Watch the full update here

The unprecedented rise in prices that we’ve seen over recent months has continued, with another busy month for the market in May.

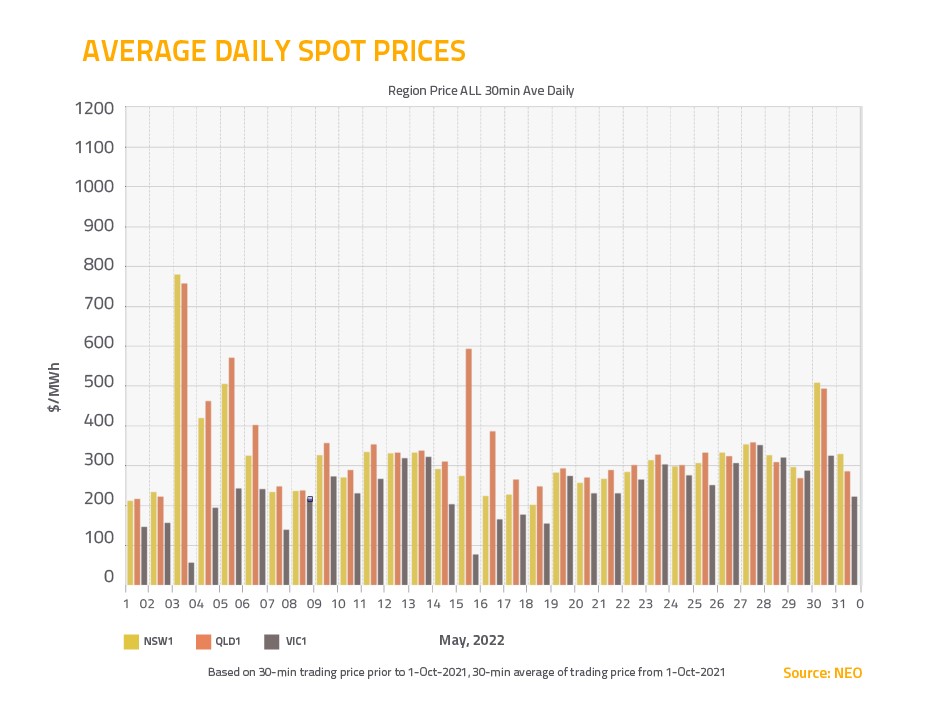

Spot Market

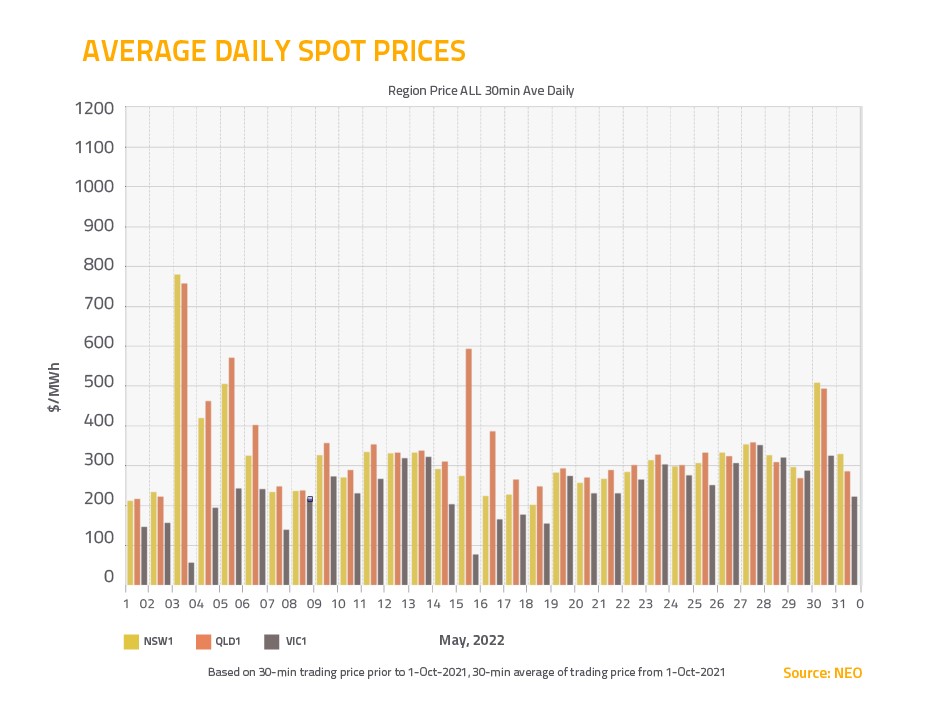

In the spot market, we saw extremely high prices in Queensland (up $100.72 to $320.48), New South Wales (up $160.42 to $347.28) and Victoria (up $92.13 to $233.64).

There’s a perfect storm of factors that are contributing to the run-up in prices. On top of an unusual number of unplanned unit outages across the National Electricity Market, the market continues to absorb the global impact of rising coal and gas prices in the wake of Russia’s invasion of Ukraine.

The La Niña weather pattern continues to make its presence felt, with extreme weather in Queensland and New South Wales limiting solar generation, affecting coal supplies and driving up demand for electricity.

The Australian Energy Regulator’s latest Wholesale Markets Quarterly report projects that higher prices will continue throughout the year. But there is some reason to expect prices to fall, with generators returning from maintenance, and the recently completed upgrades to the Queensland to New South Wales Interconnector expected to boost interstate transmission capacity.

Stanwell’s assets have continued to operate at a high level throughout this period, with approximately 97 per cent availability throughout 2022.

The reliability of these assets has helped us to apply downward pressure on prices at times when other units have been unavailable.

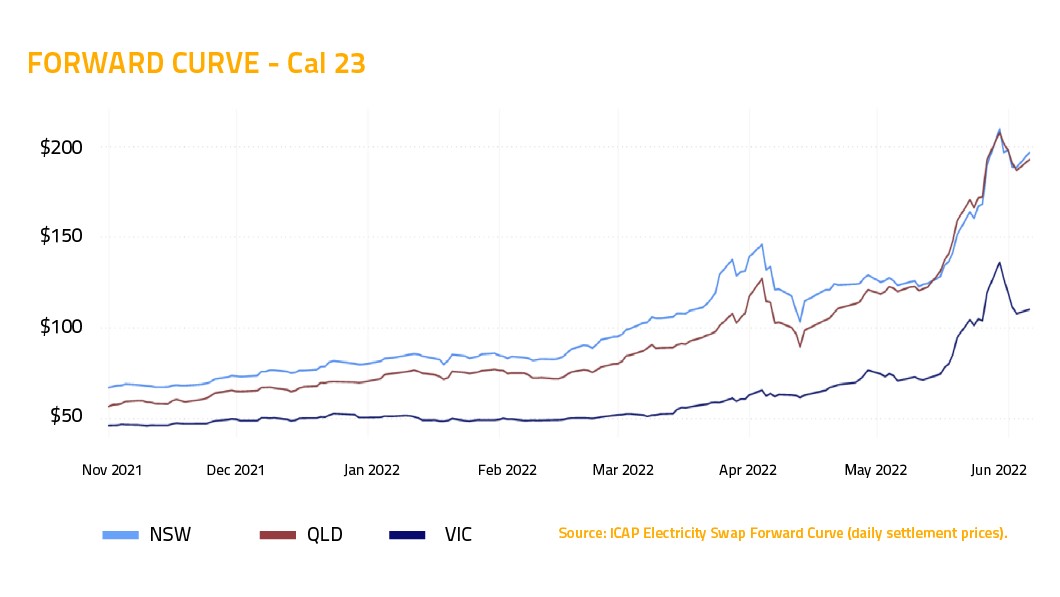

Contract Market

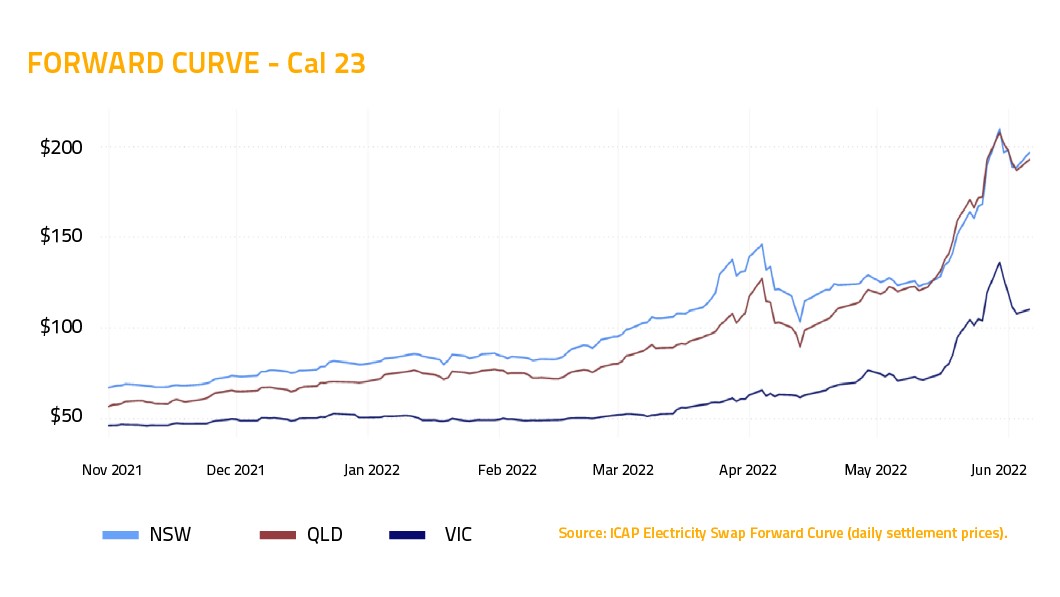

In the contract market, the same confluence of market forces that we’ve seen in the spot market is driving the forward curve to unprecedented highs, with prices rising in Queensland (up $80.70 to $201.70), New South Wales (up $67.40 to $196.35) and Victoria (up $50.95 to $127.55).

While prices have risen sharply across all regions, there continues to be a divide between north and south.

According to the Australian Energy Market Operator, inadequate connection capacity between Victoria and New South Wales is limiting the ability of generators in Victoria and South Australia to sell to northern markets, which is contributing to higher prices in Queensland and New South Wales.

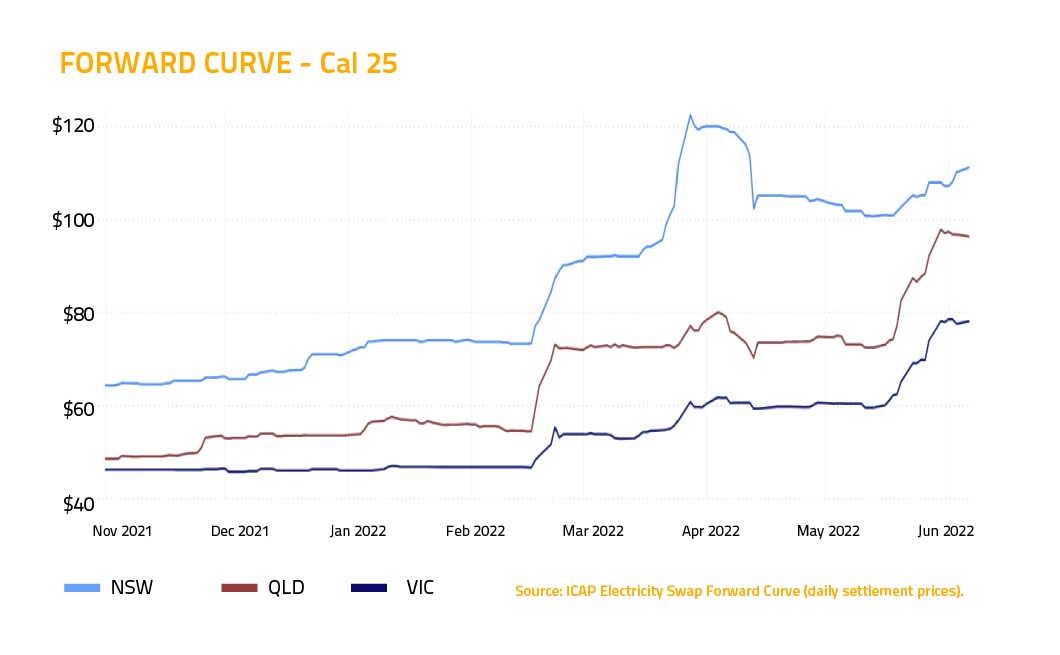

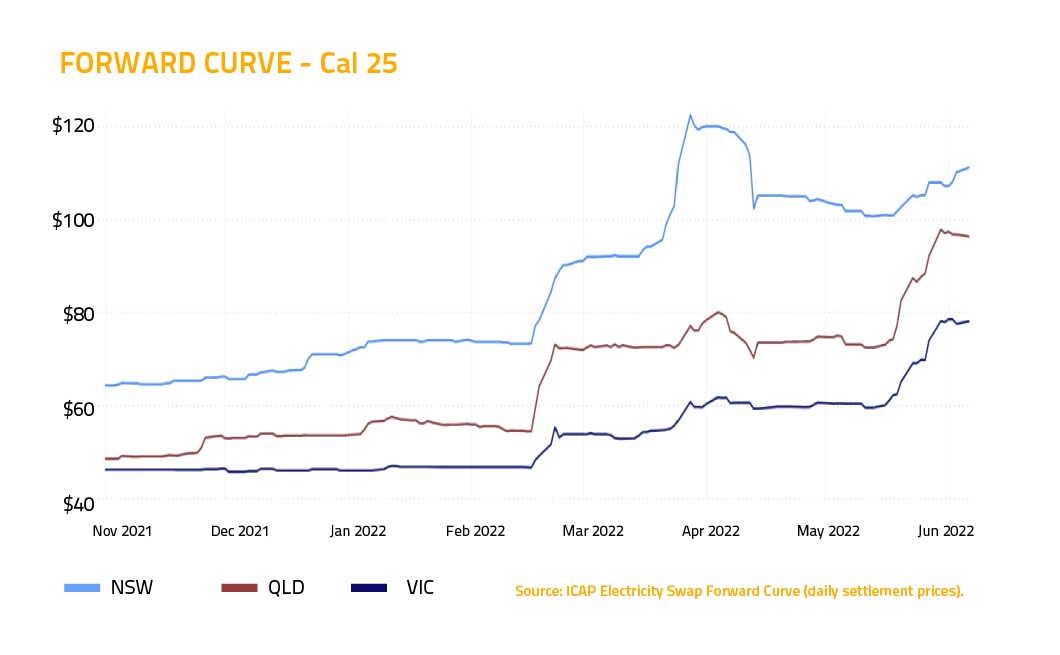

Looking ahead to Cal25, Queensland (up $22.30 to $97.05) and Victoria (up $17.10 to $77.65) are now catching up to New South Wales (up $1 to $105.05), where prices had already risen after the early closure announcement for the Eraring Power Station in February and a massive rally in March.

The early closure of plants like Eraring in New South Wales is contributing to increased price expectations in the contract market, but Stanwell will continue to provide certainty by keeping our generation assets operating for as long as the market and our customers require us to do so.

While we will increase our portfolio of renewable energy, these new assets will be supported by our existing dispatchable generation.

Environmental Market

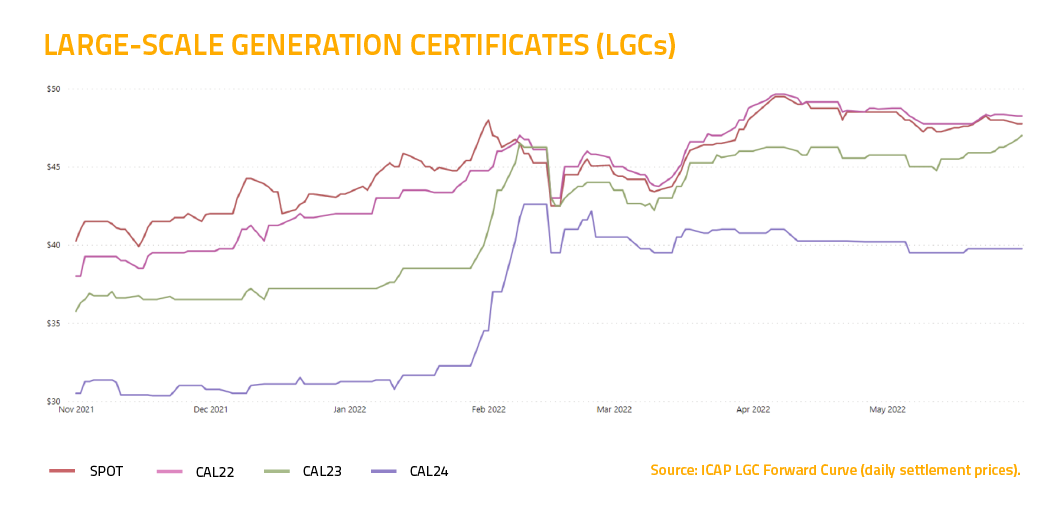

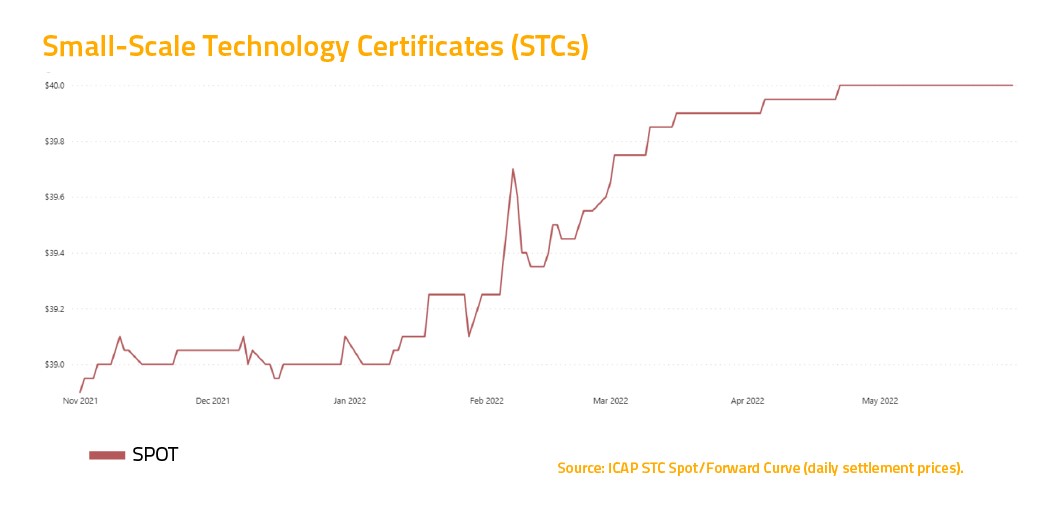

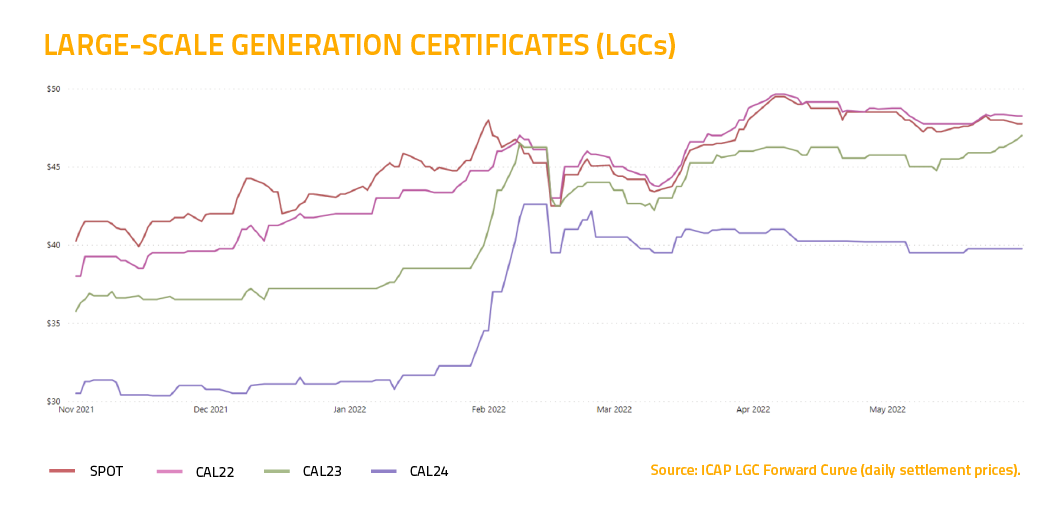

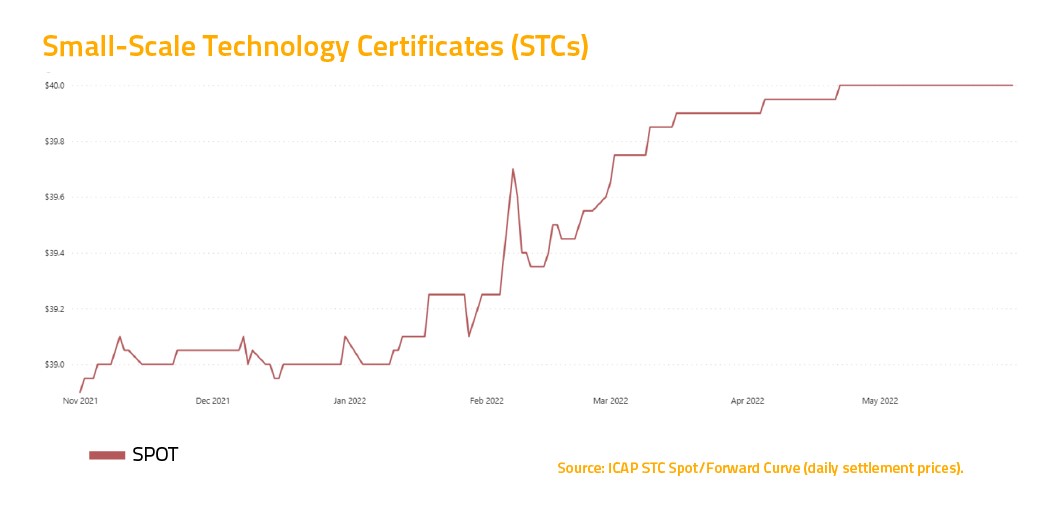

It was a quiet month in the markets for Large-Scale Generation Certificates, or LGCs (down 75 cents to $47.75), and Small-Scale Technology Certificates, or STCs (steady at $40), with little volatility

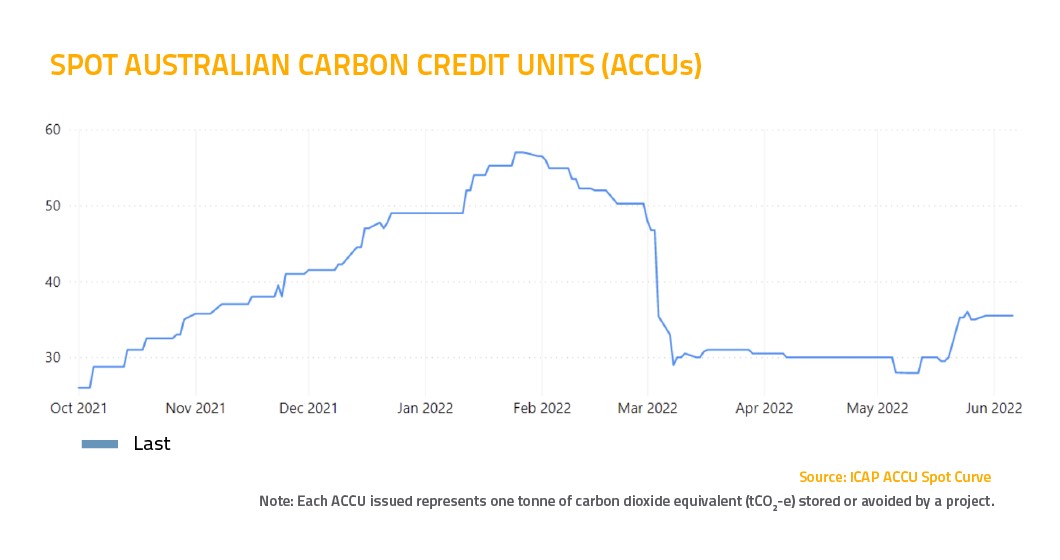

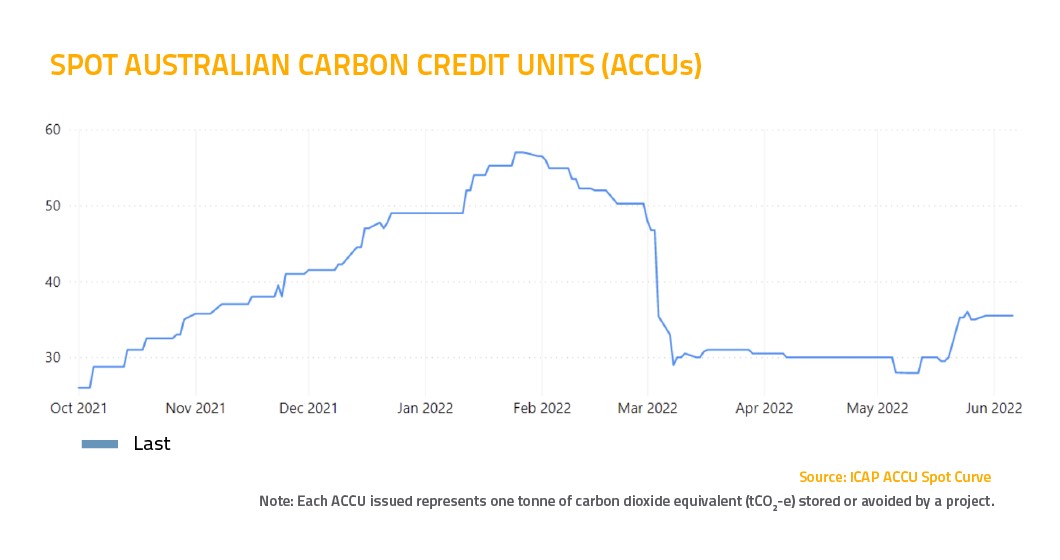

However the Australian Carbon Credit Units (ACCUs) jumped higher, up $5.50 to $35.50.

While there were no changes to the underlying fundamentals of the ACCU market, the perceived long-term support for the carbon market from Labor and the Greens led to renewed buying interest for these units in the wake of the Federal Election.

And that’s it for our May market wrap-up. Wishing you all the best for June from the team at Stanwell Energy!