By Nicola Miller – Account Manager

Watch the full update here

Rising fuel costs continued to put pressure on the energy market in March 2022.

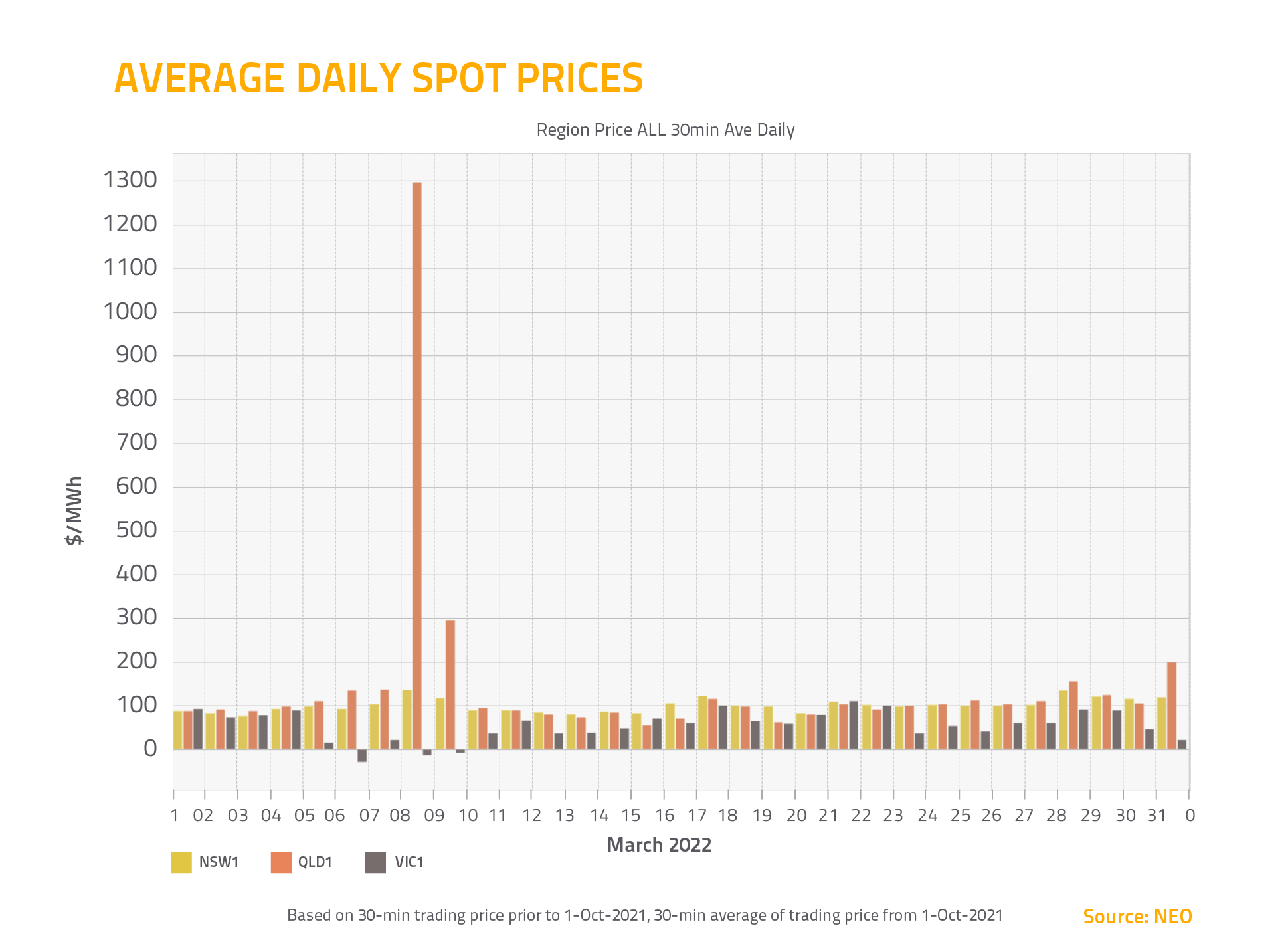

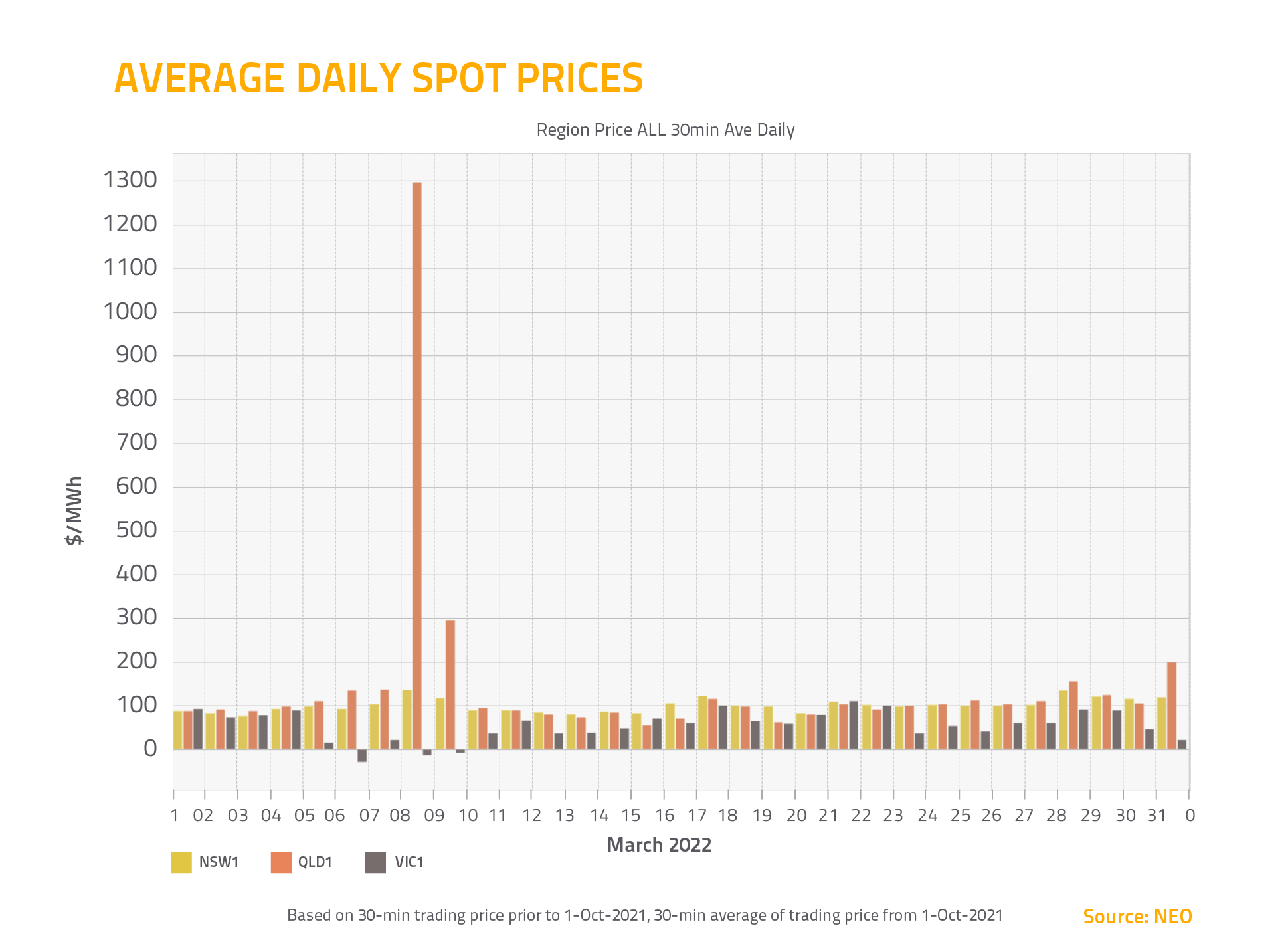

In the spot market, large unit outages at Bayswater and Mount Piper led to a significant rise in price to $100.68 (up $17.65) in New South Wales.

Minor upgrade works on the Queensland-to-New South Wales Interconnector also impacted the ability of Queensland generators to export energy to New South Wales, which contributed to the price rise.

In Queensland, the price volatility we saw in February has subsided, but prices remain relatively high at $147.20 (down $15.52), with the continued outage at Swanbank still having an impact.

As for Victoria, there was little movement in the market this month, with a flat price of $54.78 (up $0.61).

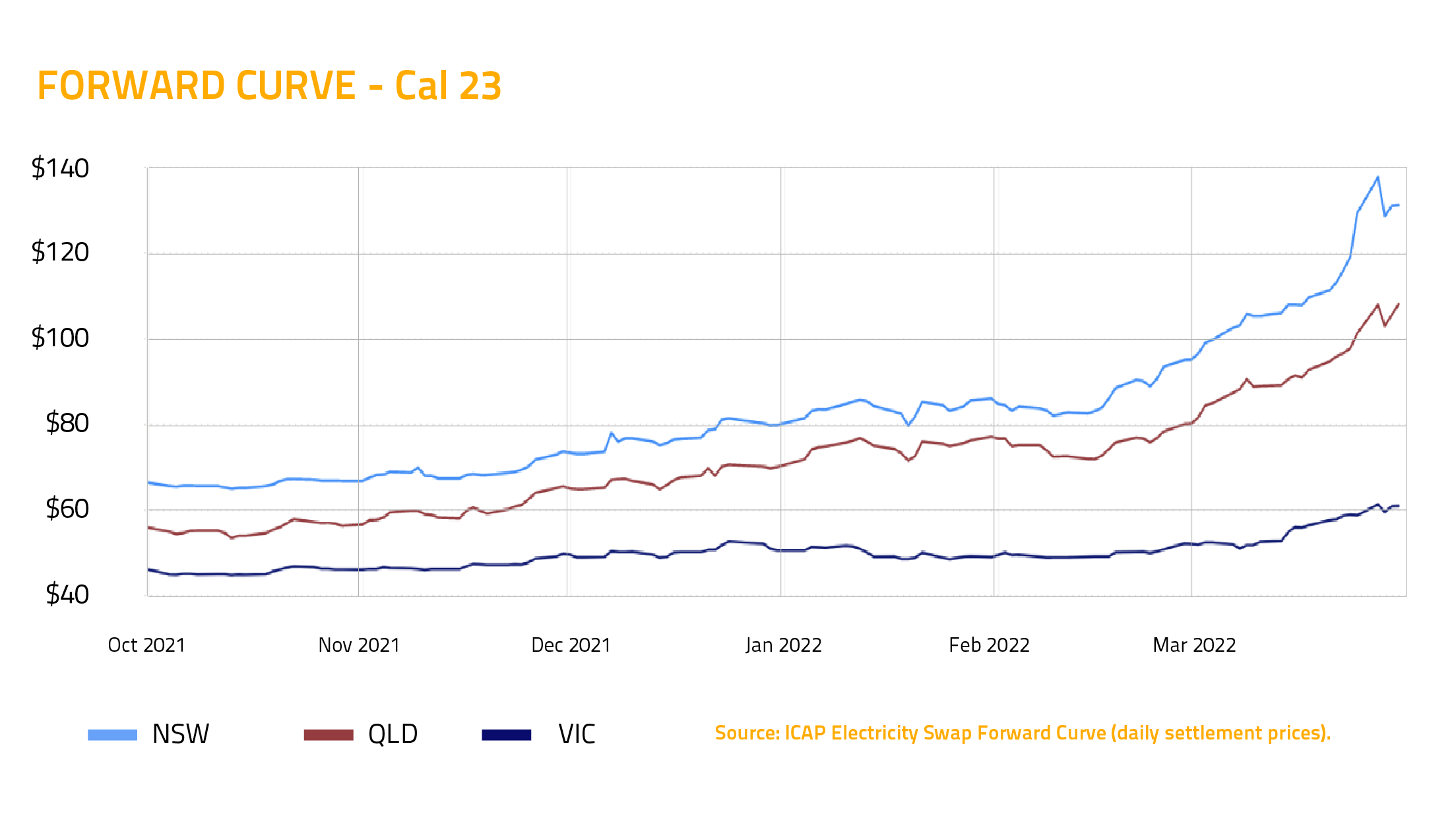

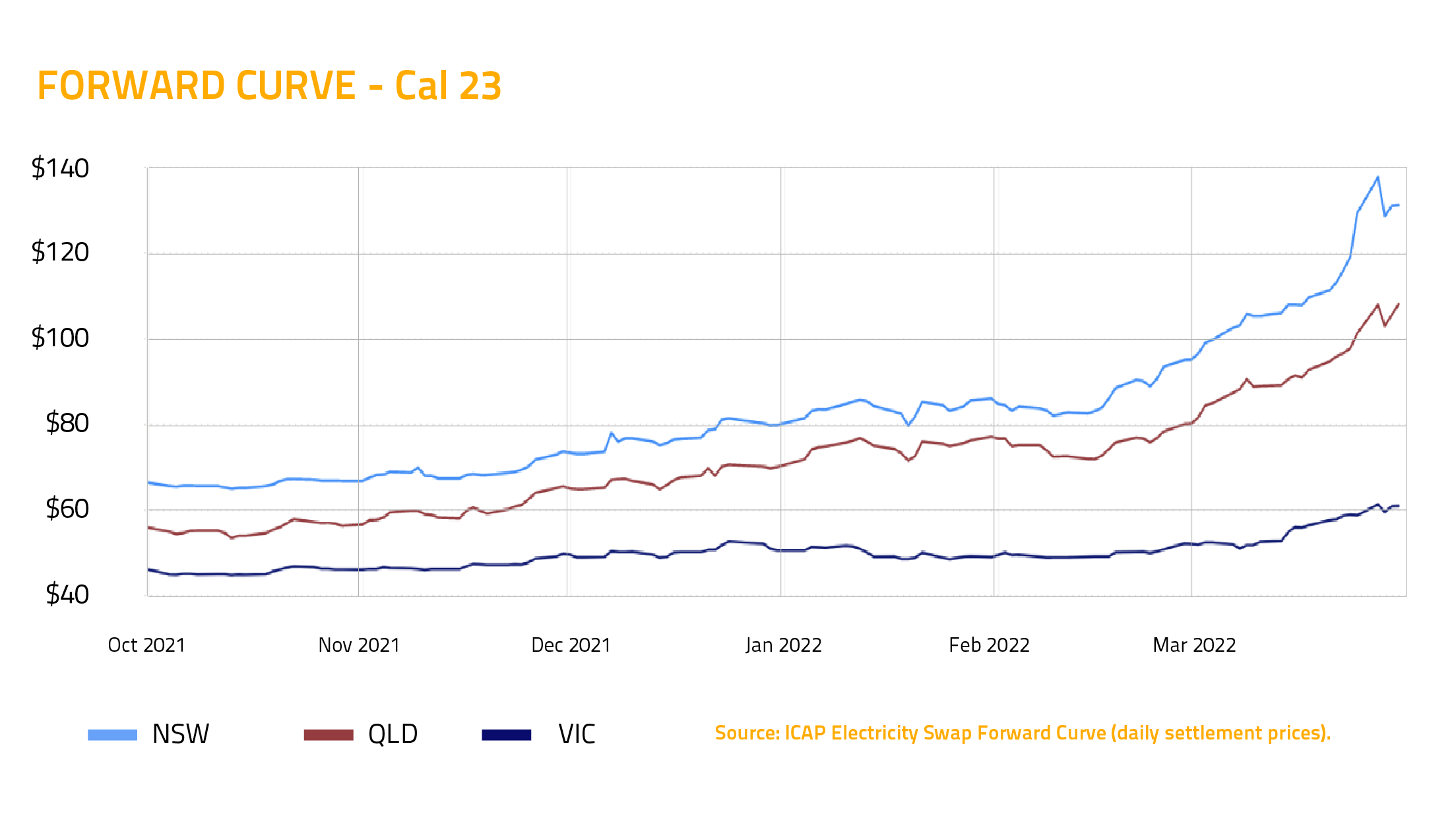

Contract market

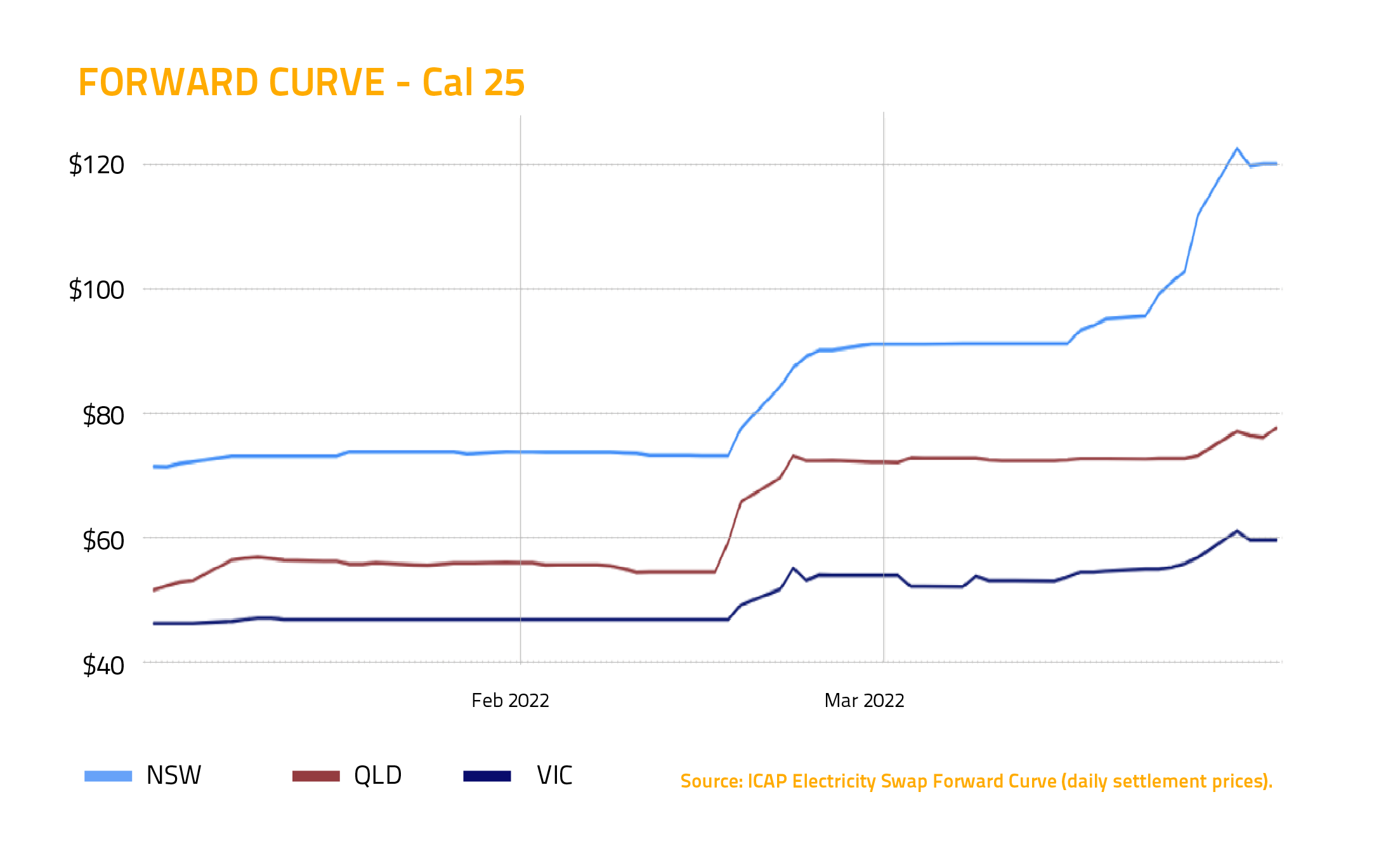

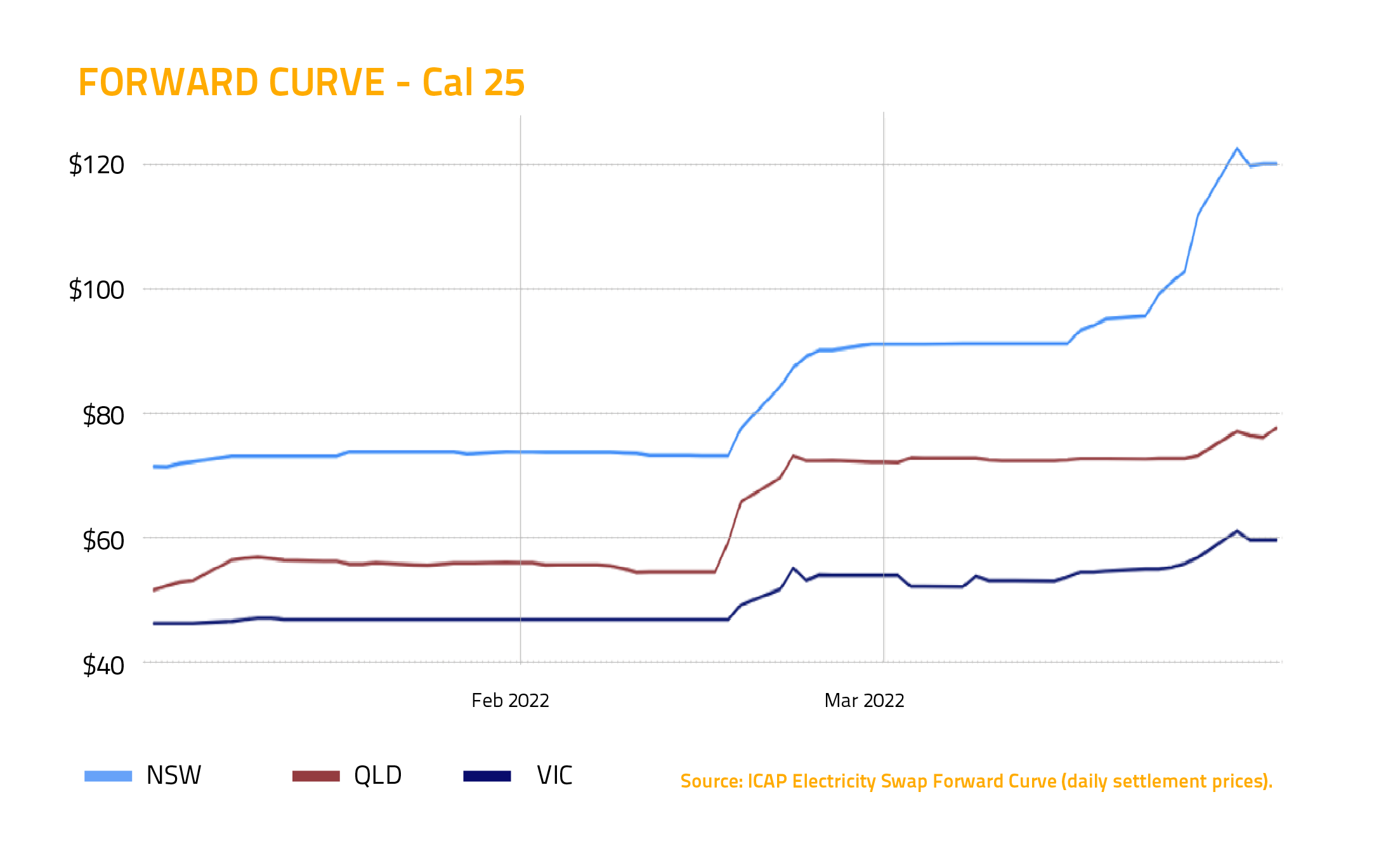

In the contract market, the cost of fuel continues to be the story. The war in Ukraine is impacting prices globally, as sanctions on Russian exports play havoc with energy markets. The effect of rising fuel prices is particularly pronounced in New South Wales, because of the higher proportion of generators exposed to spot coal prices in that state.

This pressure on fuel costs has been consistent even into the Cal 25 contracts.

Looking ahead, April is typically a softer month in the spot market. But with more outages planned across Queensland and New South Wales than there typically would be at this time of year, we may continue to see elevated spot and contract prices.

The other big energy news of the month was AGL being given the green light for its 500 MW battery at Liddell Power Station. But with the impending retirement of the station in April 2023, and the significant loss in generation that will come with that, as well as the news that the battery will only provide 150 MW of power initially, this announcement is having very little impact on the contract market at this stage.

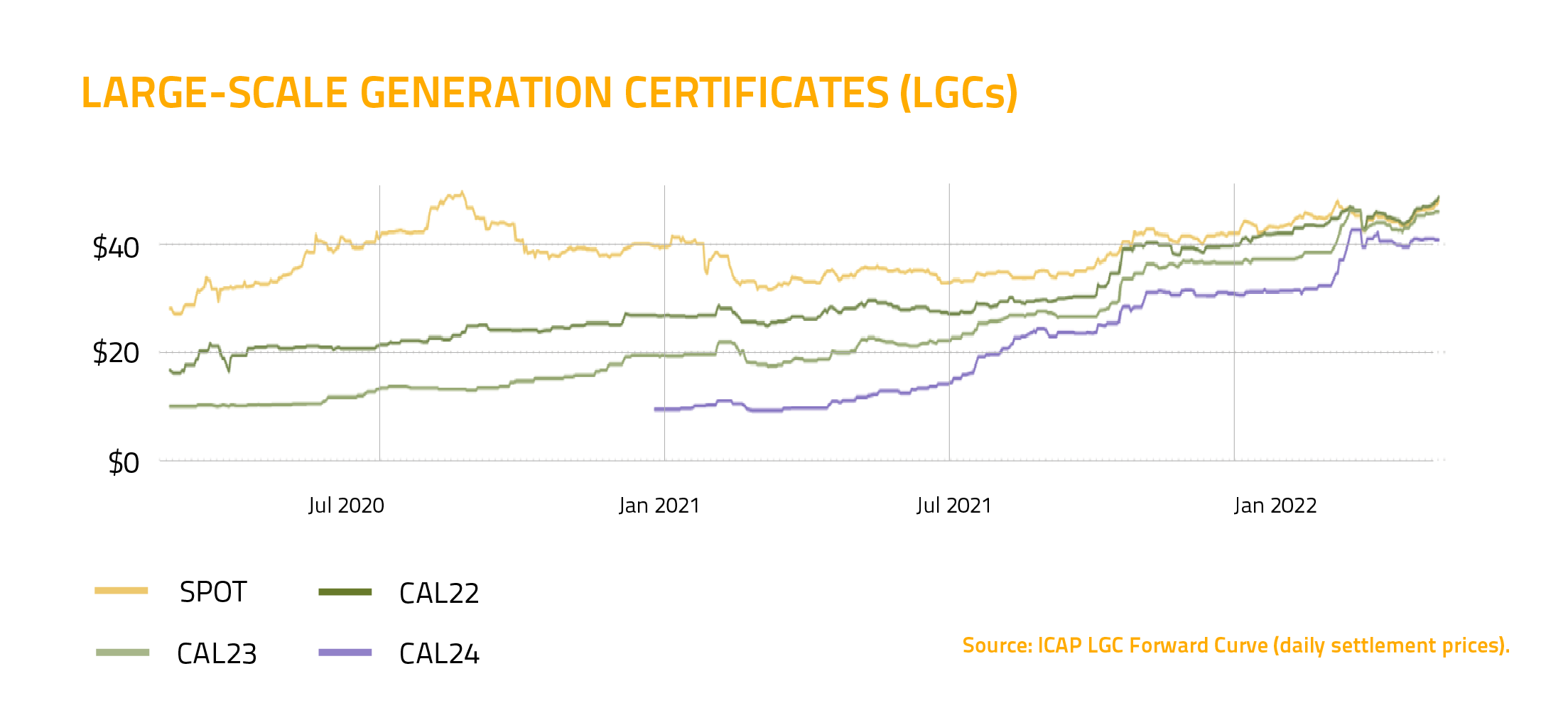

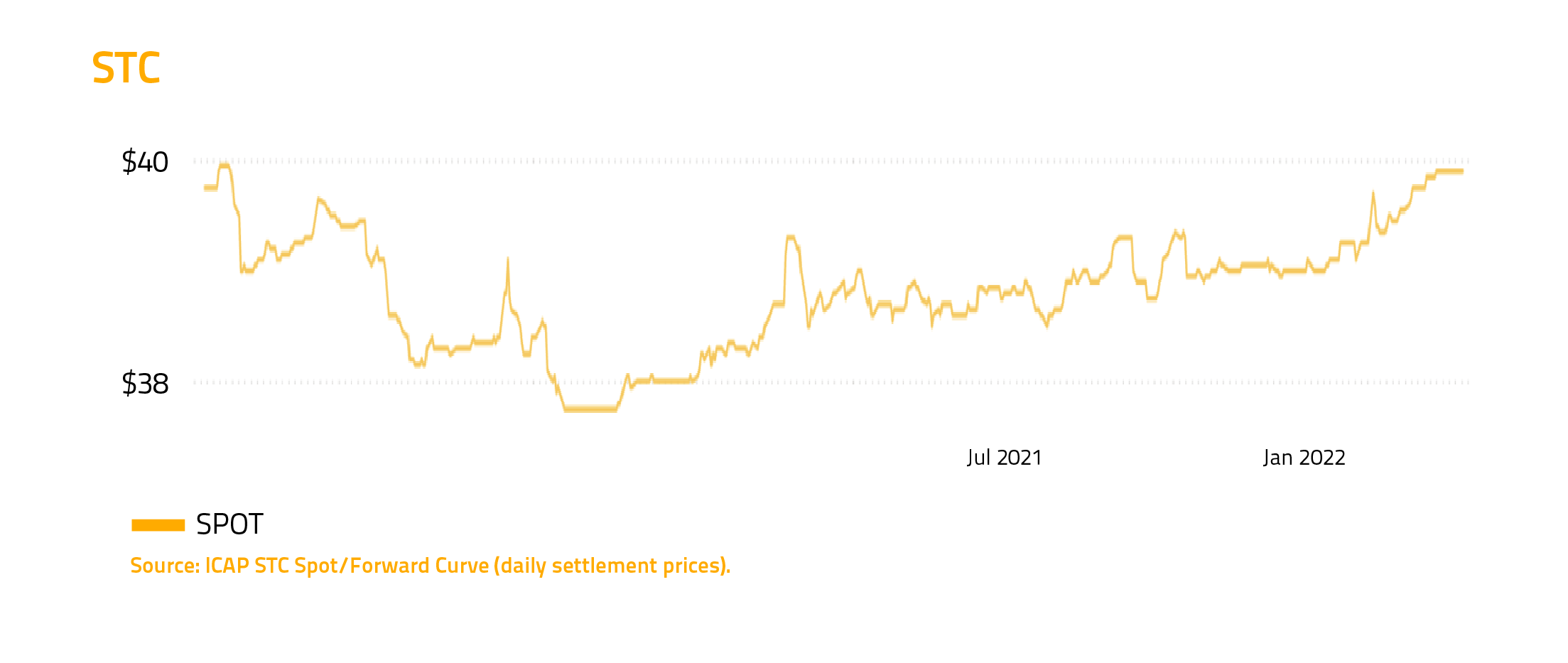

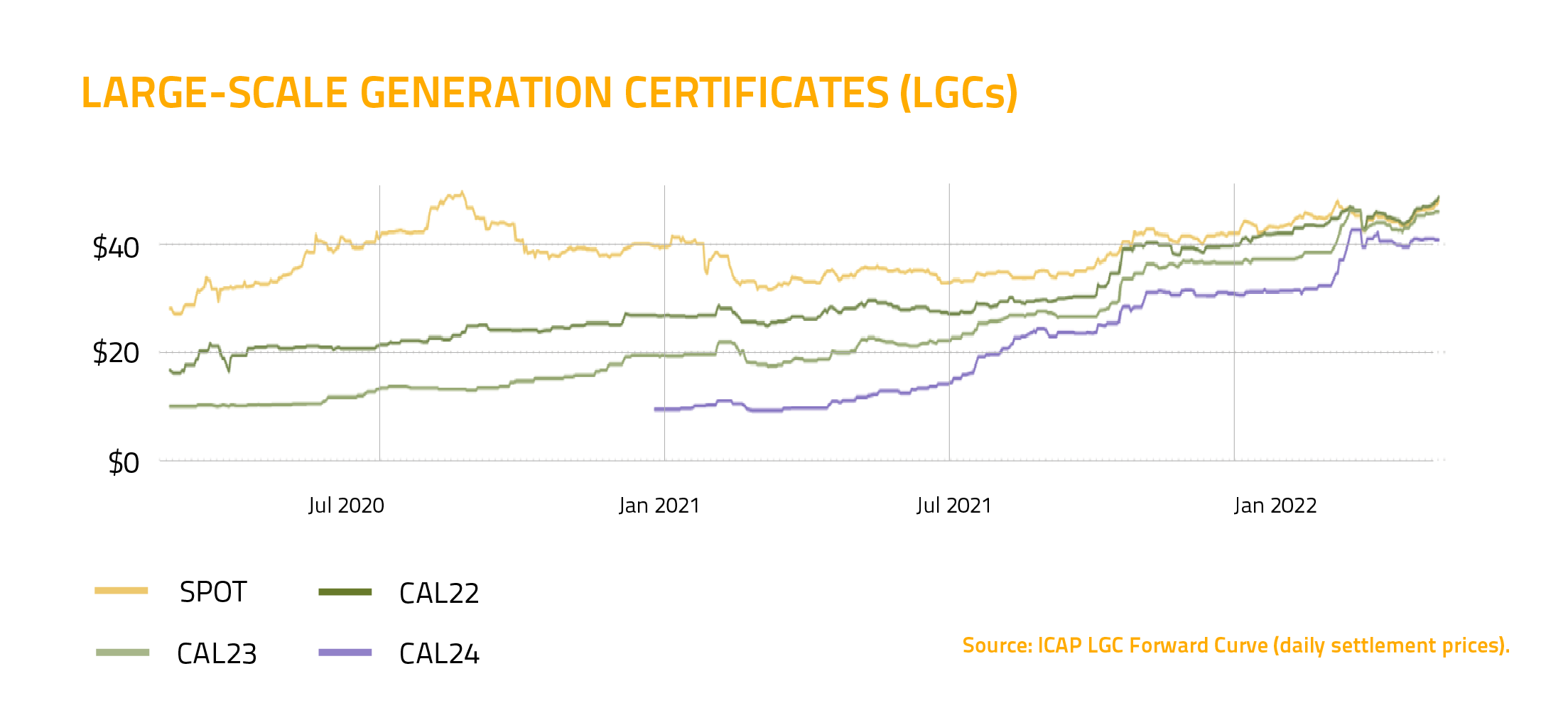

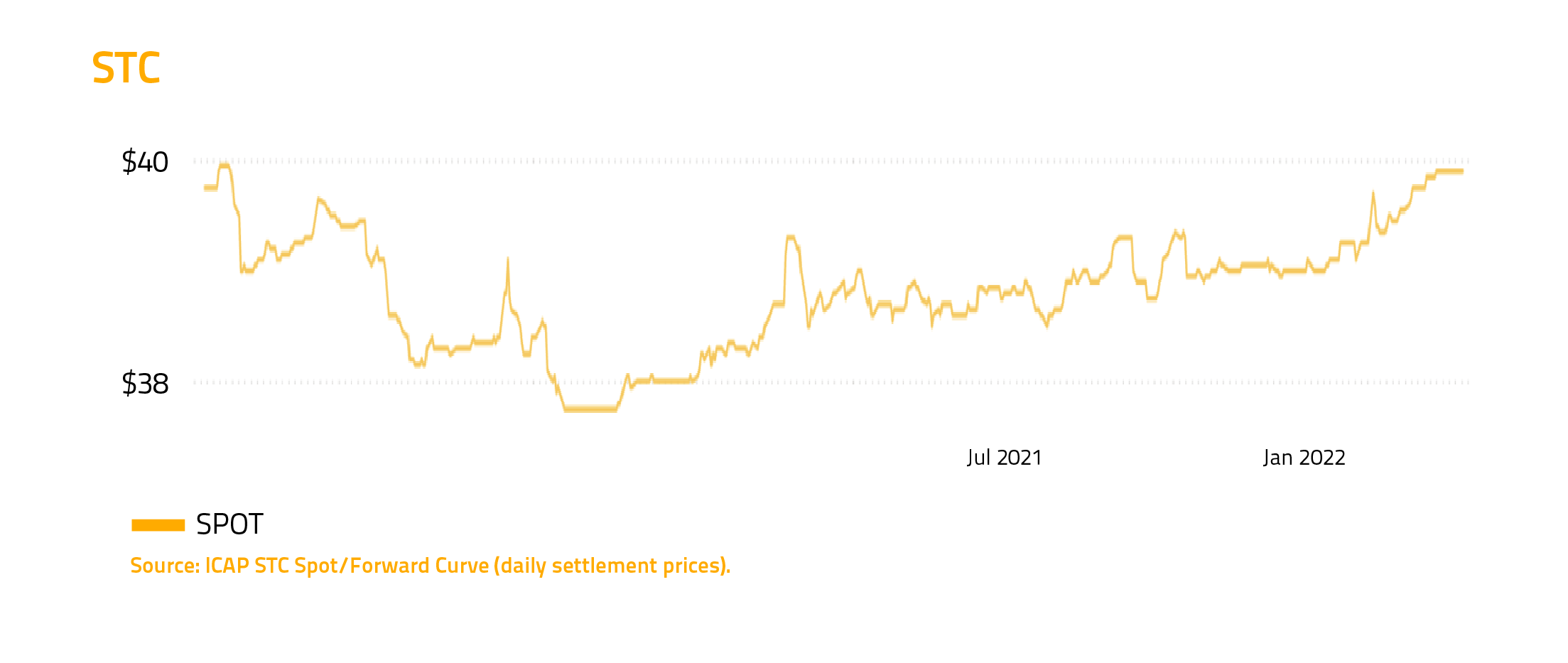

Environmental market

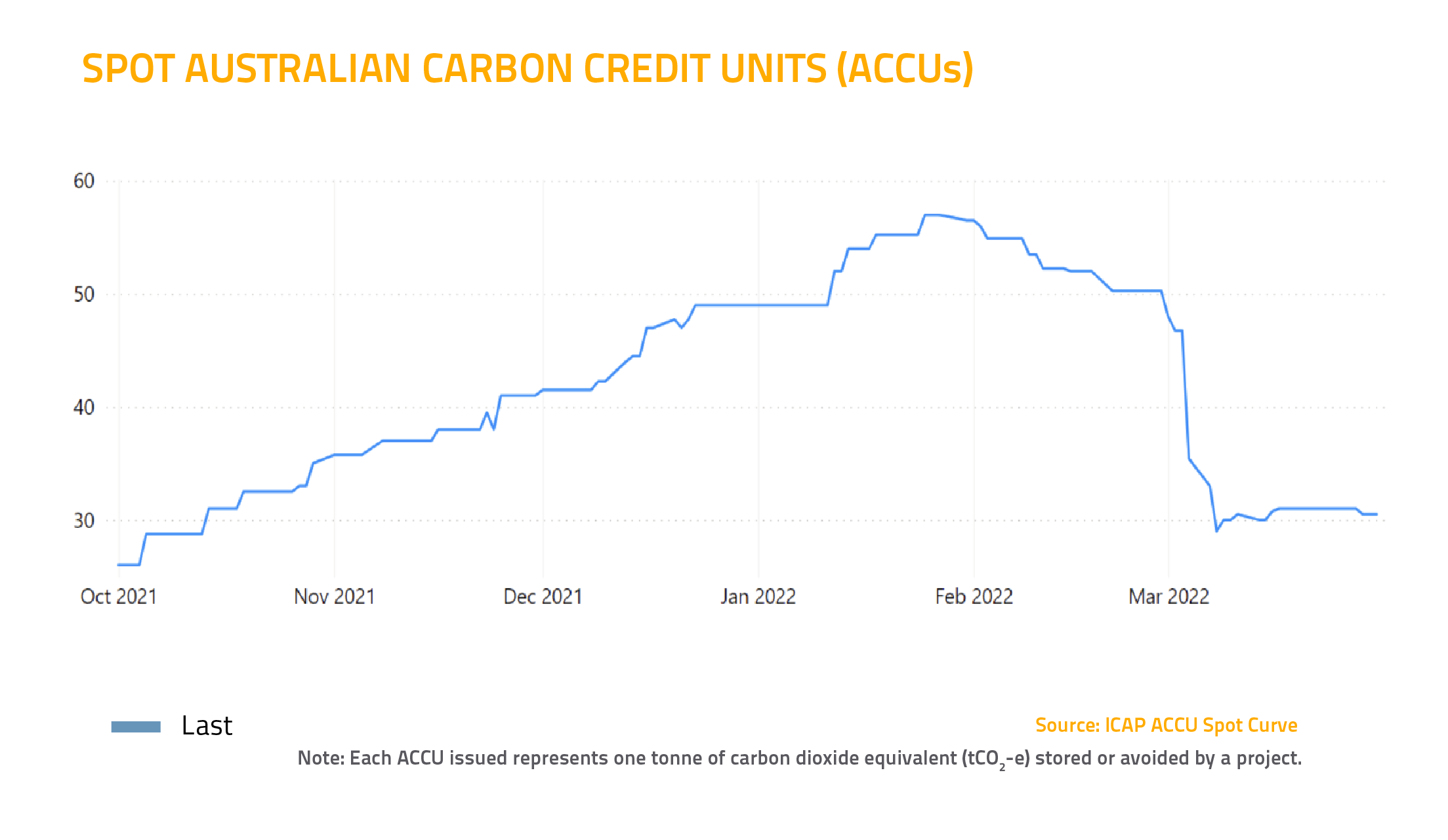

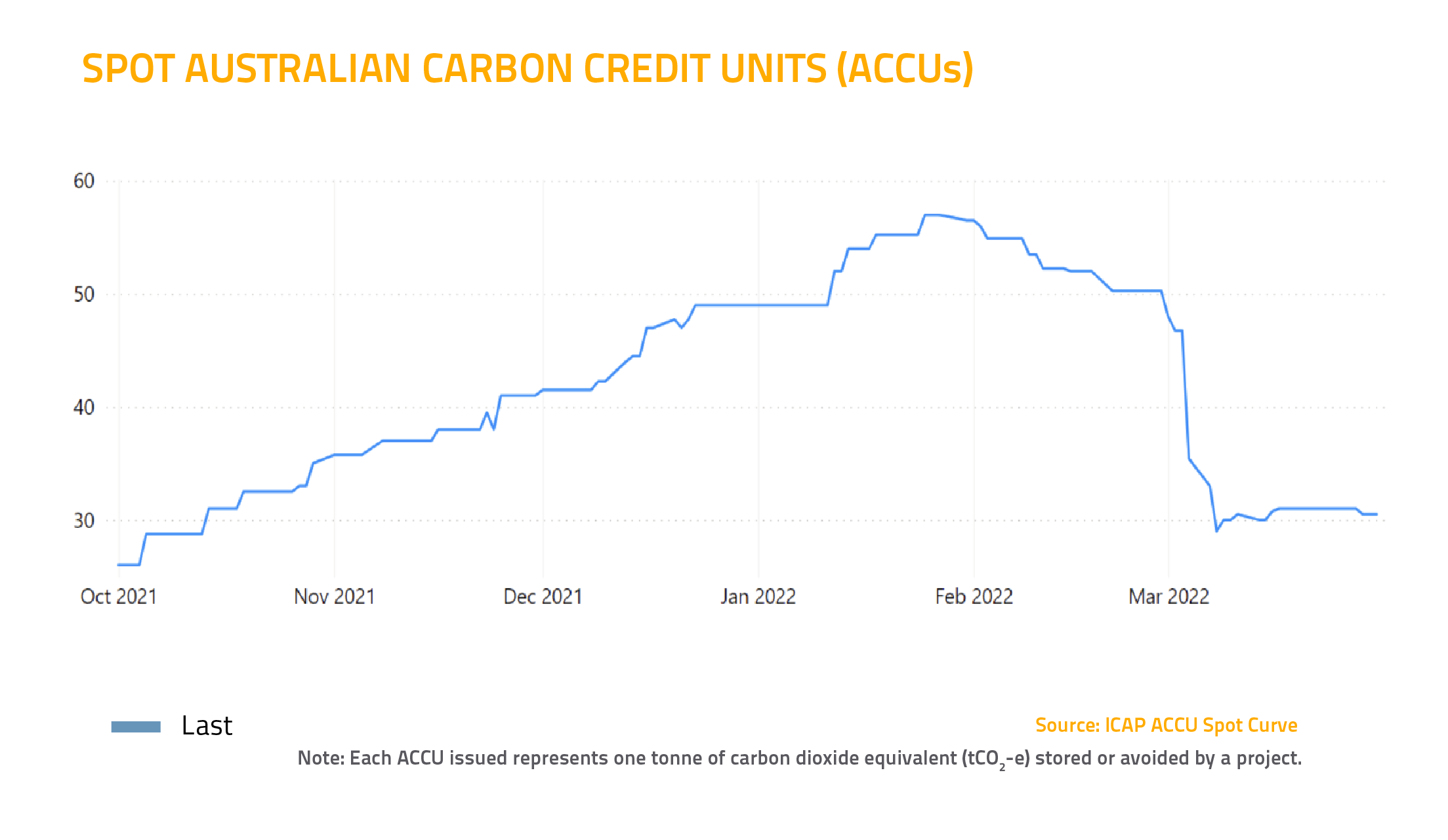

In the environmental market, the big story is the significant drop in price of Australian Carbon Credit Units, (ACCUs) which closed at $30.50 (down $19.75).

This is primarily due to the Federal Government’s recent changes to the Emissions Reduction Fund, which is expected to lead to an increase in the supply of these units.

Some commentators have also raised concerns about the credibility of certain ACCU methods.

And that’s it for our March market wrap up… wishing you all the best for April from the team at Stanwell Energy.