Watch the full update here

Prices finished higher across the spot, contract and environmental markets in March, as high temperatures, merger and acquisition activity and Federal Government policy all made an impact.

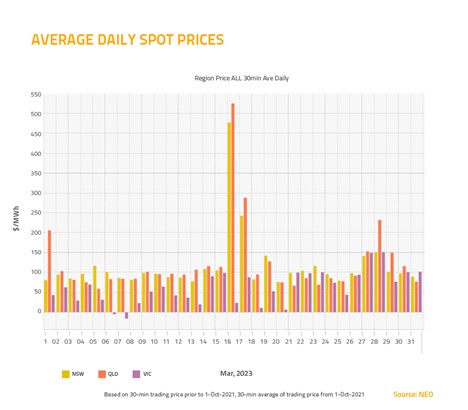

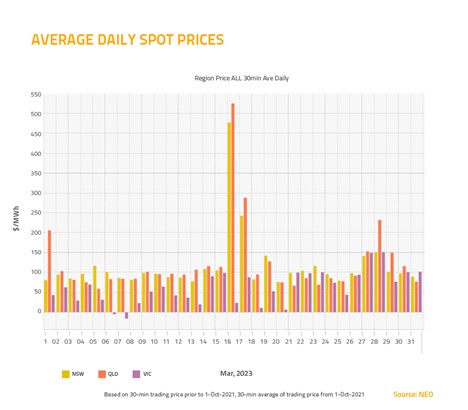

Spot market

The spot price was up in March, as unseasonably hot and humid weather led to an increase in demand. New South Wales (up $25.88 to $116.01) set a March heat record, while Queensland (up $25.88 to $116.01) finished the month with maximum temperatures well above the norm. Victoria’s spot price also finished higher, up $4.01 to $62.02.

An abundance of cloud cover throughout March led to a decrease in solar generation, which also contributed to the rise in spot prices. Unit outages across all states also contributed to the price rise.

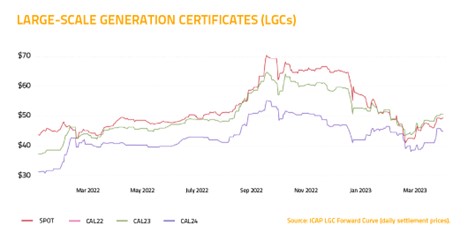

Contract market

In the forward market, prices rose after the return of additional generation to the market was delayed. This additional generation is now not expected to be available until late September at the earliest.

In New South Wales, market merger and acquisition activity has contributed to speculation about the future of existing coal fired generation assets, which are currently slated for closure by mid-2025.

This speculation has added to the volatility in the contract market.

Cal 24 prices finished higher in Queensland (up $21.65 to $107.65), New South Wales (up $25.55 to $131.95) and Victoria (up $12.10 to $84.60). Cal 25 prices also finished higher in Queensland (up $5.80 to $88.80), New South Wales (up $5.25 to $114.30) and Victoria (up $4.15 to $68.35).

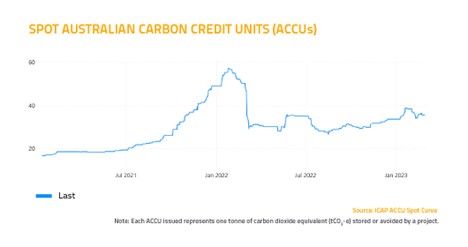

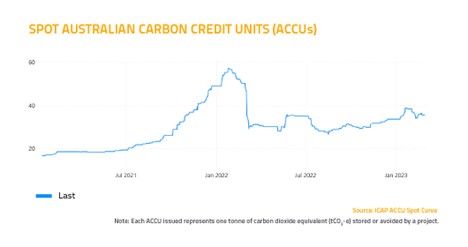

Environmental market

In the environmental market, we saw the impact of the Federal Government securing the support it needs to implement its climate policy.

Following months of negotiations, the government has reached a deal that includes a hard cap on emissions.

The market appears to have interpreted the deal as increasing demand for carbon offsets for new coal or gas generation projects. This led to a rise in the price of Australian Carbon Credit Units (ACCUs), which finished the month up $2.75 at $38.50.

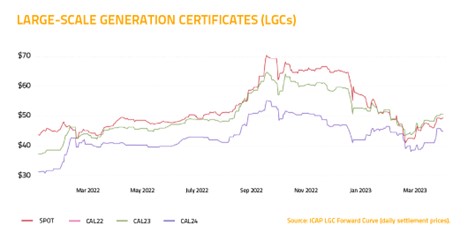

We also saw renewed interest in spot buying of Large-Scale Generation Certificates (LGCs), ahead of the March 31 submission and surrender deadline for GreenPower Accredited LGCs. LGCs finished up $6.00 at $49.25.

An increase in retail contracting interest has also seen genuine buying interest return to the longer dated LGC curve.

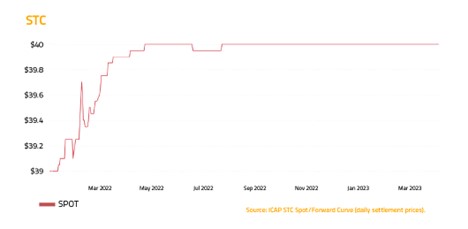

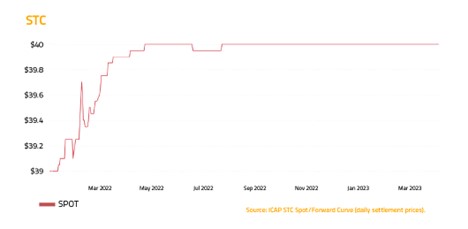

Finally, the clearing house for Small-Scale Technology Certificates (STCs) once again remained in deficit throughout March. This kept STCs at or close to the fixed price of $40 throughout the month.

And that’s it for March… wishing you all the best for April from the team at Stanwell Energy!