Watch the full update here

Daylight made the difference in the energy market this month, as increased solar generation led to a sharp drop in spot prices.

Spot Market

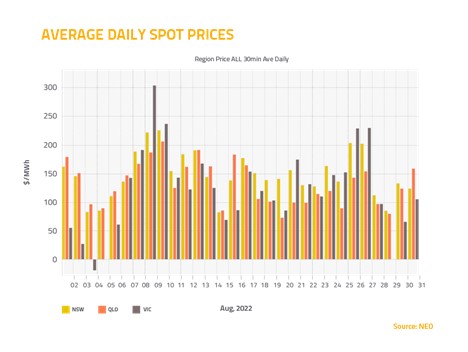

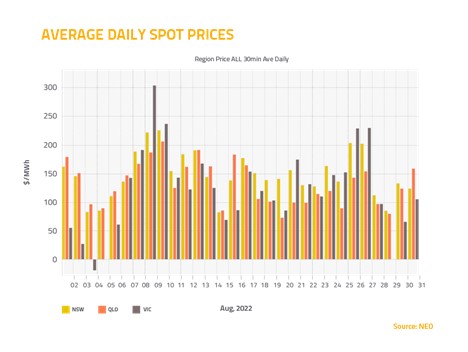

After months of elevated prices, we saw significant drops in the spot market in August.

Spot prices in Queensland (down $258.09 to $133.50), New South Wales (down $223.17 to $148) and Victoria (down $219.34 to $121) all fell by more than $200 over the last month.

The reason? Sun, sun and more sun. The overcast and rainy conditions that limited solar generation in July were nowhere to be seen in August

That meant there was plenty of solar energy in the system, which helped to reduce the price spikes that we’d been seeing in the middle of the day.

That led to spot prices falling, even though coal and gas prices remain high.

The drop in price was sharpest in Queensland, which was partly because of a constraint on the Tamworth-Armidale line that limited the amount of energy flowing south.

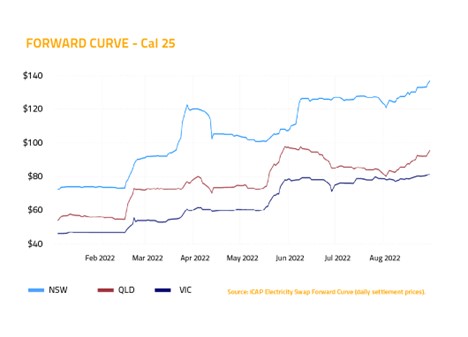

Contract Market

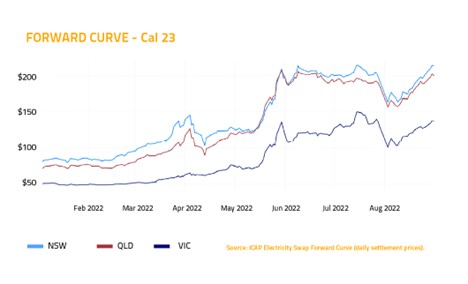

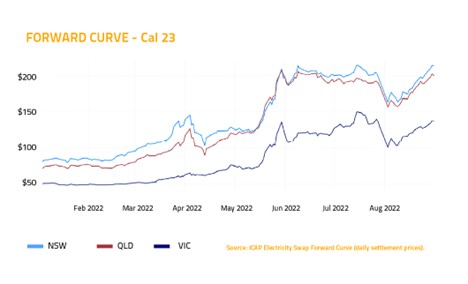

In the contract market, Cal 23 prices increased across the board (up $14.85 to $200 in Queensland, up $20.75 to $213 in New South Wales, and up $9.26 to $137.35 in Victoria).

There’s a scarcity of sellers in the contract market at the moment. This is largely due to the high cost of securing additional fuel, as the Russia-Ukraine conflict continues to disrupt coal and gas trade.

As the forward price trades higher, the ASX requires higher margins to cover the risk of financial loss due to adverse market movement, which is also limiting additional selling.

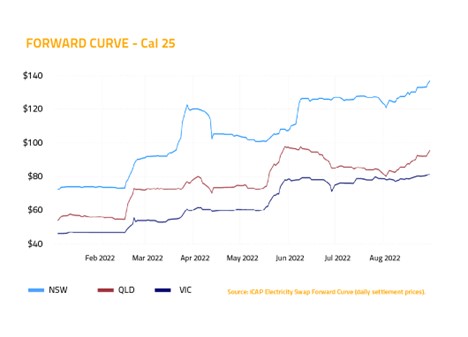

When we look ahead to Cal 25, the prices tell a similar story (up $11.30 to $95.30 in Queensland and up $10.20 to $136.70 in New South Wales).

There aren’t a lot of sellers in that contract market at the moment, but with the new financial year, there are more buyers looking to secure their energy supply for Cal 25, leading to a jump in prices.

The effect wasn’t as noticeable in Victoria (up $2 to $81), where concerns about the state’s low gas storage levels and tight pipeline capacity had already led to a price spike in July.

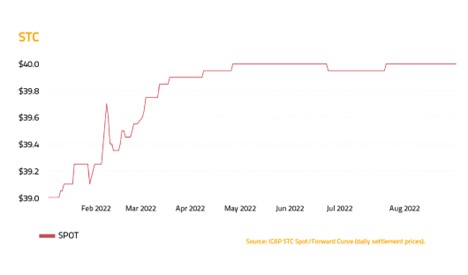

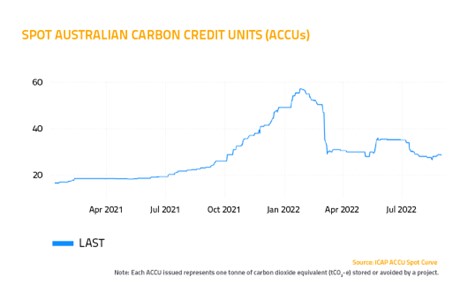

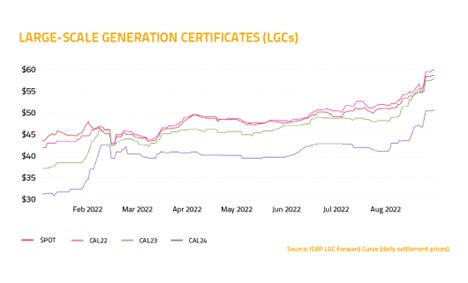

Environmental Market

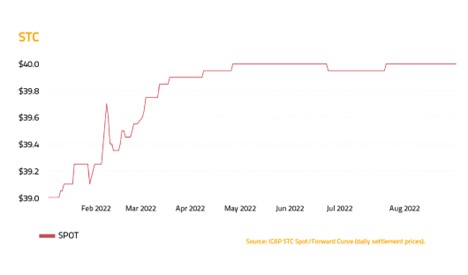

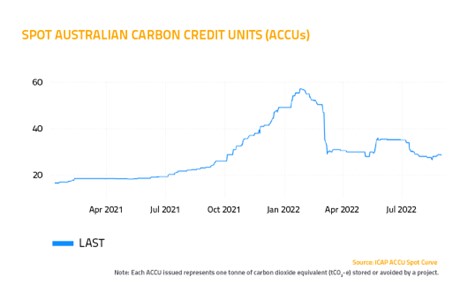

In the environmental market, we saw little movement in the prices of Small-Scale Technology Certificates (STCs) (no change at $40) and Australian Carbon Credit Units (up 50 cents to $28.50).

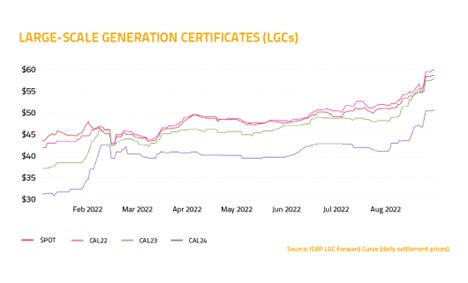

But the price for Large-Scale Generation Certificates (LGCs) increased significantly (up $7.75 to $58.75). This came as the market priced in an anticipated increase in the voluntary surrender of certificates by liable entities.

Technically, liable entities only have to surrender enough Large-Scale Generation Certificates (LGCs) to meet their obligations under the Renewable Power Percentage. But we’re seeing more companies opting to surrender above that target – sometimes up to 100 per cent – in order to signal their transition to renewable energy sources to their stakeholders and customers.

And that’s it for August… wishing you all the best for September from the team at Stanwell Energy!