By Nicola Miller – Account Manager

Watch the full update here

Outages, soaring international fuel prices and a couple of surprising announcements closer to home led to another interesting month for the energy market.

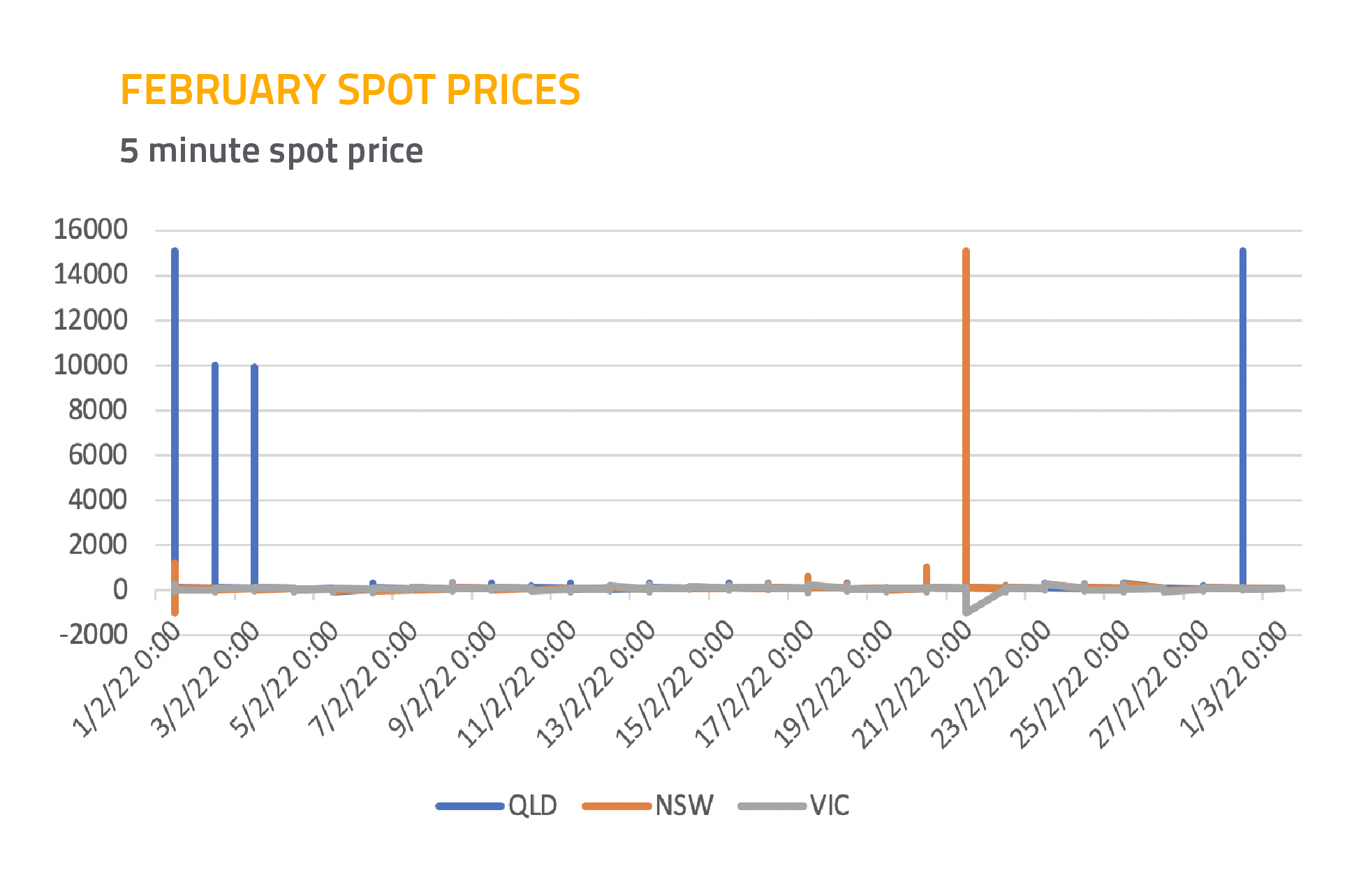

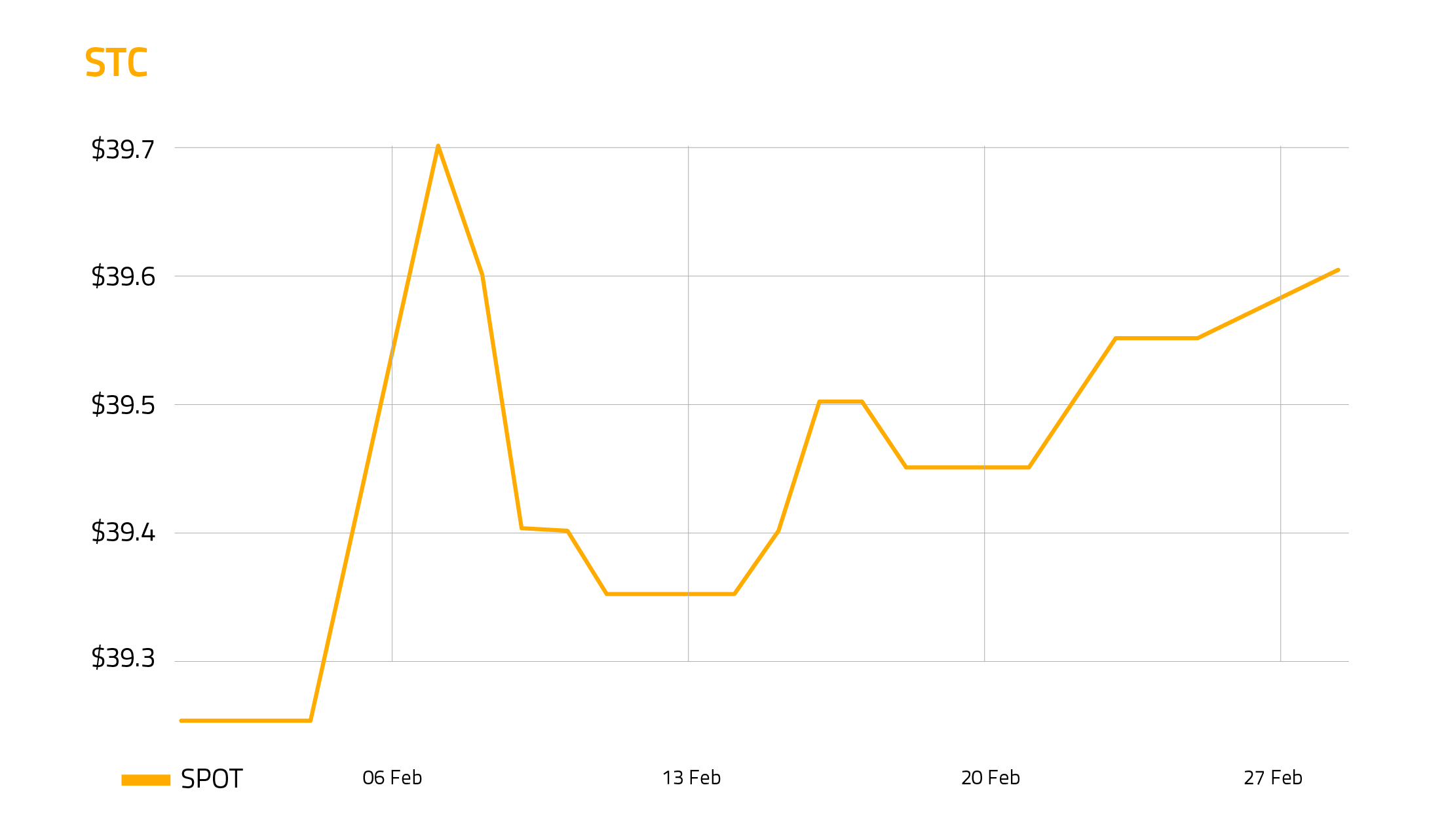

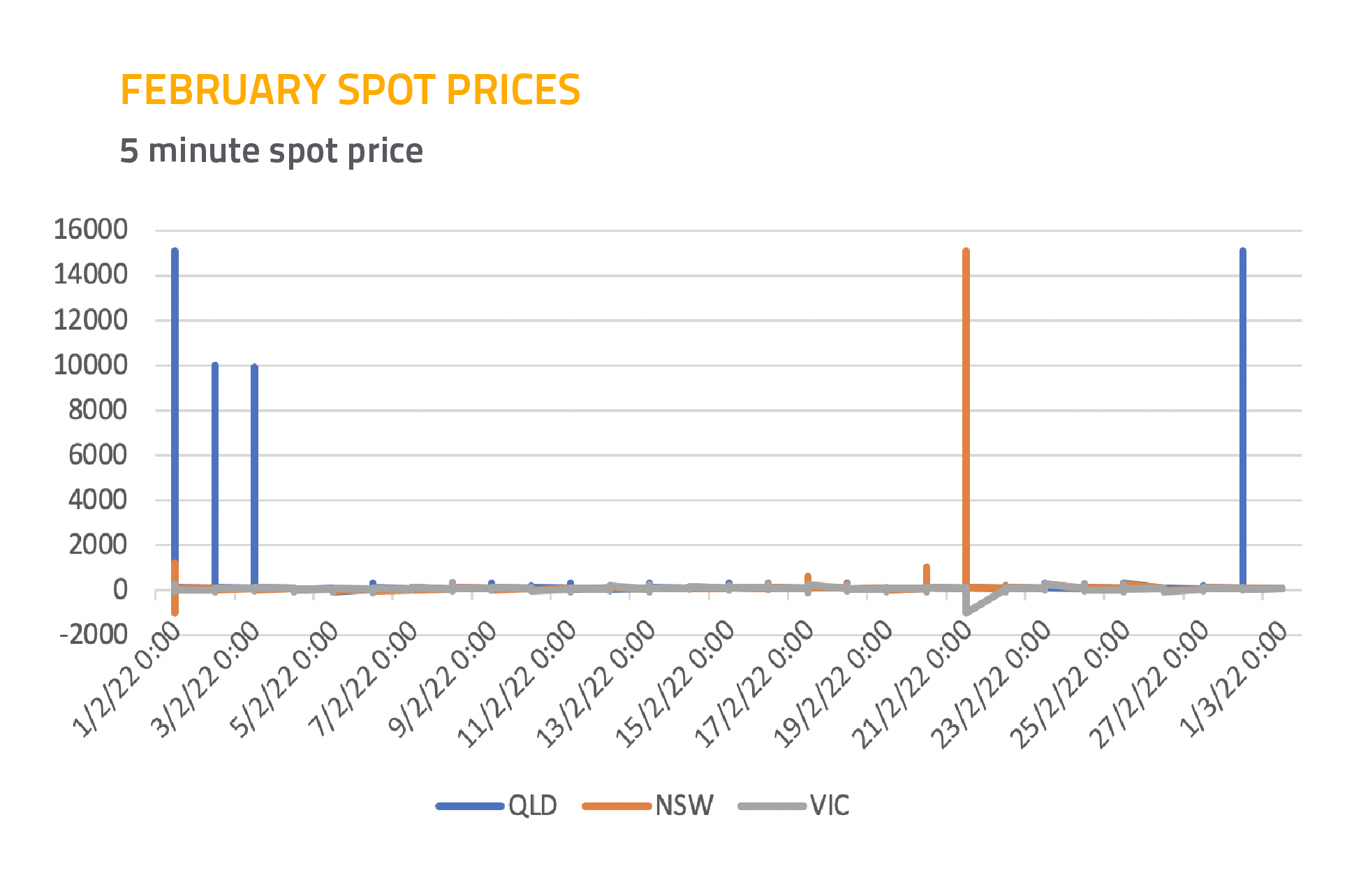

Spot market

We saw a significant rise in price in Queensland (closing up $22.82), with smaller movement in the New South Wales (up $5.86) and Victorian (down $6.65) spot markets.

In Queensland, this was due primarily to the outage at the 750MW Kogan Creek power station, which went offline in late January and came back online mid-February, as well as the continued outages at Callide C4 and Swanbank E.

High temperatures also led to particularly high demand in the first week of the month, peaking at 9,800MW megawatts and causing prices to hit the market cap. At the same time, overcast conditions throughout the summer have limited solar generation, leaving dispatchable generators to make up the shortfall.

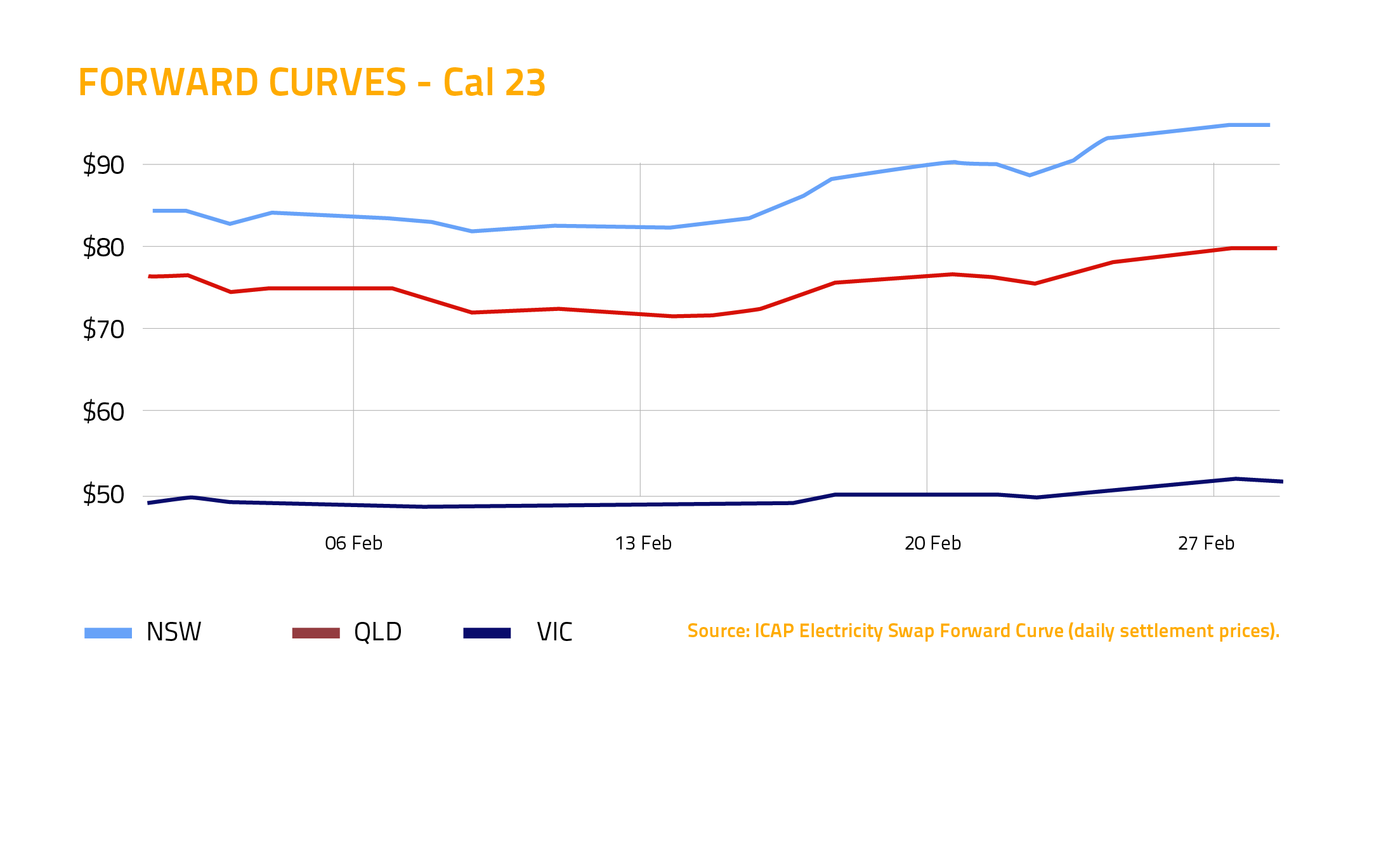

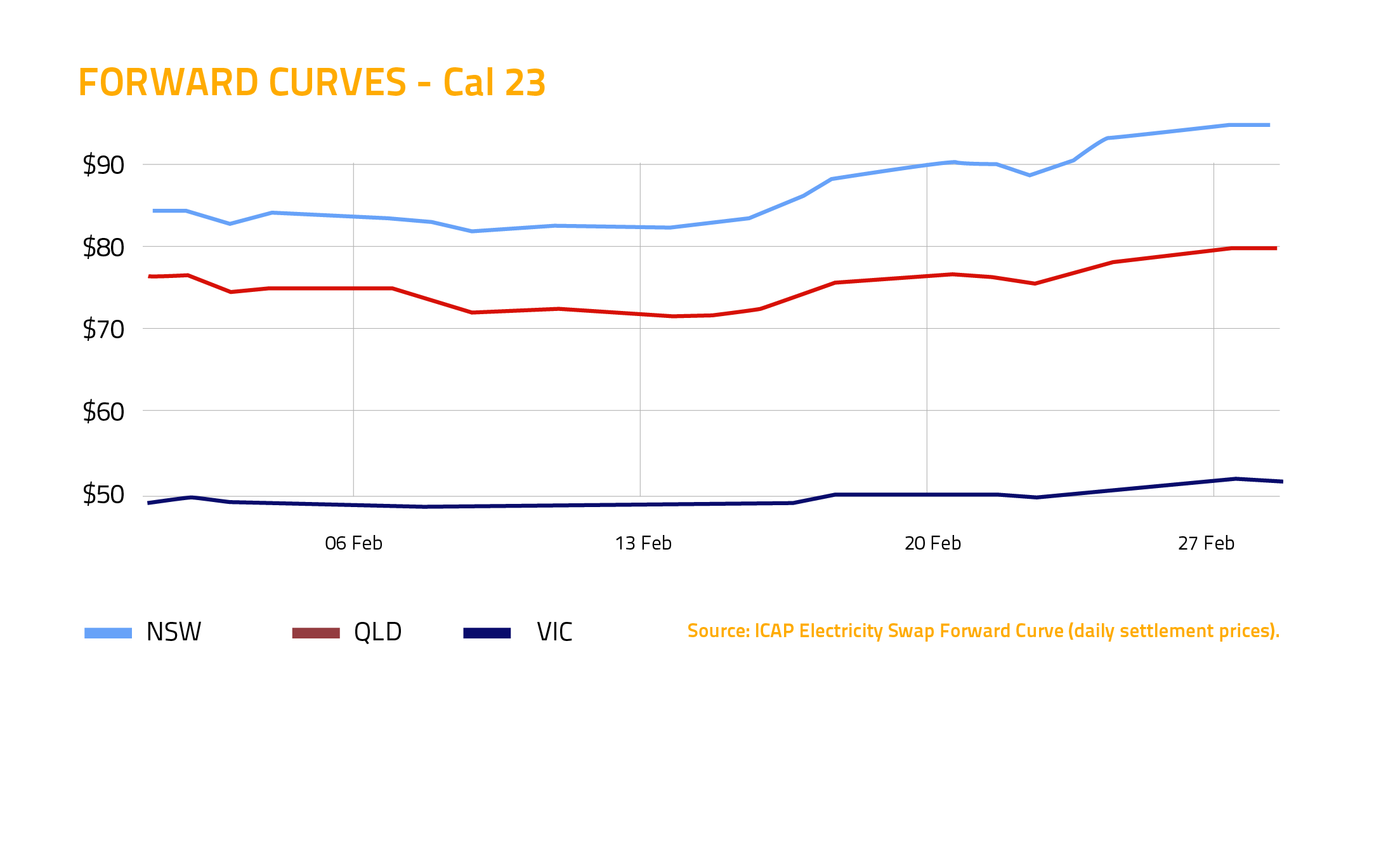

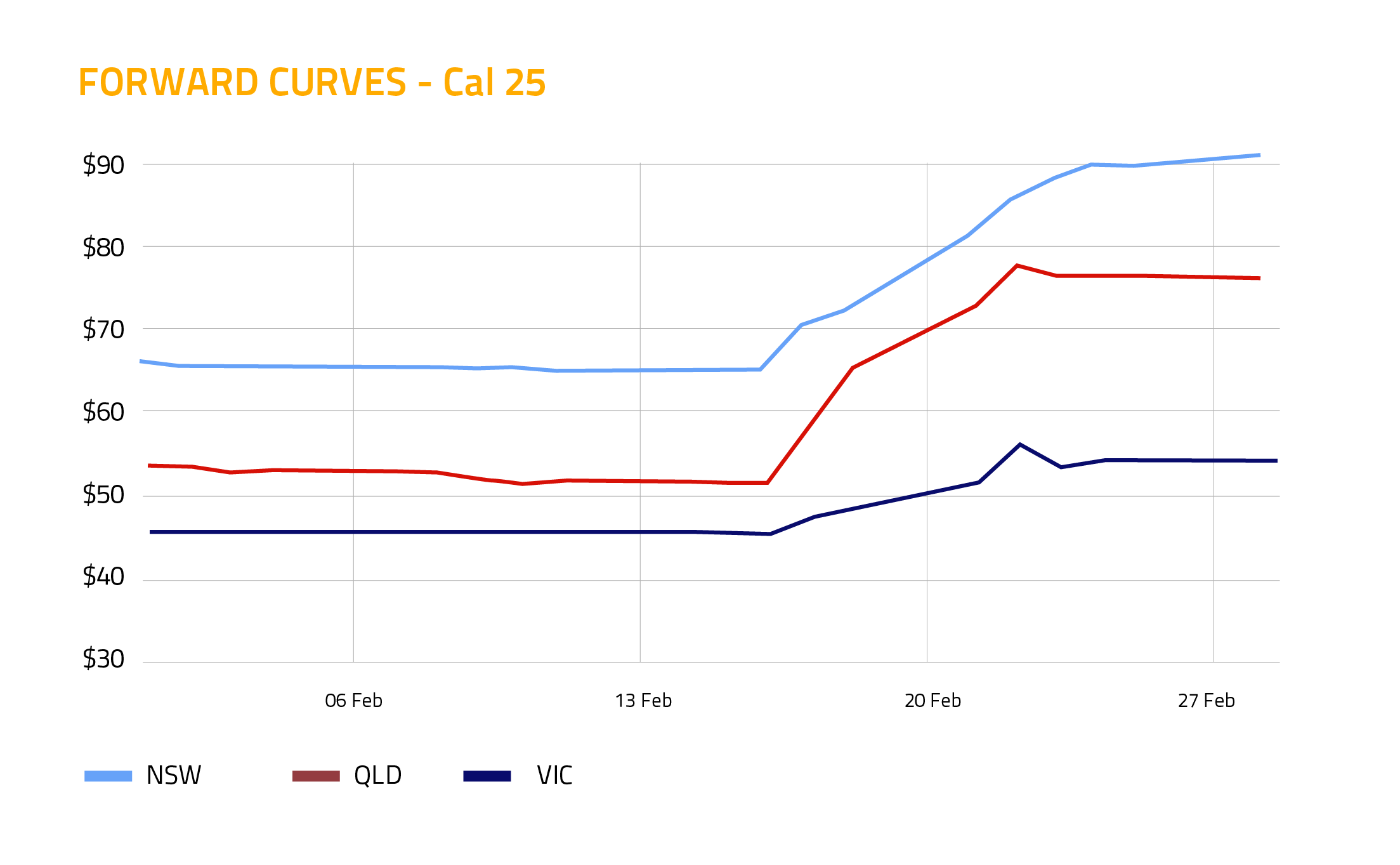

Contract market

In the contract market, the cost of fuel is driving Cal 23 prices higher across the board – up $2.95 in Queensland, $8.95 in New South Wales and $3.15 in Victoria. The conflict in Ukraine is contributing to global surges in oil, gas and coal prices.

Closer to home, two Origin Energy announcements have had an impact on the contract market. The company recently indicated that their coal-buying negotiations for the next financial year have yet to be completed, exposing them to higher coal prices, which seems to have lifted the curve across all states.

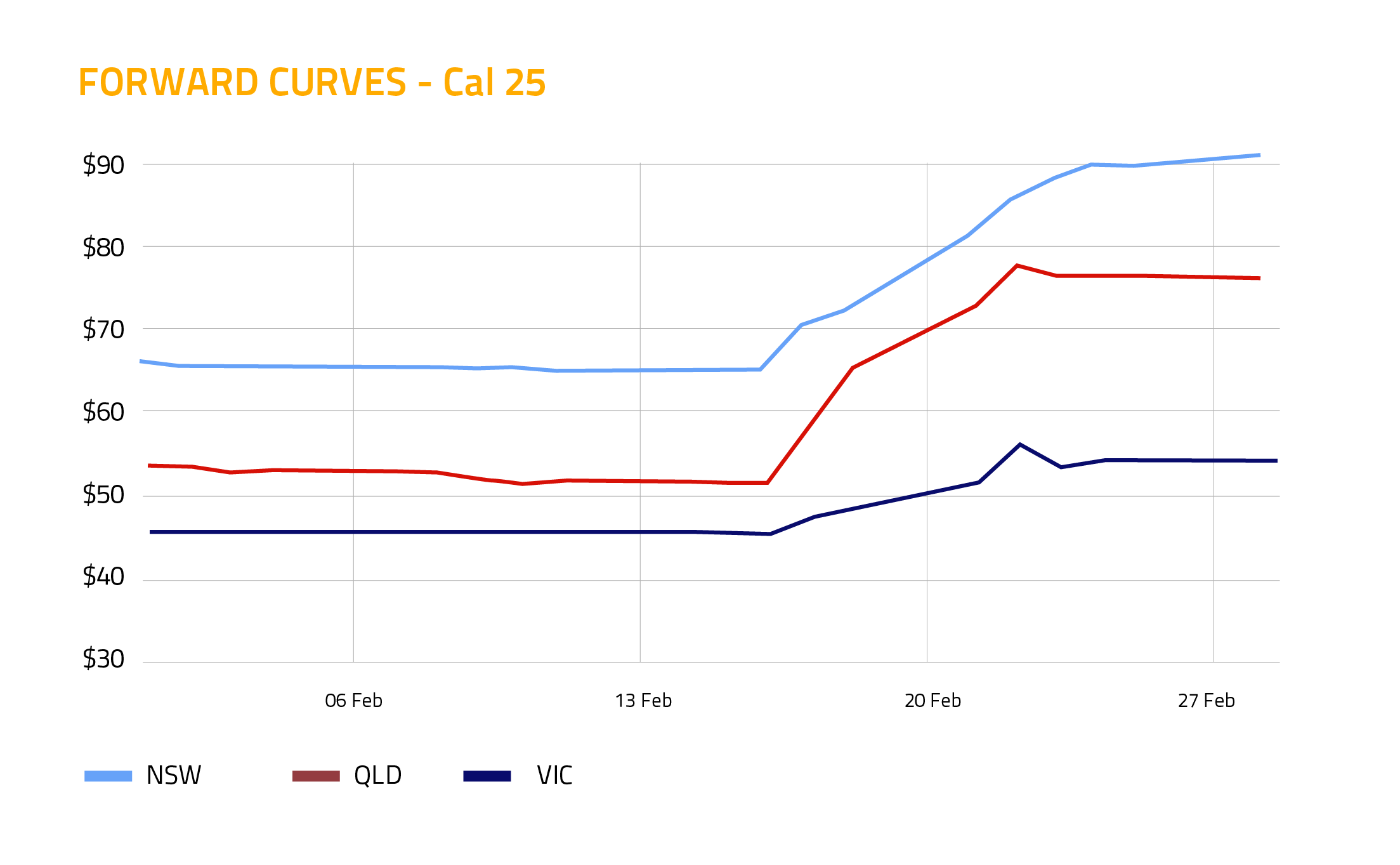

Origin also announced that it is seeking approval to close Australia’s largest coal-fired power station, Eraring, in August 2025. The news that nearly 3000MW of baseload generation would be retired seven years earlier than expected has sent Cal 25 prices curving upwards, particularly in New South Wales (up $14.05).

Of course, the other big energy news of the month was Mike Cannon-Brookes’ bid to take over AGL. Cannon-Brookes has proposed closing AGL’s power stations by 2030, but since the contract market only extends to Cal 25, this hasn’t had an immediate impact.

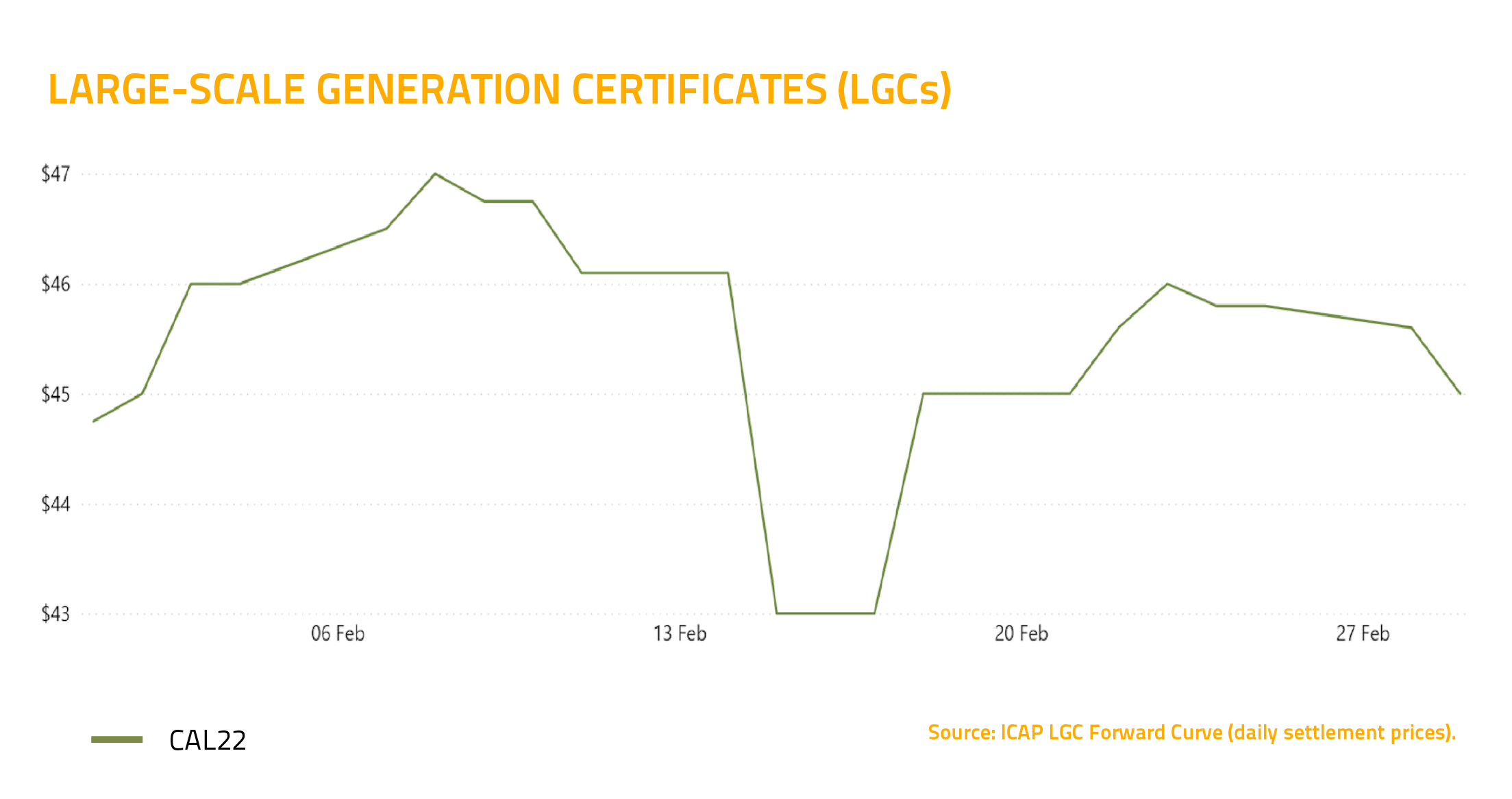

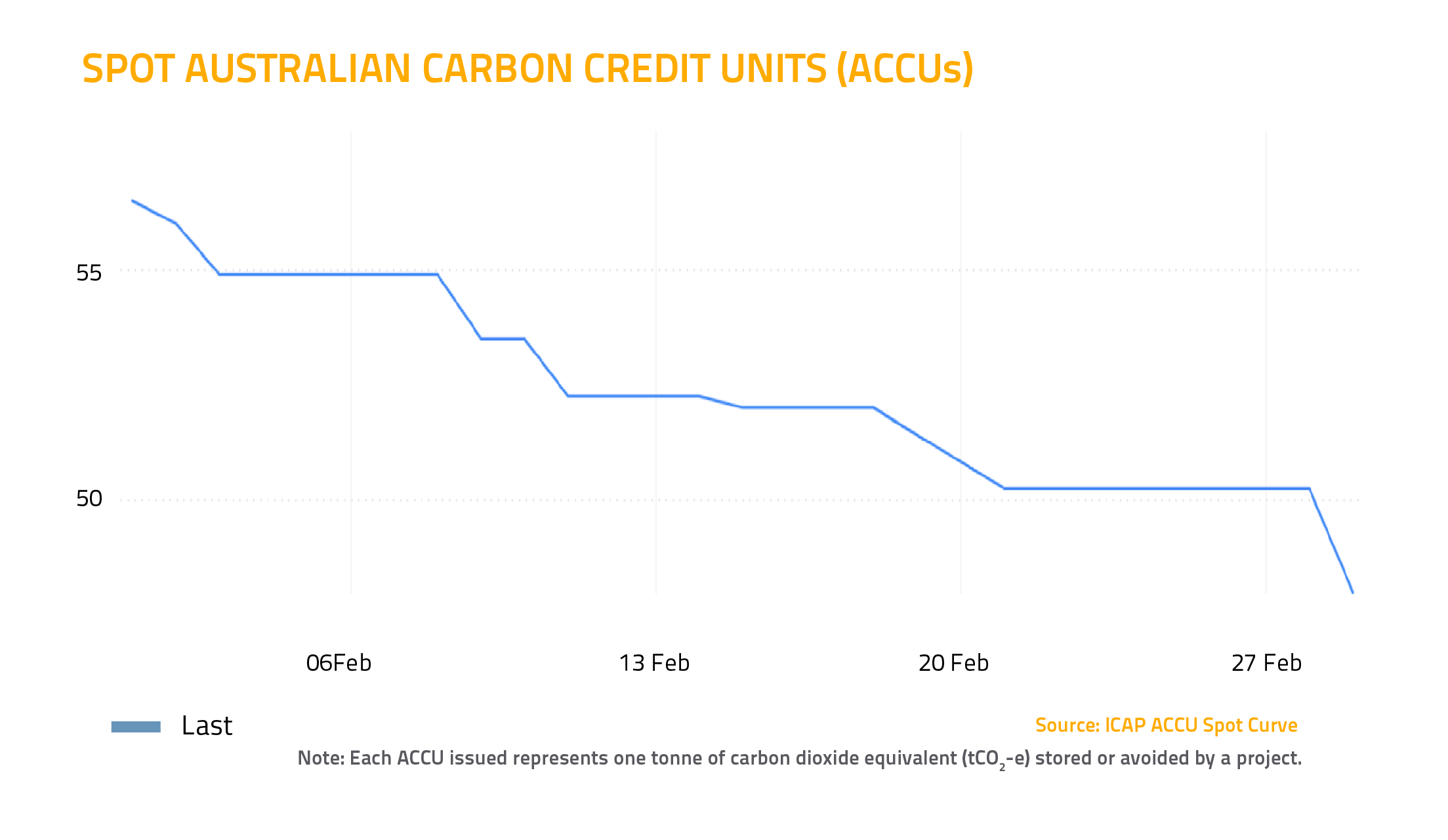

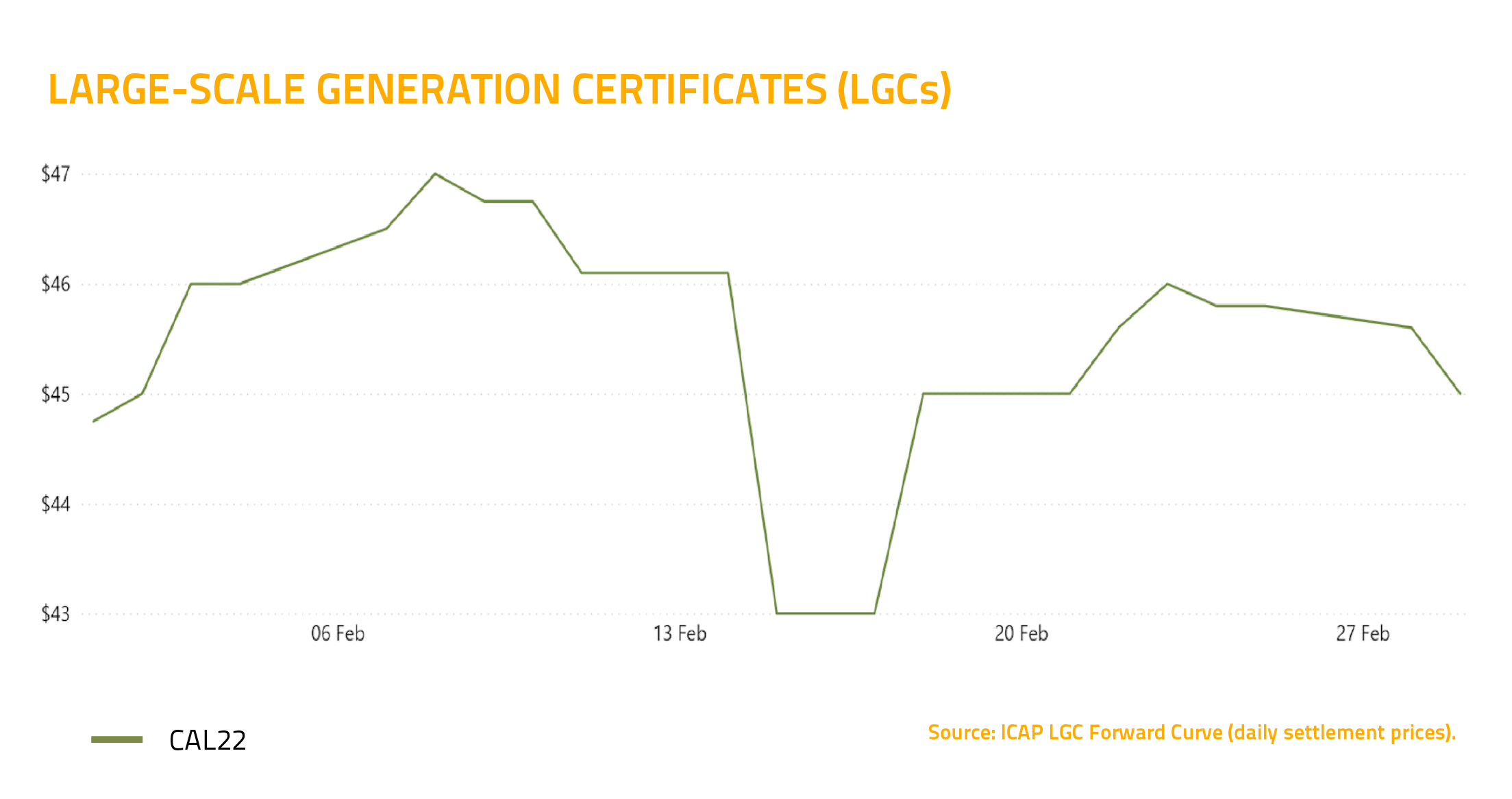

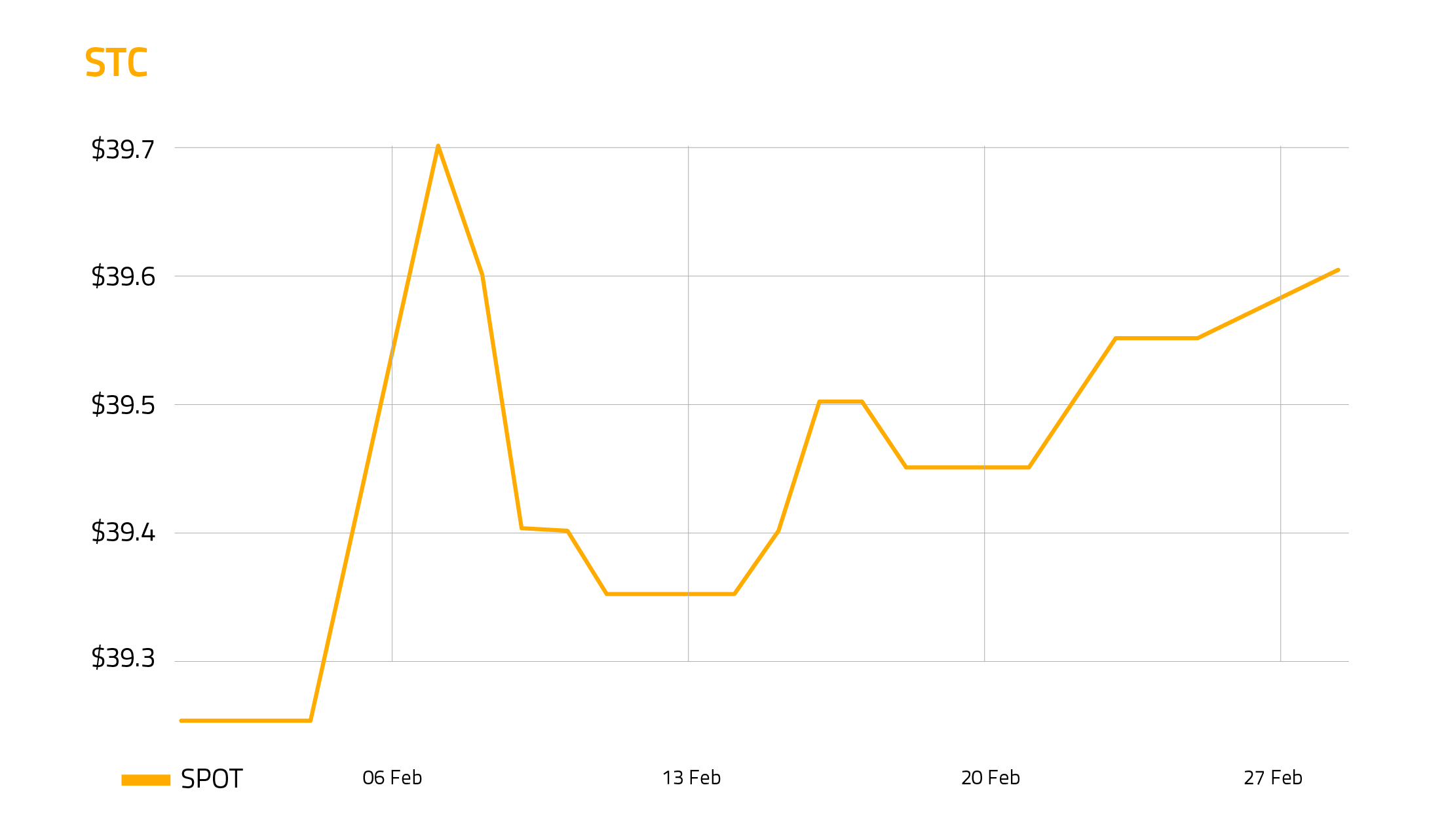

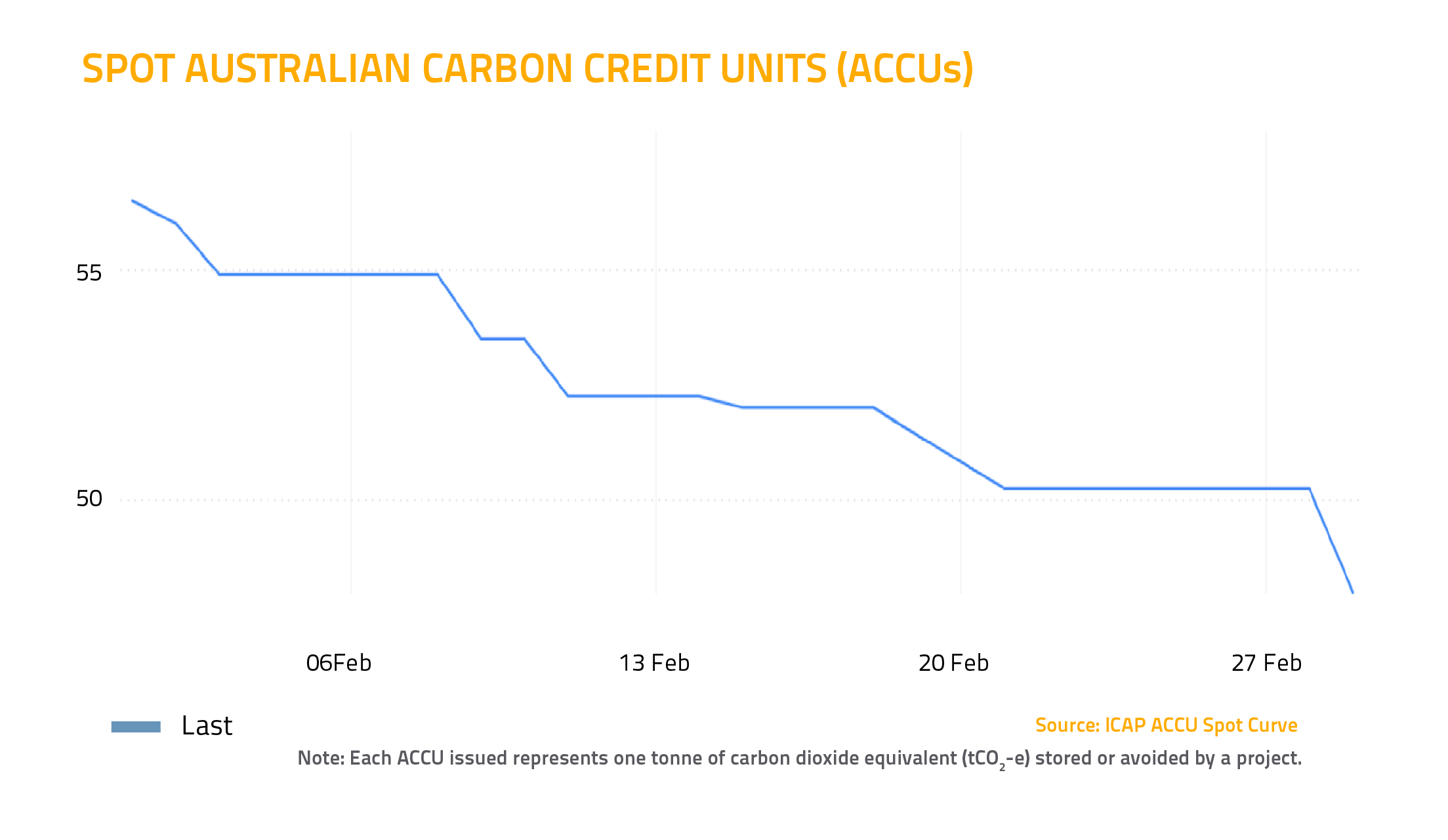

Environmental market

In the environmental market, spot LGCs (large-scale generation certificates) returned to earth after the passing of surrender deadlines that had driven demand in January.

Similarly, spot ACCUs (Australian Carbon Credit Units) softened as the market returned to normalcy after rallying to record highs in January.

That’s it for February – wishing you all the best for March from the team at Stanwell Energy.