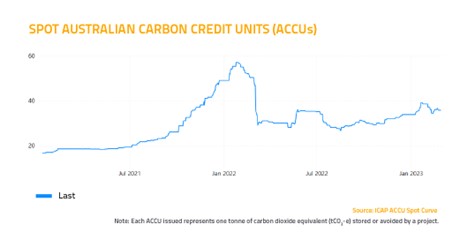

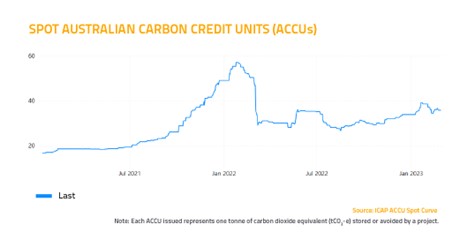

The price of Australian Carbon Credit Units (ACCUs) also went down slightly. This could simply be the market correcting itself, after prices rose by roughly the same amount last month in the wake of the Chubb Review, which affirmed the integrity of the ACCU scheme.

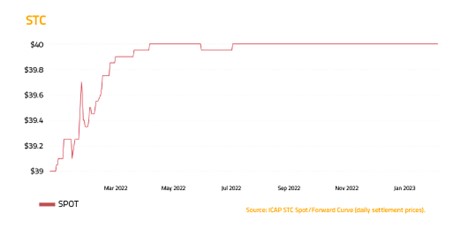

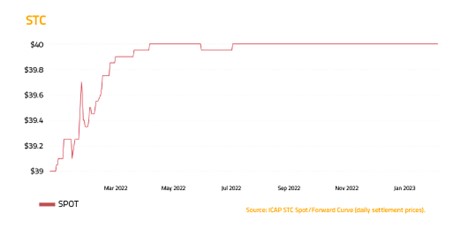

Finally, the clearing house for Small-Scale Technology Certificates (STCs) once again remained in deficit throughout February. This kept STCs at or close to the fixed price of $40 throughout the month.

And that’s it for February… wishing you all the best for March from the team at Stanwell Energy!